There are times when an important statistic simply does not pack a punch. For instance, the percentage of working-aged individuals employed in the labor force sits at 62.8%. This percentage dwells in a 36-year low cellar. Why is it so troubling? The lack of workers adversely affects middle-class consumption capability – the supposed engine that drives the U.S. economy. Indeed, fewer workers means fewer goods and services. It might also imply lower tax revenue to government entities.

Yet the above-mentioned factors do not hit hard like a Seattle Seahawks linebacker. Investors certainly don’t seem to care about the disturbing downtrend. On the contrary. Stocks tend to celebrate the likelihood that the Fed will need to maintain zero percent interest rates for much longer.

At best, low-paying job gains of 200,000-plus per month – even with the poor showing of 142,000 in August – are offsetting baby-boomer retirement. At worst, the Great Recession’s impact forged structural changes to the U.S. economy whereby corporations spend borrowed dollars from their low yielding bonds on mergers, buyouts and stock buybacks, rather than spend money on human resources; by extension, U.S. population growth alone (12 million plus) explains existing job growth (6 million plus) since June of 2009, while the unemployed fail to make meaningful strides.

Averaging 2% gross domestic product (GDP) since the end of the Great Recession is better than the euro-zone’s constant battle to stay afloat. And the U.S. Federal Reserve’s easy money policies may have created an unassailable loop; that is, companies borrow money cheaply in the credit markets, buy back their own public shares, wash, rinse and repeat. Still, won’t high-powered executives eventually balk at the idea of funneling cash into questionably valued stocks? Isn’t this a global economy where the largest trading partner (Europe) for the U.S. – the largest importer of our goods and the largest exporter of goods to us – cannot get its collective ducks in a row? How justifiable is the Fed-inspired stock rally when three years can pass without so much as a typical 10%-15% sell-off that normally occurs every 12-18 months?

Many experts also failed to notice that those who described themselves as bears in the most recent Investors Intelligence Sentiment Survey came in at 13.3%. The poll is interpreted as a contrary indicator and 13.3% is the lowest level since February of 1987. (Draw your own conclusions here.)

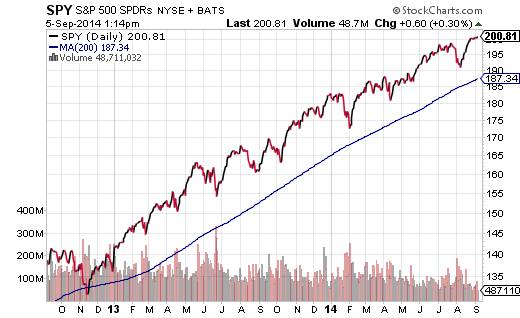

Of course, from a technical standpoint, U.S. large-cap stocks look as safe as ever. The SPDR S&P 500 (ARCA:SPY) barely missed a beat in either 2013 or 2014. U.S. small-caps appear far more vulnerable and I have precious little exposure to that arena.

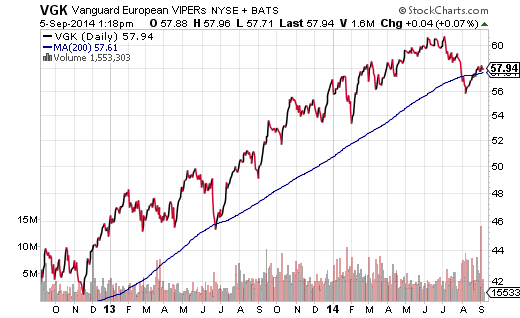

With respect to developed Europe, the European Central Bank (ECB) would need to implement a shock-n-awe approach to asset-backed purchases to impress the investment community. Today’s investors demand some signs of economic growth and moderate inflation before committing wholeheartedly to a region. Absent that, strong central bank stimulus toward making those things occur might suffice. Unfortunately, the ECB has yet to step in as aggressively as many believe is necessary, leaving funds like Vanguard MSCI EU (ARCA:VGK) struggling for direction.

This is not to say that corporations based in Europe lack fire power. Currency concerns notwithstanding, there are few reasons to doubt brand-name biggies like Nestle and Volkswagen. That said, European stock ETFs should be met with stop-limit loss order protection as well as a fair degree of skepticism.

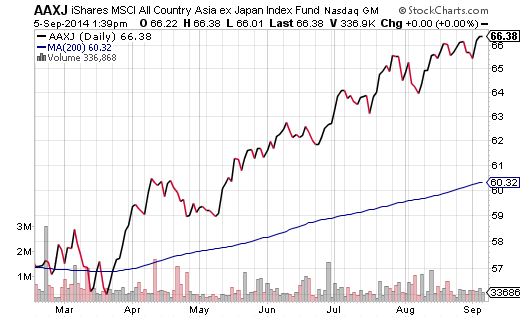

The one place where I have been increasing exposure – as opposed to maintaining or lessening it — is in the emerging markets. In early May, I asked whether emerging small caps are safer than U.S. small stocks. In February, I suggested that China ETF bashers could not see the forest for the trees. Since that time, my preferred regional proxy for China and Asian neighbors, iShares MSCI AllCountry Asia X Jap (NASDAQ:AAXJ), has picked up nearly 16.5%, while the SPDR S&P 500 (ARCA:SPY) has garnered about 9.5%.