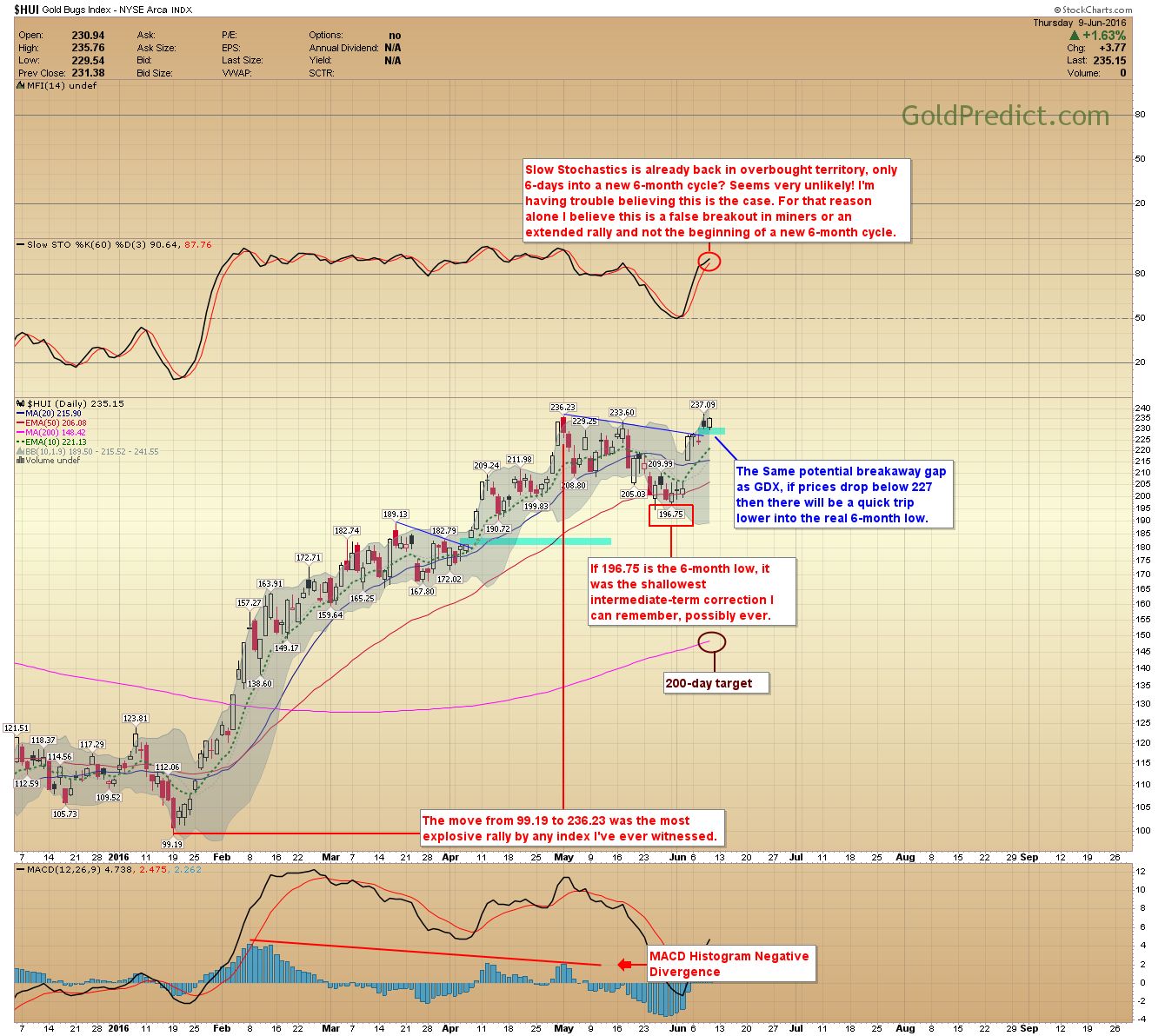

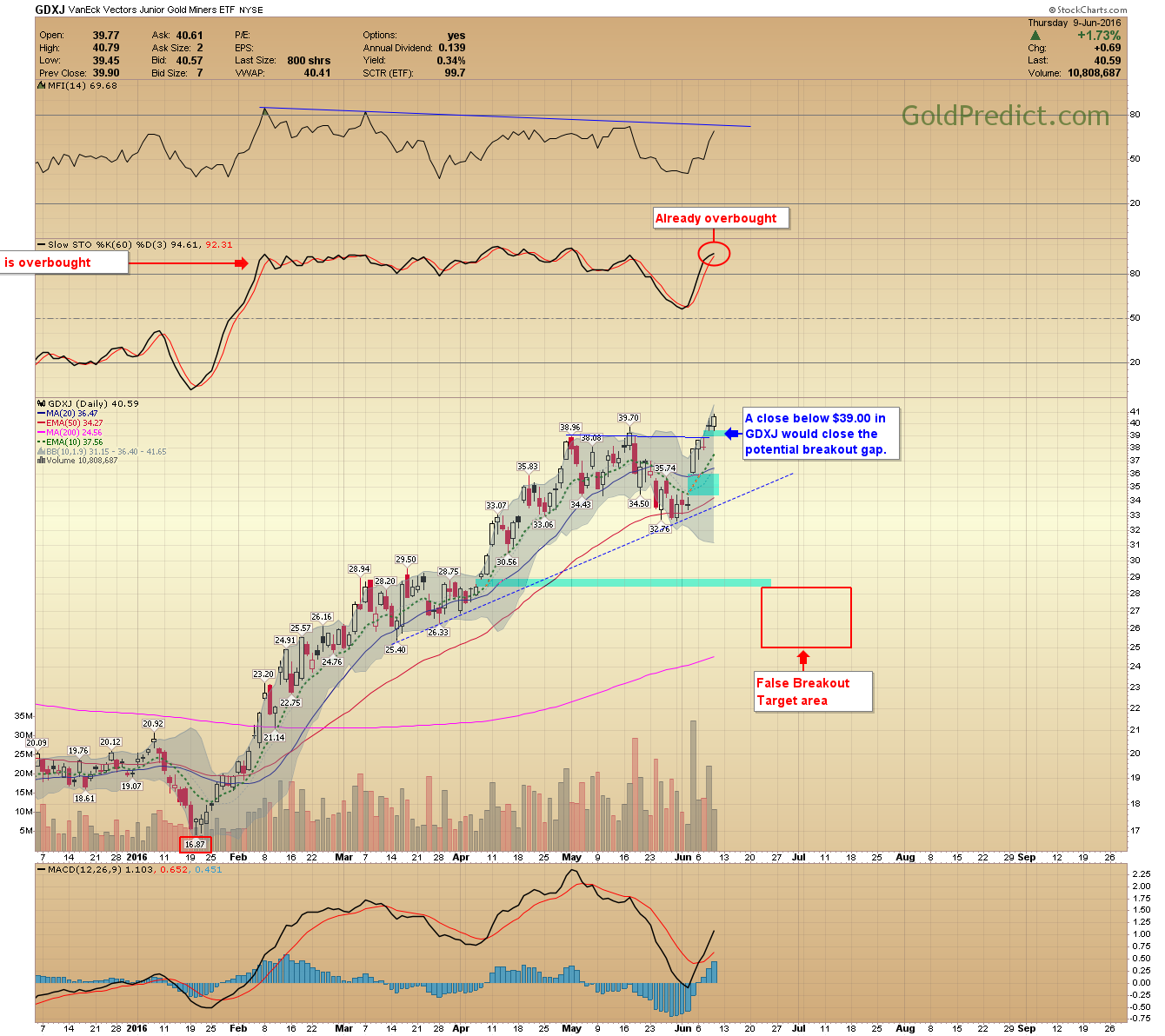

Miners have broken to new highs, and some indicators are already in overbought territory. It’s hard for me to believe that gold miners are already overbought just two weeks into a new intermediate-term cycle. I’m skeptical; this could be a false breakout and prices could drop to their 200-day moving averages. Here is an update I released before the Thursday close explaining the breakaway gap in GDX (NYSE:GDX). The next two weeks have huge implications for gold, silver and miners…we need to remain vigilant.

