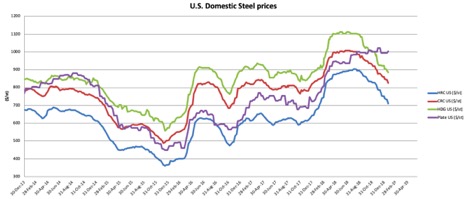

Domestic Steelprices have been in a downtrend since August when prices started to show the first signs of weakness.

All forms of steel, except plate, have shown downward price momentum.

Source: MetalMiner data from MetalMiner IndX(™)

Historically, steel prices move lower during Q3 and part of Q4. When the budgeting season starts, mills begin to raise steel prices.

For the past three years, steel prices have increased at the end of Q1, just a little delayed from the general Q4 increase.

However, this year the price increase remains in hibernation.

Steel prices continue to move lower and lead times have not increased. In fact, lead times remain the shortest in a year.

Therefore, steel price increases do not seem justified for HRC, CRC and HDG.

Plate Prices — Why Are They Moving Differently?

Meanwhile, plate prices have followed their own trend.

Plate prices have remained well-supported so far. While other forms of steel have seen price declines since August, plate prices continue to trade sideways.

In fact, plate prices have increased during this time.

Source: MetalMiner data from MetalMiner IndX(™)

Plate prices, in general, have less volatility than other forms of steel. Plate prices often trade sideways in one direction for a long time, then suddenly shift and move into a different trend.

Lead times combined with strong demand have supported plate prices. Most steel producers see lower automotive numbers, but demand from plate-consuming industries remains stronger.

While all the other steel forms have had shorter lead times during the year, with increasing domestic capacity utilization, plate lead times continue to lengthen.

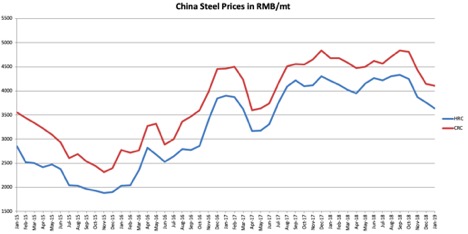

Chinese Steel Prices

The 800-pound gorilla, China, offers a window into what may happen to domestic prices.

Chinese steel prices have fallen since September 2018. Steel prices have been softer in China this year, driven by signals of weaker demand and a slower manufacturing index.

Source: MetalMiner data from MetalMiner IndX(™)

What This Means for Industrial Buyers

Current domestic steel prices appear to be in a downtrend.

Adapting the right buying strategy becomes crucial to reducing risks. Only the MetalMiner monthly outlooks provides a continually updated snapshot of the market from which buying organizations can determine when and how much of the underlying metal to buy.