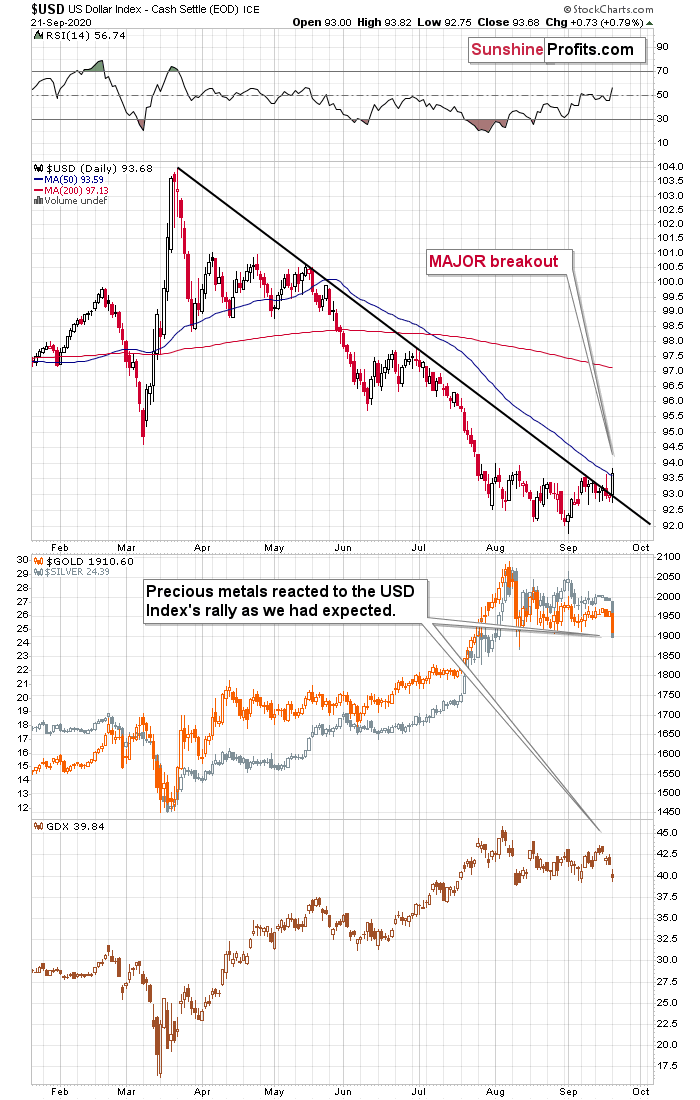

Gold, silver, and mining stocks plunged yesterday as a response to USD's breakout.

Several times, we wrote that PMs tend to react to breakouts and breakdowns in the USDX more than they do compared to other moves in the index, and yesterday's action served as the perfect confirmation for it.

The USD Index moved clearly and significantly above the declining resistance line. The three consecutive daily closes did not confirm the breakout, but traders still seem to think that a daily close above the resistance happens to be significant.

People might have thought that we were wrong to expect higher USDX values for weeks now and that our mid-year USDX broad bottoms theory is flawed. Last Friday, we even told you that the early breakout invalidation could not be taken at its face (bearish) value. This breakout proves that we were not that crazy after all. Thereby, the action that will likely follow will serve as the final proof.

The long-term USD Index chart above points out to the critical situation and how tiny the rally was so far. And yet, silver declined over $2 yesterday.

