The main currency pair on Monday is holding near the level of 1.0882, which is close to the minimum of seven weeks.

The trend of investors massively avoiding risks is bolstering the dollar. Panic was triggered last week by negative news from China, where one of the largest private developers missed a bond payment and attempted to negotiate the postponement of other transactions.

At the same time, the People's Bank of China injected funds into the financial system to stabilize the yuan. This move also alerted market participants.

Subsequently, the minutes of the last meeting of the US Federal Reserve System was released, in which the regulator did not rule out the possibility of future interest rate increases. The US dollar garnered market sympathy, while other currencies were under pressure. These conditions continue to prevail into the new week of August.

Technical analysis of EUR/USD Currency pair

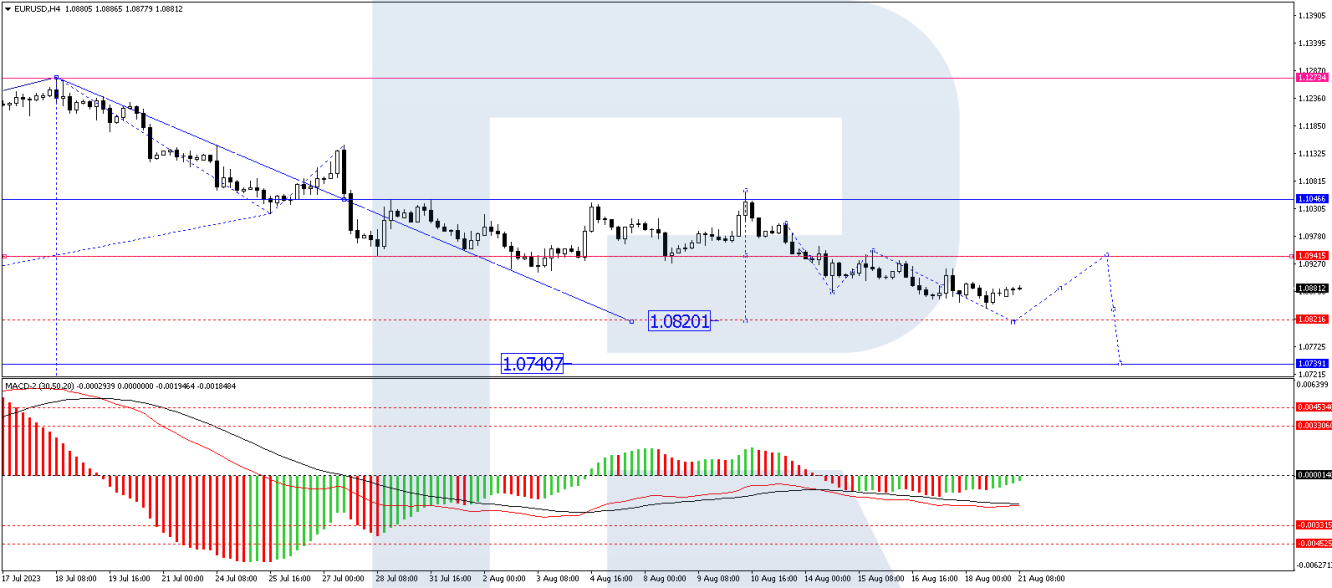

On the H4 EUR/USD chart, the quotes rebounded from the 1.0940 mark and went on to develop a structure of decline to 1.0820. Upon reaching the level, a link of correction to 1.0940 is not excluded (with a test from below), followed by a decline to 1.0740. Technically, such a scenario is confirmed by the MACD, whose signal line is under the zero mark, and a decline to new lows is expected.

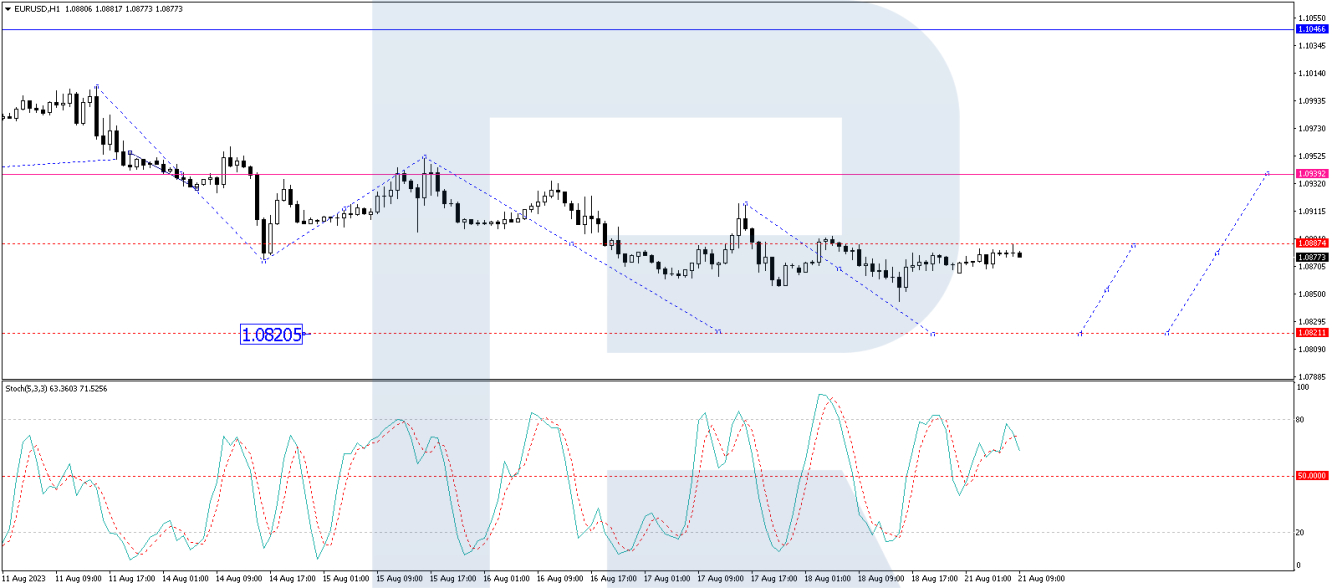

On the H1 EURUSD chart, the quotes performed a declining wave to 1.0844 and today corrected to 1.0887 (with a test from below). A narrow consolidation range is expected to develop under this level. An exit from the range downwards might allow the wave to continue to 1.0820. Technically, this scenario is confirmed by the Stochastic oscillator, whose signal line is aimed strictly downwards. The line is expected to drop to 50, and if this level breaks, the line might reach 20.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.