By now, everybody knows that the U.S. dollar made a major move higher the second half of 2014. If you are involved in the stock market at all you could not avoid this. Fundamental analysts talked of how a dollar headwind would hurt earnings in the 1st Quarter (it did). Macro traders noted the impact of weaker global currencies and their local markets. And even vacationers started to drool at the prospect of a cheap European vacation.

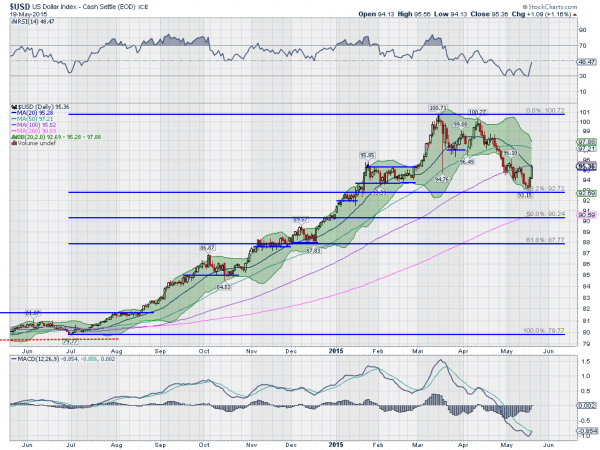

But then it ended. As the Dollar Index hit 100, the move ended. A month of consolidation followed and then in mid April a pullback began. This was the most anticipated pullback in currency history. Or at least in 2015. Every trader expected the dollar to give back some gains. As of last Friday’s low the pullback had retraced 38.2% of the move higher. A knock-out punch?

That ratio is an important one for traders as it is a key Fibonacci retracement. Along with a 50% and 61.8% retracement, it is a level where things happen. And this is why it may also be where the Dollar reverse back higher, resuming the trend up. A retracement of only 38.2% is a show of strength for the US Dollar. So maybe just a standing 8 count.

But that is not the only reason it may be reversing. The momentum indicators that had moved to very overbought levels ion the move higher, have reset to oversold levels. The RSI bounced for a month around the oversold level before making a higher high Tuesday. And the MACD is about to cross up, giving a buy signal.

Most importantly the Index itself did move higher. It did so with a long and strong candle Monday and followed that up with a second one Tuesday. Nearly a straight drive higher in a big range all day both days. Some will note that it now has to contend with the 100 day SMA. And that level is important, but not because it is the 100 day SMA. Rather because it is the prior high from the weak bounce in early May. It represents actual price resistance, where the Index did reverse.

A move above that high at 96.10 would give additional confidence to the reversal story. From there those that are short the Dollar Index could be in for a big shock. The Measured Move higher, and also an AB=CD pattern, would target a move up to 114 on the Dollar Index. Don’t count the dollar out yet.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.