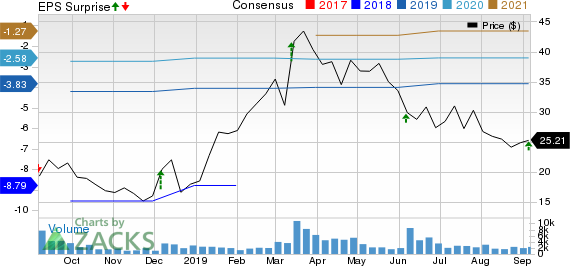

Domo (NASDAQ:DOMO) reported second-quarter fiscal 2020 non-GAAP loss of 96 cents per share, narrower than the year-ago quarter’s loss of $3.44 and the Zacks Consensus Estimate of a loss of $1.

Revenues of $41.7 million increased 21.6% on a year-over-year basis, primarily driven by customer addition. The figure also beat the consensus mark of $41 million.

International revenues represented 26% of total revenues in the reported quarter, consistent with the previous quarter.

Billings increased 9% year over year to $38.8 million. Moreover, dollar-based net revenue retention rate was greater than 100%.

Customer Growth & Retention

Domo stated that 49% of customers were on multi-year contracts at the end of second-quarter fiscal 2020 compared with 38% at the end of the year-ago quarter.

Gross retention rate was 90%. The company now has more than 460 enterprise customers.

Notably, customer additions during the reported quarter included Lighthouse customers and EDP, a global energy company.

Additionally, the company added Inditex (MC:ITX), which is one of the world's largest fashion retailers with international brands like Zara.

Moreover, Domo signed key expansion deals with notable customers, including consumer packaged goods giant, L'Oreal, and real-estate services company Zillow.

Also, Domo announced a partnership with Zendesk to help customers offer better service to end users. The company also signed a deal with a well-known manufacturer of electronic household products.

Quarter Details

Subscription revenues (83.7% of total revenues) were $34.9 million, up 23.8% year over year. Professional services and other revenues (16.3%) increased 11.2% to $6.8 million.

During the quarter, Domo announced web services named "Domo for Amazon (NASDAQ:AMZN) Web Services (AWS)," a purpose-built package giving AWS customers an easy way to make data from AWS services securely accessible within a company to drive new business value.

In second-quarter fiscal 2020, gross profit rose 26.2% year over year to $27.4 million. Gross margin expanded 240 basis points (bps) to 65.9%.

Notably, non-GAAP subscription gross margin was 75% in the reported quarter compared with 71% in the year-earlier quarter.

GAAP sales & marketing (S&M) expenses contracted 13.2% year over year to $29.5 million. GAAP research & development (R&D) expenses declined 18.5% to $17 million, and GAAP general & administrative (G&A) expenses fell 9.1% to $9.3 million.

Total non-GAAP operating expenses contracted 6.8% year over year to $51.3 million in the reported quarter on lower marketing and R&D costs.

Non-GAAP operating loss of $23.7 million was narrower than the year-ago quarter’s loss of $33.2 million.

Balance Sheet & Cash Flow

As of Jul 31, 2019, Domo had cash, cash equivalents and short-term investments of $133.9 million compared with $154 million reported in the previous quarter.

Moreover, adjusted cash used in operations was $18.7 million compared with $22.2 million in first-quarter fiscal 2020.

Guidance

For third-quarter fiscal 2020, revenues are anticipated between $41.5 million and $42.5 million. Non-GAAP net loss per share is expected between $1 and $1.04.

Billings are expected to total $36.5 million. Domo expects operating expenses to increase in the third quarter.

Adjusted cash used in operations is expected at around $17.5 million.

For fiscal 2020, revenues are anticipated between $168 million and $169 million. Non-GAAP net loss per share is expected between $4 and $4.1, wider than the previous guidance of a loss of $3.79-$3.87.

Billings are expected to be around $172 million. Adjusted cash used in operations is expected at around $74.5 million.

Zacks Rank & Stocks to Consider

Currently, Domo has a Zacks Rank #3 (Hold).

Chegg (NYSE:CHGG) , Benefitfocus (NASDAQ:BNFT) and Anixter International (NYSE:AXE) are better-ranked stocks from the same industry. All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Chegg, Benefitfocus and Anixter is currently pegged at 30%, 25% and 8%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Chegg, Inc. (CHGG): Free Stock Analysis Report

Benefitfocus, Inc. (BNFT): Free Stock Analysis Report

Anixter International Inc. (AXE): Free Stock Analysis Report

Domo, Inc. (DOMO): Free Stock Analysis Report

Original post

Zacks Investment Research