Dollar is generally weak this week so far and in particular, dip to new 2014 low against the Aussie overnight. Euro also managed to recover against the greenback and took out a minor resistance at 1.3844. G7 released a joint declaration in The Hague after a summit yesterday and warned that if Russia continues to escalate the situation with Ukraine, there will be future actions targeted at economic sectors that will have "an increasingly significant impact" on the Russian economy. It's reported that for now, G7 will hold back from further actions, though, unless Russia move deeper into Ukraine after annexing Crimea. Also, G7 leaders said they will not attend the planned G8 meeting in Moscow in April and the summit in Sochi in June as Russia's actions were not consistent with the "shared beliefs and shared responsibilities" that had made the formation of the G8 possible.

In Eurozone, ECB President Draghi hailed that "considerable progress" were made in Ireland's banking sector. But he also noted that mores are needed to be done, including completion of restructuring of damaged backs. He emphasized "resolving these issues will be crucial in order to ensure the emergence of a sound banking sector that will support the domestic economy in the coming years." ECB governing council member Liikanen said the central bank will look at the exchange rate as it has an impact on inflation. And he reiterated ECB's easing bias as there is a "clear downward bias" and thus, monetary policy will remain accommodative well into recovery.

On the data front, China conference board leading indicator rose 0.9% in February. The calendar of European session is rather busy. German IFO will be a focus while UK inflation data is another. In particular, UK CPI is expected to drop further to 1.7% yoy in February which could give the central bank some pressure for maintaining stimulus longer. From US, house price indices, consumer confidence and new home sales.

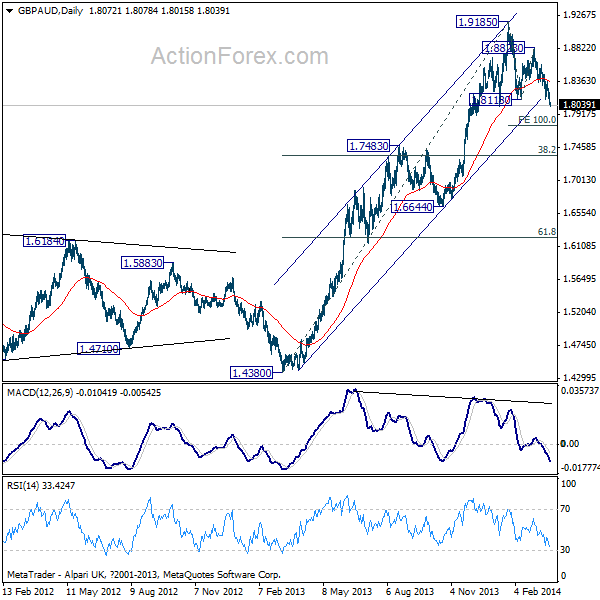

Sterling is so far the biggest loser this month, in particular against Aussie and Kiwi. GBP/AUD took out 1.8118 support last week and resumed the whole decline from 1.9851. Also, the break of the medium term rising channel and bearish divergence condition in daily MACD suggests that whole rise from 1.4380 has completed too. Fall from 1.9185 is current viewed as a corrective move while could go deeper to 100% projection of 1.9185 to 1.8118 from 1.8823 at 1.7756 and possibly below. At this point, we'd expect strong support from 1.7483, which is close to 38.2% retracement of 1.4380 to 1.9185 at 1.7349 to contain downside to complete the correction.