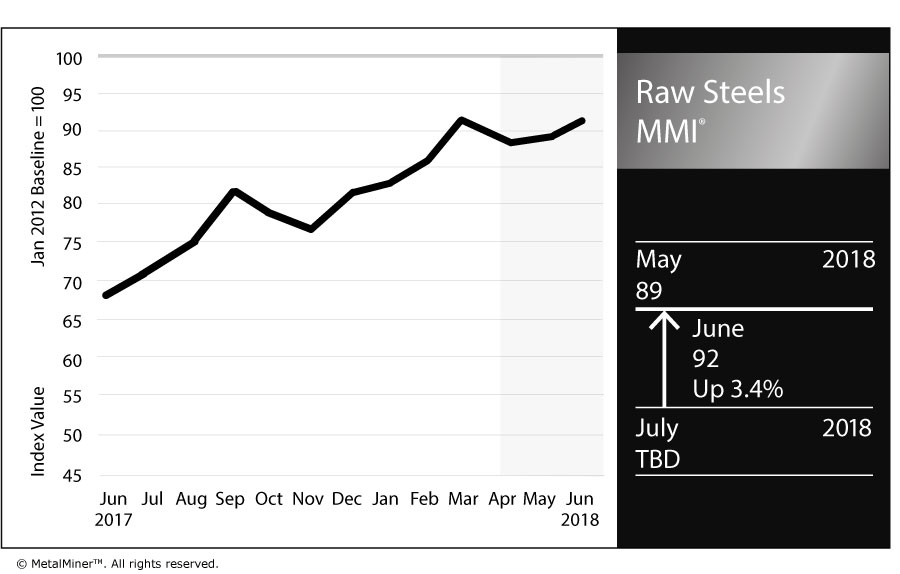

The Raw Steels Monthly Metals Index (MMI) increased three points this month, moving up for a June reading of 92.

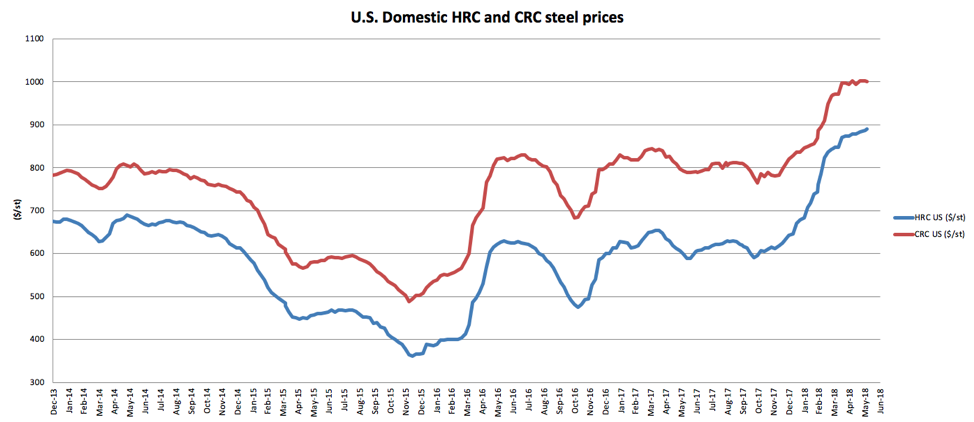

Domestic steel momentum seems to keep going, with domestic steel prices increasing again. Chinese steel prices also increased in May, adding support to higher domestic steel prices.

Domestic steel prices remain at more than seven-year highs.

Source: MetalMiner data from MetalMiner IndX(™)

Steel prices also increased at the beginning of June. The pace of the increases seems to have slowed down, but prices remain in an uptrend.

Tariffs

June 1 served as the latest steel and aluminum tariff exemption deadline. However, on May 31 President Trump announced that no country exemptions will continue. Therefore, Canada, Mexico and the EU became subject to the steel and aluminum tariffs of 25% and 10%, respectively.

MetalMiner considered different policy scenarios with regard to tariffs. All of them — except a continued exemption of the steel tariffs — supported the US domestic steel price increase. The current situation will support steel prices further.

Mexico has already hit back with trade tariffs on some other products (such as pork and bourbon) from the US.

