Main Market Movers

USD

The dollar has slumped even further as drama from Washington leaves a cloud of uncertainty over the greenback. The latest source of concern is Anthony Scaramucci’s sudden ousting after 10 days as the White House Communications Director. The constant theatrics from the Trump administration have caused investors to fear that Mr. Trump is incapable of bringing any real change to policy, thus turning bearish on the dollar.

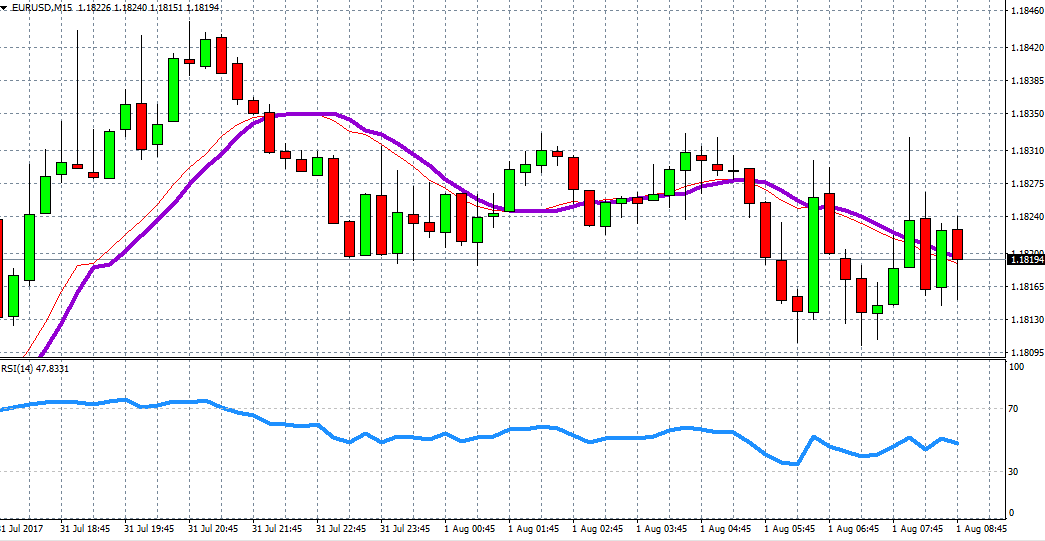

EUR

The euro rallied against the dollar, clocking up the best monthly gain in over a year. Investors are plunging bullish bets into the single currency as an alternative to the US dollar, bringing the euro to the highest point since January 2015.

EURUSD

Since the euro is only an alternative to the waning dollar, there may be little fundamental reason for the single currency to hold these highs. The EURUSD could come back down to the $1.17 region if no fundamental driver appears.

Today’s flurry of European economic data may provide that momentum.

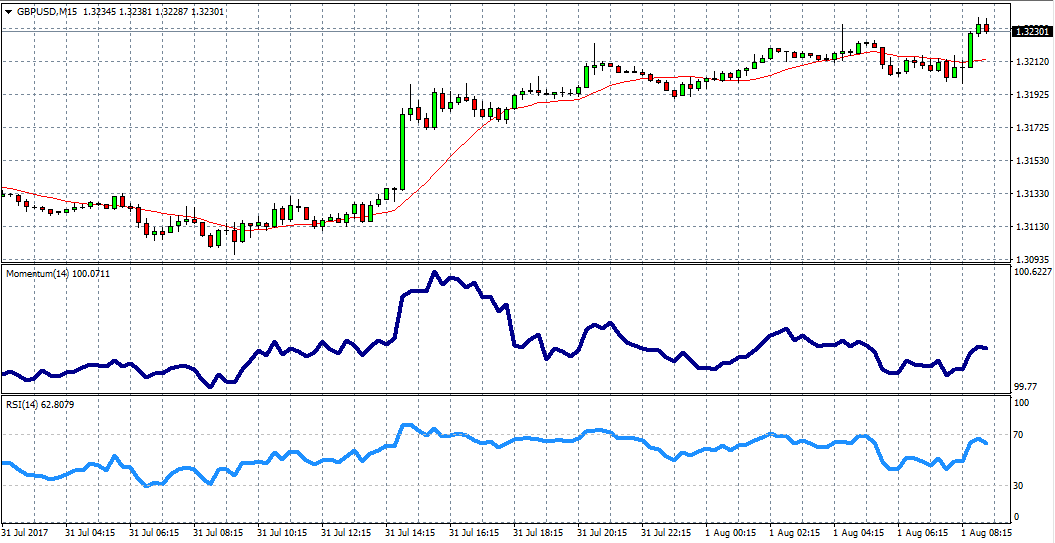

GBP

The pound is at $1.32, the highest it’s been since September. On Monday, sterling clutched onto a 0.6% gain. Over the past five sessions, the currency has added 1.8%, rebounding a total of 7% in 2017.

GBPUSD

Global Equities

Financial stocks and commodities pushed up European equities. London’s FTSE 100 is particularly sensitive to the rally in commodities, outperforming most other major European indexes, up 0.7%.

Germany’s DAX 30 is up 0.78%, while France’s CAC 40 has added 0.8% to its value, the largest rise in European indexes today.

The positivity has lurched upon US sentiment, bringing equities higher this morning. The tech-heavy Nasdaq is 0.4% higher, while Wall Street’s proxy has advanced 0.2%.

Commodities

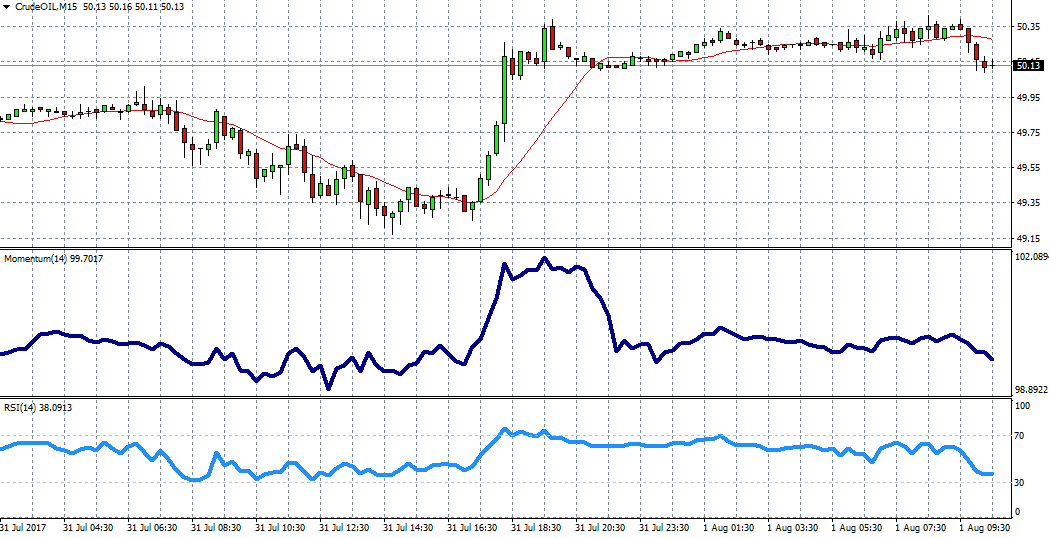

Crude Oil

Trading above the $50 mark, crude oil has recovered from its afternoon dip on Monday.

Crude’s momentum is diving however and moving averages seem to be curving downwards, so possible bearish tones could prevail.