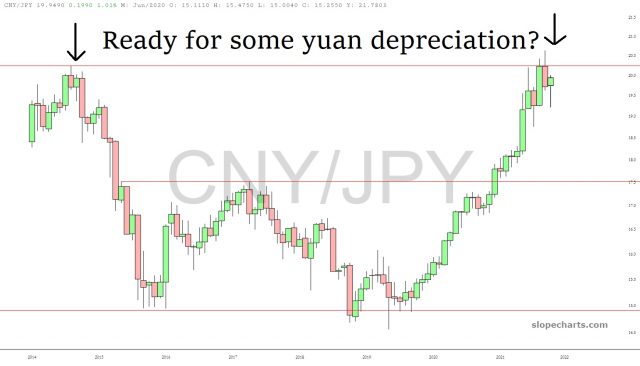

Few are looking for this one, but if the yen breaks lower, then I think we’re weeks at most away from a major depreciation in the Chinese yuan. Remember the market plunge of August 2015? Similar conditions are in place with reversal in commodities, Fed tightening (escalation from 2015 when Fed had flat balance sheet and no rate hikes), U.S. Dollar rally and disastrous economic policy in China.

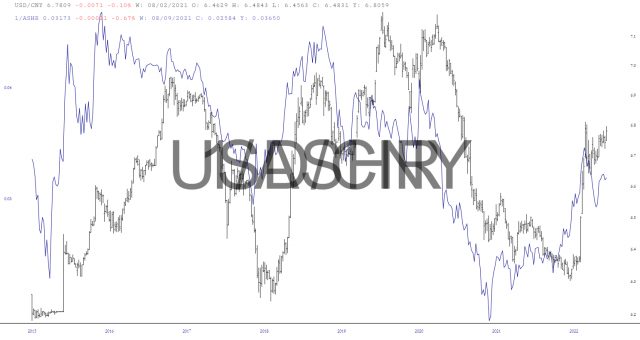

USD/CNY looks ready to rip…………

If a depreciation proves bearish for equities again, then ASHR might offer the best bang for your short buck. Otherwise, the currency itself also has cheap options for the expected move, which I think would carry it well past USD/CNY 7.

Assume USD/JPY makes a modest new high around 140 and CNY/JPY slips to 19, that translates to USD/CNY 7.40 area. Slightly OTM puts on CNY would deliver more than a 10x return.

Back in late January I posted Ready for the Yen Shock? I was then celebrating a long yen trade this summer: Weather Forecast: It’s Raining Yen, Hallelujah. It was a great trade, but in context the yen drop didn’t trigger the kind of shock I thought it might. The yuan is another story. It’s a very low volatility currency. Most investors don’t watch it at all or have vaguely positive ideas about it. The Kyle Bass traders who expect a much lower value for CNY are noisy, but few in actual number. I can tell by how cheap yuan puts are today.