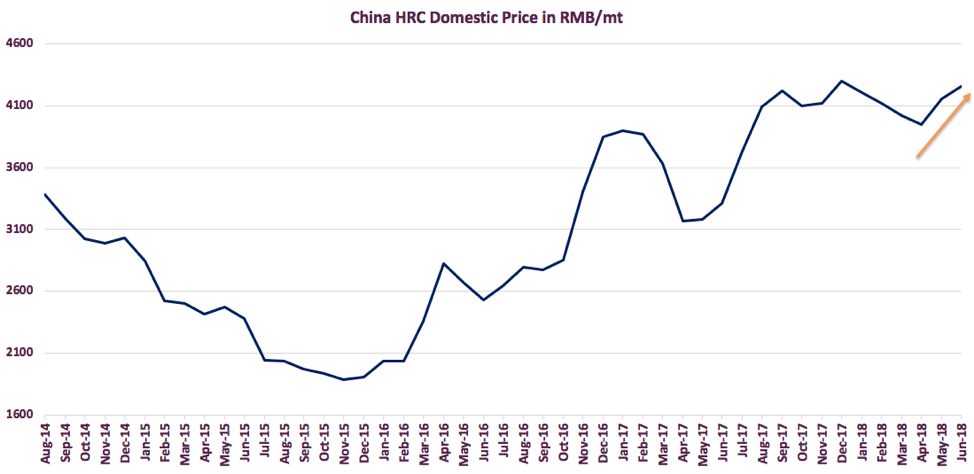

Chinese Steel Prices

Chinese steel prices recovered from a previous downtrend and increased again in May. Early June price indications also show higher prices and a recovery in Chinese steel prices.

Source: MetalMiner data from MetalMiner IndX(™)

Chinese steel prices fell in conjunction with their historical seasonal cycle, which appeared stronger due to the overcapacity closures and higher-than-expected production during the winter season in China. However, prices usually start to increase again around April-May, signaling the start of the construction season, when steel demand is high.

Despite recent price increases, Chinese steel remains cheaper than US domestic steel (even with a 25% steel tariff). This comes down to the price run-up of US domestic steel prices, which have moved toward 2012 highs.

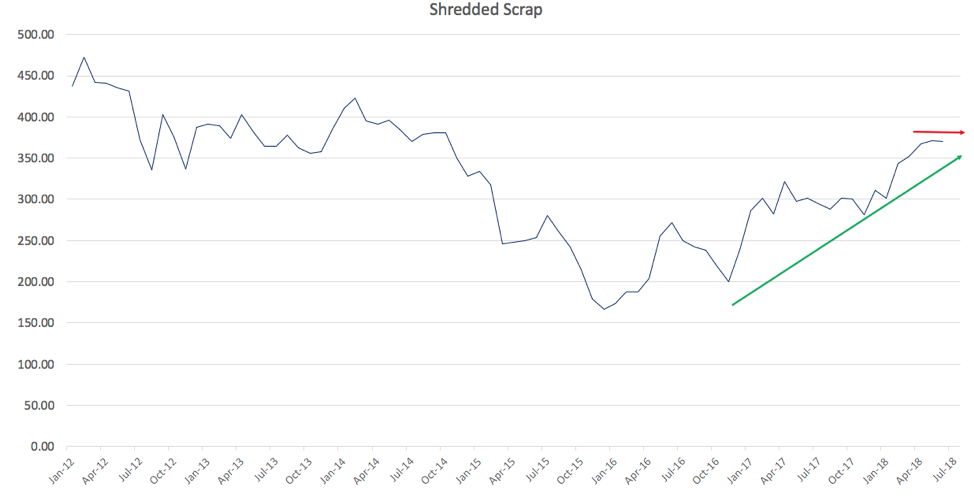

Contrary to domestic steel price movements, domestic shredded scrap traded more sideways at the beginning of June. Price increases have slowed down, as shredded scrap prices moved toward 2014 levels.

Source: MetalMiner data from MetalMiner IndX(™)

However, given the current domestic steel price movements, buying organizations can expect higher shredded scrap prices in the coming months.

What This Means for Industrial Buyers

As steel prices remain high, buying organizations may want to follow price movements closely to decide when to commit to mid- and long-term purchases.

Actual Raw Steel Prices and Trends

The US Midwest HRC Steel Futures price increased this month by 12.4%, going up to $905/st.

Chinese steel billet prices decreased by 0.2%, while Chinese slab prices rose by 1.2%, moving to $665/mt.

The US shredded scrap price closed the month at $370/st, trading flat from last month’s reading.

by Irene Martinez Canorea