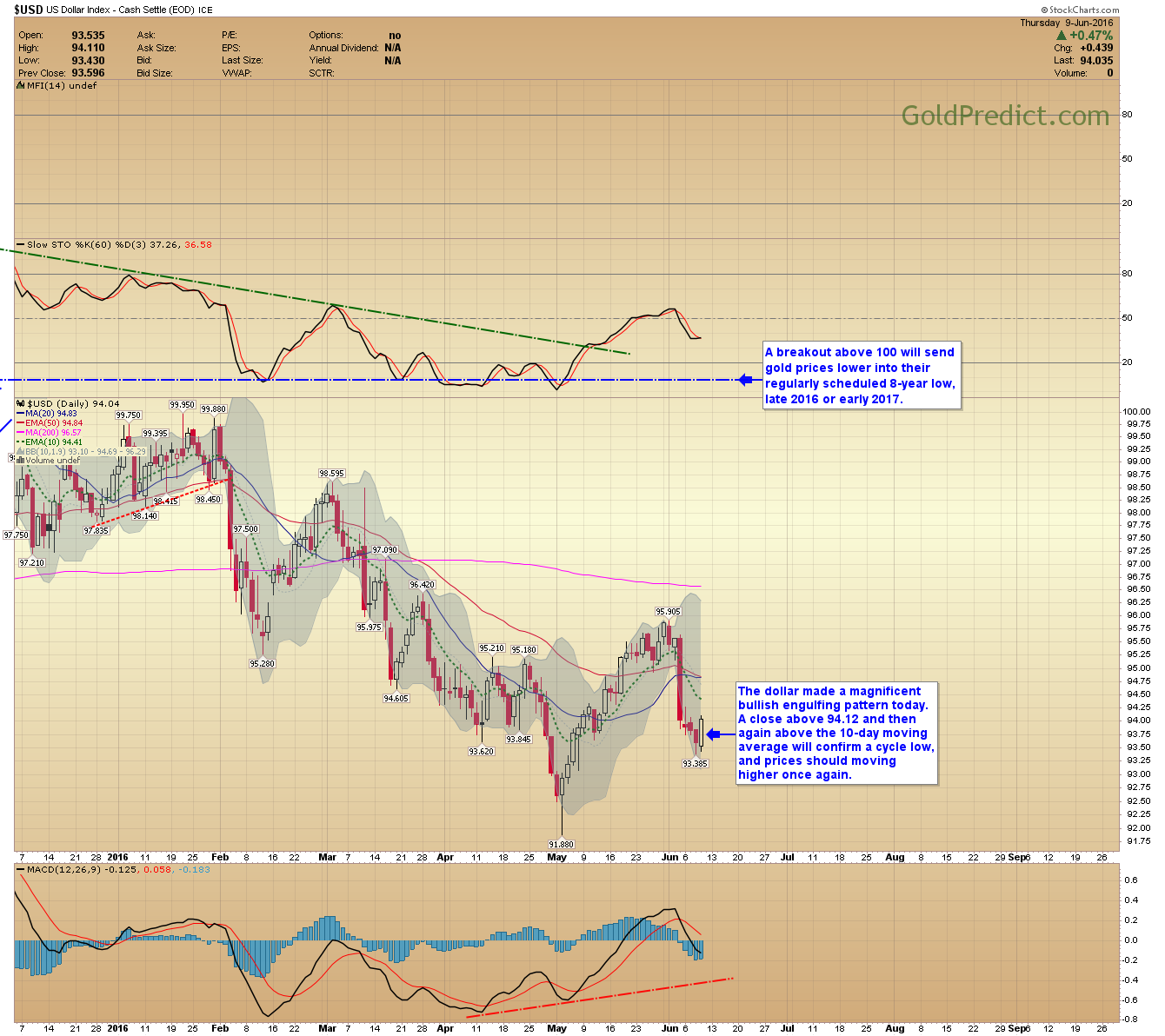

-US DOLLAR- The dollar made a bullish engulfing pattern today. A close above 94.12 and then again above the 10-day moving average will confirm a cycle low, and prices should move higher once again.

