My how the worm can turn in a moment in these markets. Now, I am not suggesting that the dollar has reversed massively in the past 36hrs, but some of the overall bullishness that had characterised movements in the greenback at the beginning of the week have started to lessen. The reason for this is not strength elsewhere, but simply a little more weakness in the data than some of the bulls had bargained for.

Missed Expectations

Yesterday’s GDP announcement didn’t help. Growth missed expectations of 2.5%, coming in at 2.4%. This is being attributed to smaller inventories and less government spending. Personal consumption also rose by 3.4% – a healthy figure. This was not a massive miss, but alongside a spike higher in initial jobless claims to 354k, the market decided that the dollar was due a pullback. Analysts had expected the number of people claiming wage insurance would remain at 340k.

Of course, it is also the end of the month and investors, if they backed the dollar at the beginning of the month would still be up around 2% on a trade weighted basis, may simply be just taking some profits on what has, until lately, been a one-way street. Similar moves will be seen if today’s Michigan consumer confidence measure disappoints although we find that to be unlikely.

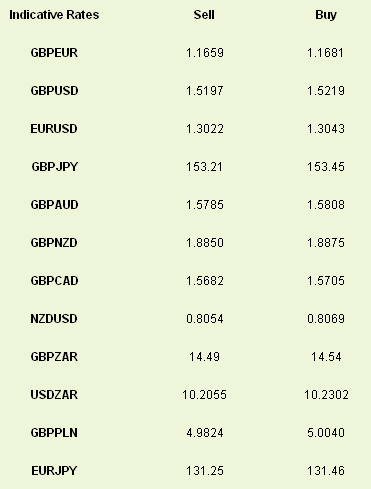

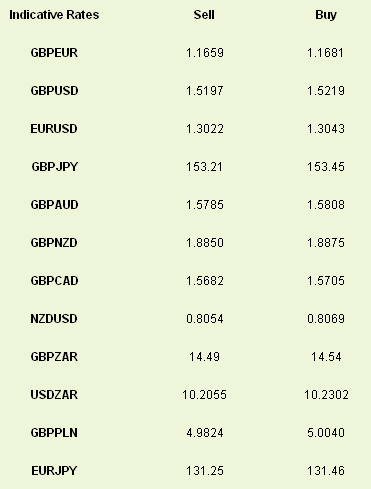

The USD weakness propelled EUR/USD above 1.30 and GBP/USD above 1.52 -- air we did not believe either would be breathing anytime soon.

NZD has fought back from its weakness yesterday, after comments from the central bank took NZD/USD to a nine-month low. The RBNZ said will continue to intervene to weaken the currency, moving forward. In April, the central bank sold the most amount of currency since May 2008, although the actual figures were significantly less than had been expected and this will negate the impact of any further intervention chatter that may be forthcoming.

The RBNZ is also attempting to battle a rising housing market which shows some characteristics of becoming a bubble (high LTVs for example). Obviously, this could be contained to a certain extent, but that would put the NZD higher as well. We therefore are happy to think that NZD will remain supported for longer.

One currency that has come in for an absolute shellacking of late has been the ZAR. GBP/ZAR and USD/ZAR both hit the highest level in four years yesterday. The collapse of the gold price in April should have been a harbinger for further ZAR losses, but the ensuing losses in silver, copper and other markets have also hurt the rand hugely over the past few weeks.

Rand has come in for a beating following further strikes by miners in recent months leading to a 7.1% fall in industrial production and a hit to growth that led to a below expectation GDP print of 1.9%. Similar issues blighted South Africa last year until the situation descended into violence and we hope similar scenes are not repeated. In the meantime there is very little to stop the rand from weakening, especially if labour disputes continue or spread to other unionised occupations.

Missed Expectations

Yesterday’s GDP announcement didn’t help. Growth missed expectations of 2.5%, coming in at 2.4%. This is being attributed to smaller inventories and less government spending. Personal consumption also rose by 3.4% – a healthy figure. This was not a massive miss, but alongside a spike higher in initial jobless claims to 354k, the market decided that the dollar was due a pullback. Analysts had expected the number of people claiming wage insurance would remain at 340k.

Of course, it is also the end of the month and investors, if they backed the dollar at the beginning of the month would still be up around 2% on a trade weighted basis, may simply be just taking some profits on what has, until lately, been a one-way street. Similar moves will be seen if today’s Michigan consumer confidence measure disappoints although we find that to be unlikely.

The USD weakness propelled EUR/USD above 1.30 and GBP/USD above 1.52 -- air we did not believe either would be breathing anytime soon.

NZD has fought back from its weakness yesterday, after comments from the central bank took NZD/USD to a nine-month low. The RBNZ said will continue to intervene to weaken the currency, moving forward. In April, the central bank sold the most amount of currency since May 2008, although the actual figures were significantly less than had been expected and this will negate the impact of any further intervention chatter that may be forthcoming.

The RBNZ is also attempting to battle a rising housing market which shows some characteristics of becoming a bubble (high LTVs for example). Obviously, this could be contained to a certain extent, but that would put the NZD higher as well. We therefore are happy to think that NZD will remain supported for longer.

One currency that has come in for an absolute shellacking of late has been the ZAR. GBP/ZAR and USD/ZAR both hit the highest level in four years yesterday. The collapse of the gold price in April should have been a harbinger for further ZAR losses, but the ensuing losses in silver, copper and other markets have also hurt the rand hugely over the past few weeks.

Rand has come in for a beating following further strikes by miners in recent months leading to a 7.1% fall in industrial production and a hit to growth that led to a below expectation GDP print of 1.9%. Similar issues blighted South Africa last year until the situation descended into violence and we hope similar scenes are not repeated. In the meantime there is very little to stop the rand from weakening, especially if labour disputes continue or spread to other unionised occupations.