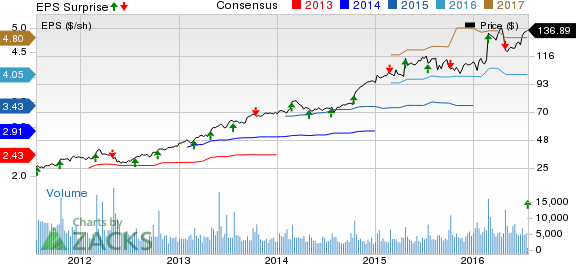

Domino's Pizza Inc. (NYSE:DPZ) posted robust second-quarter 2016 results, wherein both earnings and revenues beat the respective Zacks Consensus Estimate. Consequently, the company’s shares gained almost 6% on Jul 21.

Performance in Detail

Adjusted earnings of 98 cents per share beat the Zacks Consensus Estimate of 93 cents by 5.4%. Earnings climbed 21% year over year on strong sales and lower shares outstanding.

Quarterly revenues increased 12% year over year to $547.34 million and surpassed the Zacks Consensus Estimate of $529.2 million by 3.42%. The improvement was primarily backed by higher supply chain revenues. Increased domestic franchise and company-owned store revenues, and higher international revenues on the back of growth in both comps and store count also led to the upside. However, negative foreign currency translation partially limited the top-line growth.

Comps

Excluding the impact of foreign currency translation, global retail sales (including total sales of franchise and company-owned units) were up 11.7% year over year. Strong comps from domestic and international stores supported the improvement. Excluding foreign currency impact, global retail sales gained 14.3%.

During the quarter, the company’s domestic store (including company-owned and franchise stores) comps were up 9.7% which was unfavorable compared to 12.8% growth in the year-ago quarter. The downturn was mainly due to intense competition. The company experienced year-over-year comps growth of 9.1% at company-owned stores compared with a 12.5% jump last year. Domestic franchise comps grew 9.8%, lower than 12.8% growth in the prior-year quarter.

Comps at international stores, excluding foreign currency translation, grew 7.1%. This was better than the prior-quarter improvement of 6.7%.

Margins

The company’s operating margin expanded 20 basis points (bps) to 31.4% in the quarter. Strong franchise businesses positively impacted margins as a greater percentage of revenues came from both international and domestic royalties.

Domino's currently has a Zacks Rank #4 (Sell).

Stocks to Consider

Some better-ranked stocks in the same industry include Chuy’s Holdings Inc. (NASDAQ:CHUY) , Dave & Buster's Entertainment, Inc. (NASDAQ:PLAY) and Diversified Restaurant Holdings (NASDAQ:SAUC) . All three stocks sport a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

DOMINOS PIZZA (DPZ): Free Stock Analysis Report

DAVE&BUSTRS ENT (PLAY): Free Stock Analysis Report

CHUYS HOLDINGS (CHUY): Free Stock Analysis Report

DIVERSIFIED RST (SAUC): Free Stock Analysis Report

Original post

Zacks Investment Research