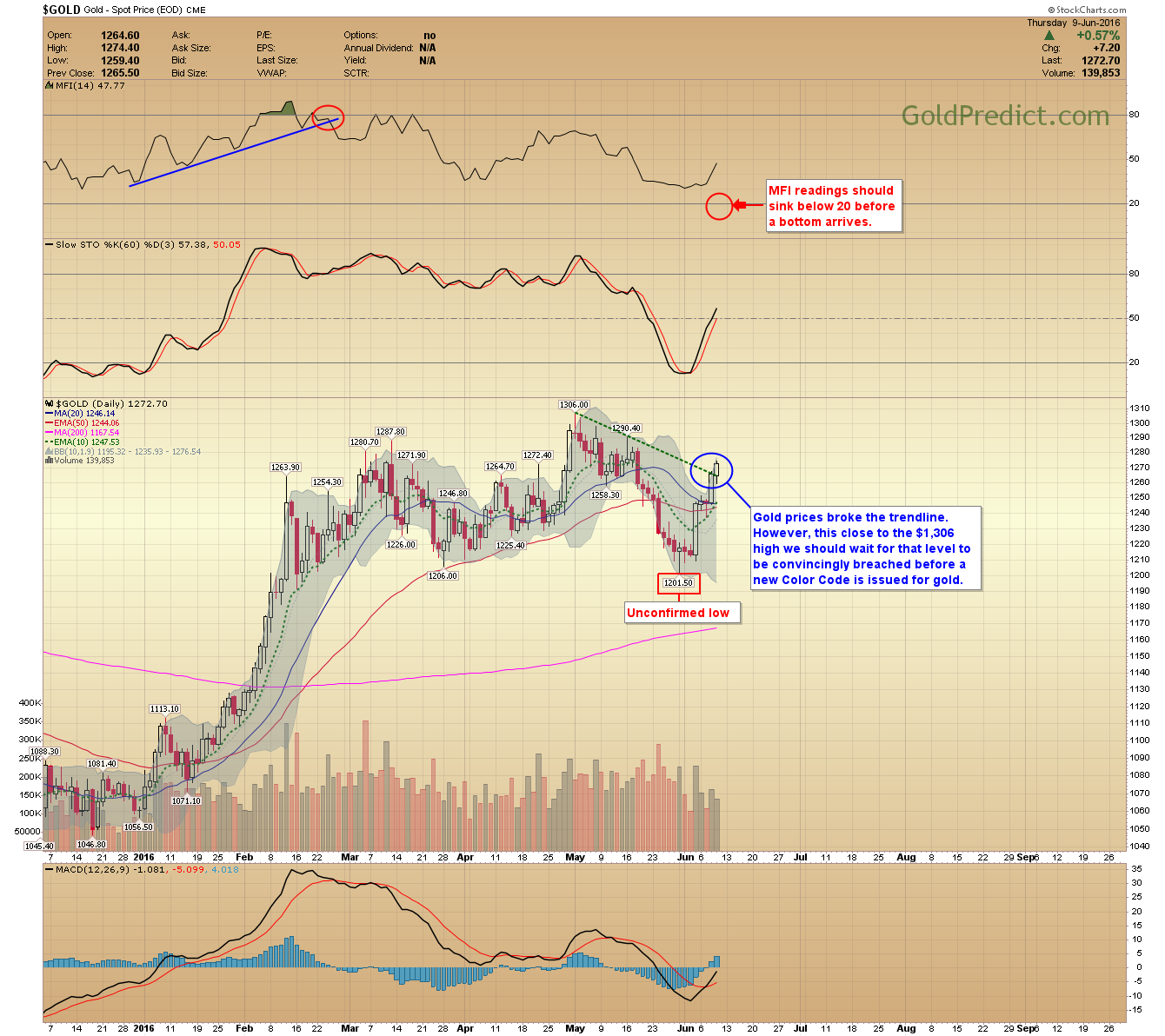

-GOLD- Gold prices broke the trendline. However, this close to the $1,306 high we should wait for that level to be convincingly breached before a new Color Code is issued.

-SILVER- Silver is behaving like it put in a 6-month cycle low but I’m not entirely convinced, just yet.

-HUI- If 196.75 is the 6-month low, it was the shallowest intermediate-term correction I can remember. The Same potential breakaway gap exists in the HUI; if prices drop below 227 then there will be a quick trip lower into the real 6-month low. Note: Slow Stochastics (top) is already back in overbought territory, only 7-days into a new 6-month cycle? Seems very unlikely! I’m having trouble believing this is the case.

-GDXJ- A close below $39.00 in VanEck Vectors Junior Gold Miners (NYSE:GDXJ) would close the potential breakout gap.

-WTIC- Oil touched the $51.00 minimum target, and prices could rise a little further. A close below the ascending wedge pattern will signal the top and prices should drop toward the target below.

Have a good weekend!