Investing.com’s stocks of the week

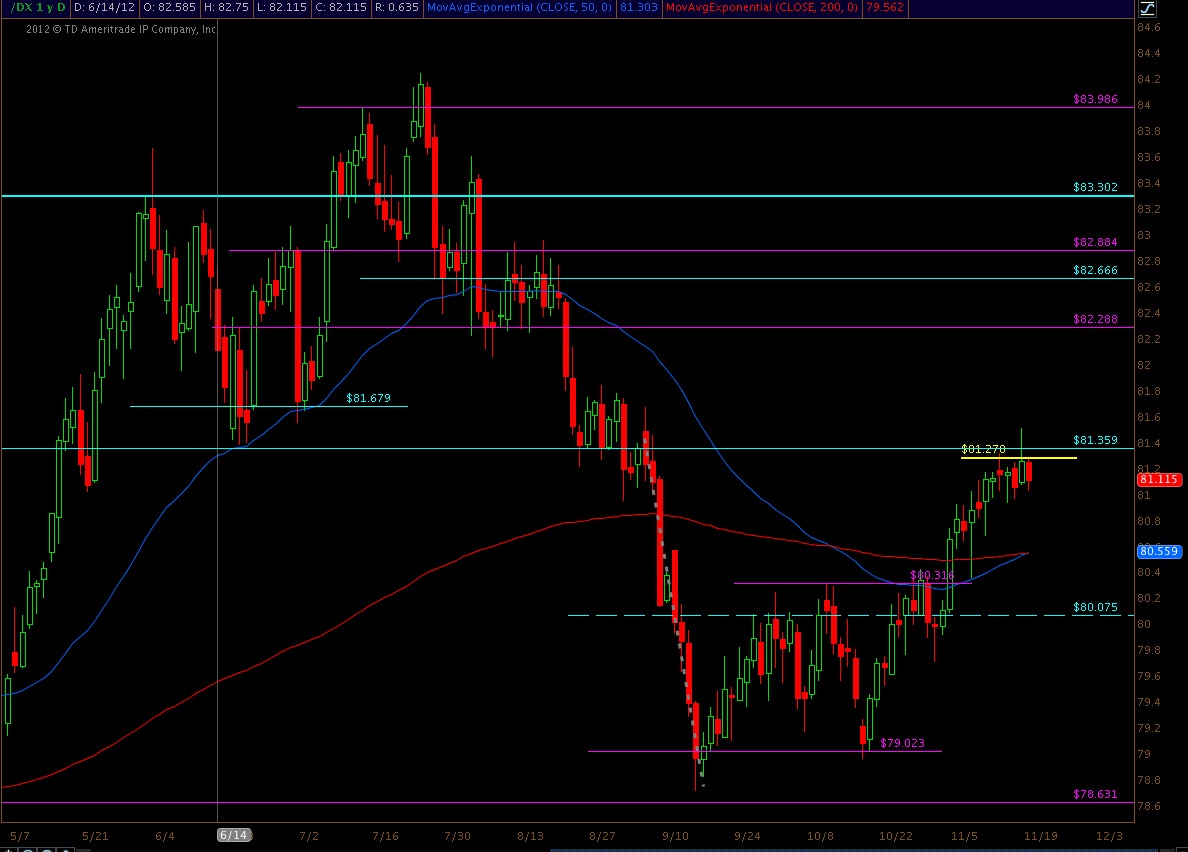

Piker Trader has noted the rally in the dollar has stalled out as it has hit resistance at 81.35 and 81.22. Most recently the dollar has been failing at the 81.27 level and looks to be forming a rounded top pattern. This is becoming evident as the dollar slowly chops around this level and looks to forming a upside down U shape. This is more of a visual pattern and not a pattern that is developed by connecting resistance levels or trend lines.

