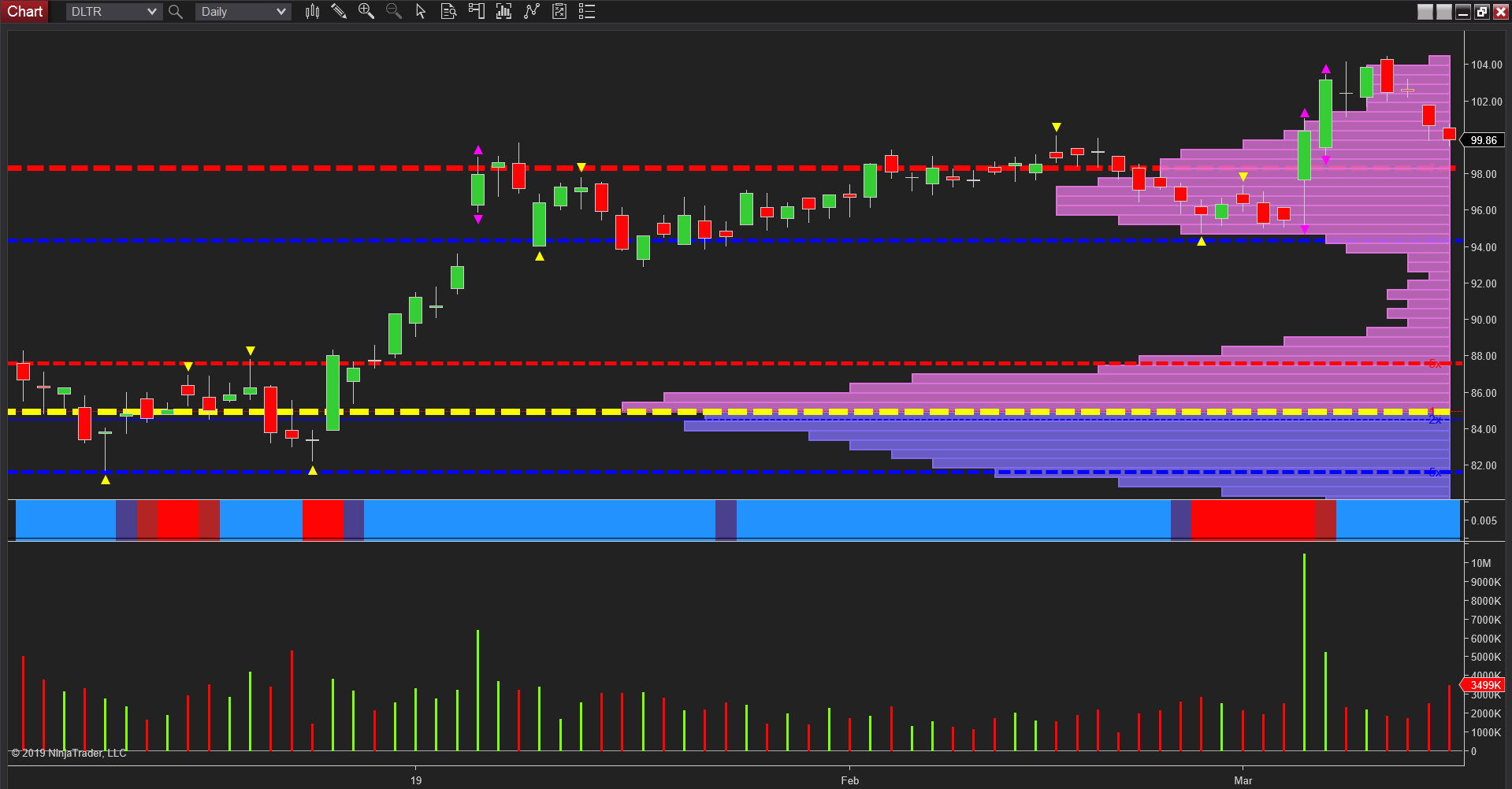

Recent price action in DollarTree (NASDAQ:DLTR) has confirmed the weakness of the current rally which has all the hallmarks of a trap move higher with the appearance of volatility signals on the daily chart, coupled with extreme volume also adding to this analysis.

The Quantumtrading volatility indicator triggers in real time and signals the price action has moved outside its average true range and confirming two aspects of volatility which can best be described as the compression of time. The first aspect is the market makers are participating and second, once volatility appears, congestion is likely to follow as the price action retraces within the spread of the candle. And it can also result in a full reversal from the primary trend higher to primary trend lower.

In this case, the first volatility candle appeared on March 6 which was accompanied with extreme volume, with the second candle triggered the following day on high volume. This was followed by congestion and consolidation, with a further sign of weakness on the two bar reversal of March 11 and 12. Since then we have seen rising volume and falling prices which confirm the weakness now building for this stock.

Below are two strong levels of price support and denoted with the red dashed line of the accumulation and distribution indicator. The second is at $94.20. If the first of these is breached, then the second is likely to be tested also, and should this fail we could see the stock move down to a third level of support at $87.80 in the longer term.

Finally, note the third volatility signal which appeared at the start of the year on the gapped up move and the extensive congestion which duly followed.