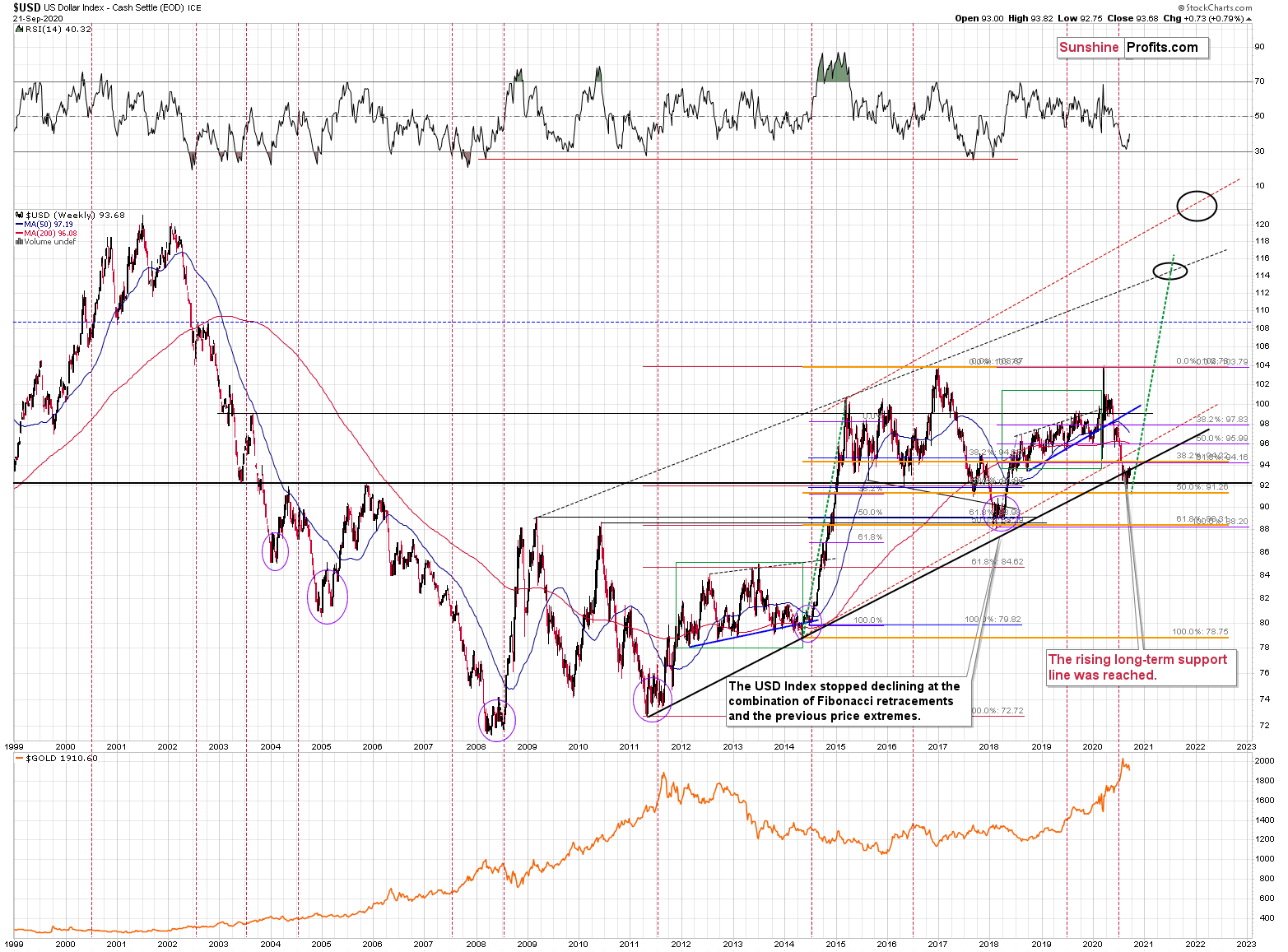

We've previously commented on the USDX chart above as follows:

The USD Index is at a powerful combination of support levels. One of them is the rising, long-term, black support line that's based on the 2011 and 2014 bottoms.

The other major, long-term factor is the proximity to the 92 level - that's when gold topped in 2004, 2005, and where it - approximately - bottomed in 2015, and 2016.

The USDX just moved to these profound support levels, and it's very oversold on a short-term basis. It all happened in the middle of the year, which is when the USDX formed major bottoms on many occasions. This makes a short-term rally here very likely.

While it might not be visible at the first sight, the USD Index moved briefly below the long-term, black support line and then it invalidated this breakdown before the end of the week. This is a very bullish indication for the next few weeks.

Based on the most recent price moves, the USDX is once again below the above-mentioned strong rising support line, but we doubt that this breakdown would hold. We expect to see an invalidation thereof that is followed by a rally.

The above is still valid, especially if we keep USD's yesterday's breakout into consideration.

The implications for the precious metals market are very bearish.