The Dollar was Trumped

The primary driver overnight was President–elect Trump’s press conference. Judging by the market’s reaction, notably the fierce decline in the US dollar, dealers were extremely discouraged by the lack of detail regarding the new administration’s economic plan, as the presser was more about extinguishing smouldering hot spots regarding conflict of interest and the Trump organisation's associations with Russia. Dealers will now turn to the Inauguration State of the Union, which in my view, offers the ideal platform to present his plans for a massive infrastructure spending program. USDJPY, USDMXN and USD CNH, predictably were the primary focus as volume surged.

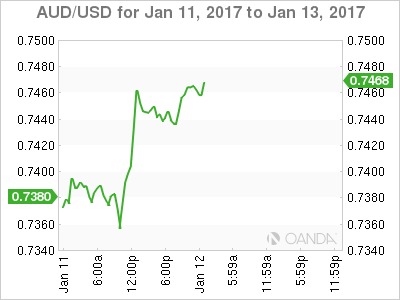

The Australian Dollar

It is all in the details, but in the case of last night’s Trump presser, it was “the lack thereof." The Australian dollar surged overnight as the level of scepticism regarding the new US administration’s economic policies dramatically increased. For those hoping for clues about tax reform and infrastructure spending, you will likely need to wait until the Inauguration for confirmation.The AUD roared 1 cent higher as dealers were quick to seize the moment as US yields dropped, making the Aussie that much more attractive. Eyes will be on the commodity markets' reaction today, given that much of the recent speculative price action, especially in iron ore, was predicated on the US infrastructure spend. However, I think this week’s surging China PPI print may provide sufficient fuel to sustain the current Aussie rally, which is poised to make another leg higher.

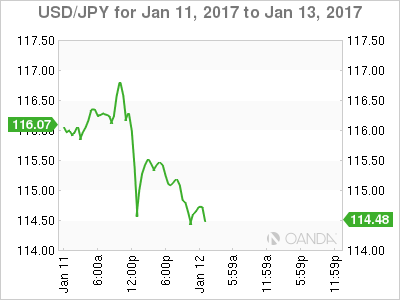

The Japanese Yen

The USDJPY was hammered after Trump offered zero details on infrastructure spending plans or corporate tax reform. the US 10-Y bottomed at 2.32-3% as USDJPY plummeted to 114.25 before dip buyers emerged.To refer to the overnight moves as a rollercoaster would be an understatement. However, the break of the 115.00 level is a massive breach; if strong USDJPY demand does not appear out of Tokyo this morning to confirm overnight dip demand, we may be in for another “position event” that could see a significant retrenching of long USDJPY positions. How committed dealers are willing to re-engage long dollar will be the key, but amid renewed uncertainty about US fiscal policy, traders will likely err on the side of caution and wait for definitive policy measures before reloading USD longs. At a minimum, dealers will be rethinking the Trump trade, which should be negative for the dollar fortunes near-term as uncertainty should point towards risk reduction

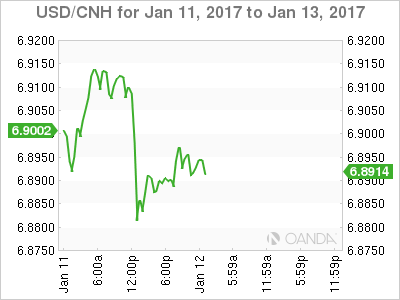

Yuan

Trump did not deliver the fireworks some were expecting, rather he underwhelmed, failing to provide any financial guidance. Volumes were extremely high on the CNH overnight, but the bulk of the activity was short duration, headline-driven moves. The CNH is tracking the broader US dollar, which is trading weaker on the back of softer US bond yield. Given the current market momentum, expect dollar rallies to be capped until the incoming US administration offers some semblance of forward economic guidance. While I am sure it is coming, last night’s presser was not the ideal platform, and the major bazooka style fiscal announcements may be forthcoming at the Presidential Inauguration State of the Union speech. I expect dollar dips in CNH to be well supported.

EM Asia

Regional focus is squarely on the South Korean won and the Chinese RMB complex. Despite the fear of rising US interest rates and possible US trade sanctions, the KRW has performed admirably, as suspected equity inflows are providing a tailwind for the KRW. Low valuations are key as investors view 8-10% potential upside as outweighing the risk for a further depreciation in the KRW.