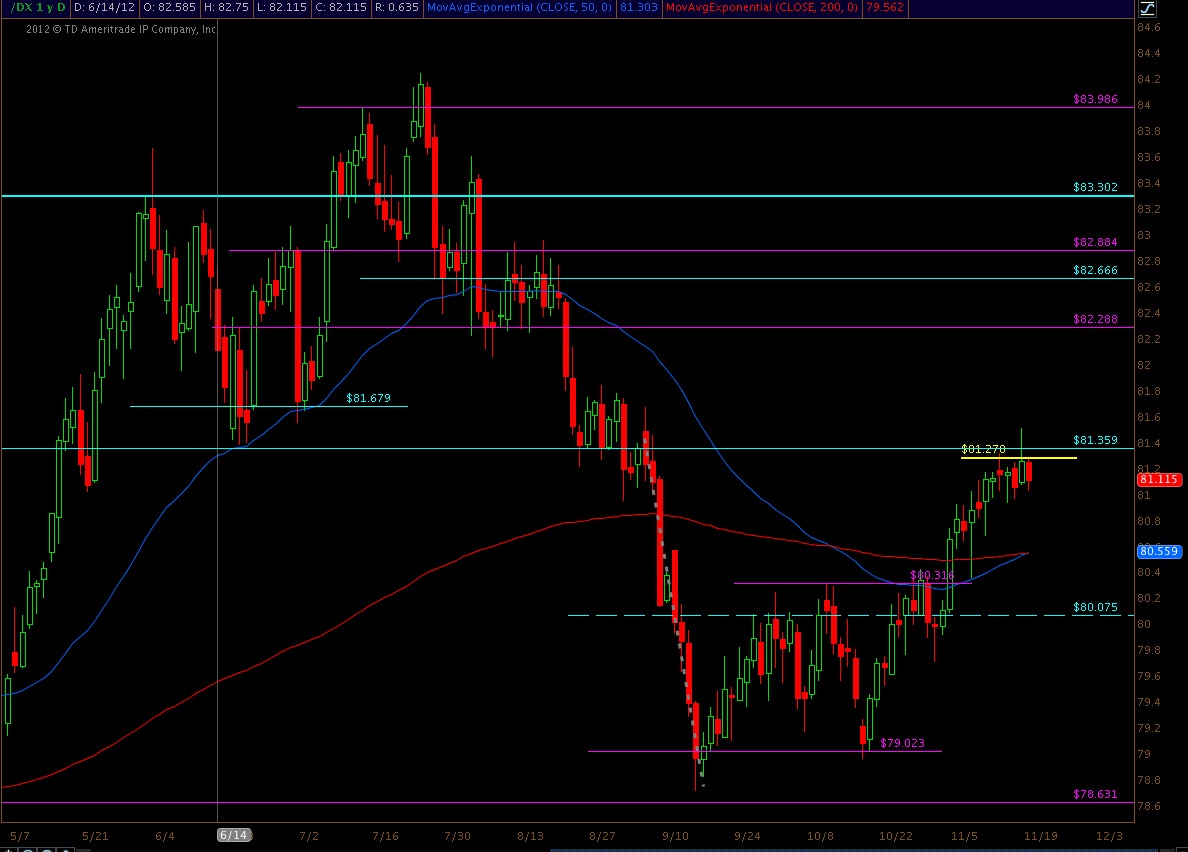

Below is the direction of what the rounded top would need to take to be a complete pattern. For this pattern to work out DX would need to first break 81.04, this would create selling to get the dollar at least back to its breakout level at 80.07. Note that when the rounded top ends it creates a buying opportunity as the stock tends to bounce off support.

If the dollar rounded top does work out, it would be bullish for the market and bullish metals and oil. It is very possible the dollar top pushes the dollar lower to at least 80.07 to 78 helping the market rally before the year end. At these levels the dollar could bounce and again would be bearish for the market.

Below is the direction of what the rounded top would need to take to be a complete pattern. For this pattern to work out DX would need to first break 81.04, this would create selling to get the dollar at least back to its breakout level at 80.07. Note that when the rounded top ends it creates a buying opportunity as the stock tends to bounce off support.

If the dollar rounded top does work out, it would be bullish for the market and bullish metals and oil. It is very possible the dollar top pushes the dollar lower to at least 80.07 to 78 helping the market rally before the year end. At these levels the dollar could bounce and again would be bearish for the market.