Domino’s Pizza, Inc. (NYSE:DPZ) posted robust second-quarter 2017 results, with both earnings and revenues beating the Zacks Consensus Estimate.

However, shares of the company have declined more than 10% in yesterday’s trading session as strength in domestic markets was overshadowed by weak international comps growth. Although the international segment posted positive comps, the figure came in much below expectations, due to softness in European markets.

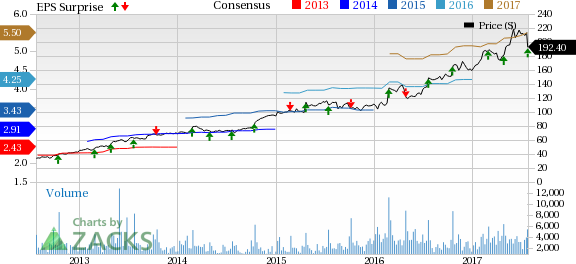

Domino's Pizza Inc Price, Consensus and EPS Surprise

Performance in Detail

Adjusted earnings of $1.32 per share beat the Zacks Consensus Estimate of $1.22 by 8.2%. Further, earnings climbed 34.7% year over year on strong sales as well as a lower share count.

Quarterly revenues jumped 14.8% year over year to $628.6 million and surpassed the Zacks Consensus Estimate of $613.4 million by 2.5%. The improvement was backed by higher supply chain revenues as well as increased same store sales and store count growth at both domestic and international markets.

Comps

Global retail sales (including total sales of franchise and company-owned units) were up 11.8% year over year. The uptick was primarily owing to strong comps from domestic stores. Excluding foreign currency impact, global retail sales increased 14.1%.

During the quarter, the company’s domestic stores (including company-owned and franchise stores) comps increased 9.5%. This compared unfavorably with 9.7% growth in the year-ago quarter and 10.2% growth in the previous quarter.

The company experienced year-over-year comps growth of 11.2% at domestic company-owned stores, higher than 9.1% comps growth in the year-ago quarter but lower than 14.1% growth in the last quarter. Also, domestic franchise stores comps grew 9.3%, lower than comps growth of 9.8% recorded in the year-ago quarter as well as the preceding quarter.

Comps at international stores, excluding foreign currency translation, grew 2.6%. This was much lower than the prior quarter and year-ago quarter improvement of 4.3% and 17.0%, respectively.

Margins

Domino’s operating margin decreased 30 bps year over year to 30.7% in the quarter.

Meanwhile, the net income margin increased 150 bps to 10.5%. The increase in the company’s net income was primarily driven by an increase in comps growth and store count as well as higher supply chain volumes and lower food costs. However, the improvements were partially offset by higher general and administrative expenses from investments in technological initiatives as well as unfavorable foreign exchange translations.

Zacks Rank & Upcoming Releases

Domino’s currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other firms in the restaurant space, BJ's Restaurants, Inc. (NASDAQ:BJRI) and Dunkin' Brands Group, Inc. (NASDAQ:DNKN) are expected to release their second-quarter numbers on Jul 27. The Zacks Consensus Estimate for the quarter’s earnings is pegged at 51 cents for BJ's Restaurants and 62 cents for Dunkin' Brands.

Yum! Brands, Inc. (NYSE:YUM) is scheduled to report its quarterly numbers on Aug 3. The Zacks Consensus Estimate for the quarter’s bottom line is pegged at 61 cents.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

BJ's Restaurants, Inc. (BJRI): Free Stock Analysis Report

Dunkin' Brands Group, Inc. (DNKN): Free Stock Analysis Report

Original post