Major discount-store retailer, Dollar Tree, Inc. (NASDAQ:) is on track with its long-term growth strategies, including store expansions, cost-containment efforts and focus on integration of Family Dollar.

Let’s see if these strategic endeavors can help the company regain investors’ confidence that has been dwindling of late.

Why Is DLTR Falling?

Well, the company’s shares have plunged 11% in the last six months, underperforming the Zacks categorized Retail – Discount & Variety industry’s dip of 1.4%. More recently, this Zacks Rank #3 (Hold) stock has slipped 3.5%, since it reported first-quarter fiscal 2017 results last month.

Dollar Tree’s earnings missed our estimate in the quarter, after posting back-to-back surprises in the last two. Though sales improved year over year, it was somewhat impacted by delay in tax refunds and cycling of reduced SNAP benefits from last year.

Reduction in SNAP benefits has been a concern for Dollar Tree for a while now, and with chances of President Donald Trump’s proposed food stamp cut getting passed, the situation could get worse. Trump has suggested reducing food stamps program by $193 billion, which is approximately 25% of the budget for the program. Cut in SNAP benefits is likely to hamper Dollar Tree’s performance, as people with low income will have less money to spend and could restrict their spending to low margin products.

Furthermore, management curtailed its earnings outlook for fiscal 2017, while it slightly twisted its sales view. The company now forecasts net sales for fiscal 2017 (which will contain an additional week) in the band of $21.95–$22.25 billion, compared with the old projection of $21.94–$22.33 billion.

Earnings per share for fiscal 2017 are now expected to be in the range of $4.17–$4.43, which includes an impairment charge of 13 cents recorded in the first quarter. Earlier, management projected earnings in a band of $4.20–$4.56 per share in fiscal 2017.

Apart from hurting investors’ sentiments, these factors also caused a downtrend in the Zacks Consensus Estimate for the second quarter and fiscal 2017. Evidently, estimates for the quarter and the fiscal have dropped to 87 cents and $4.45 from 90 cents and $4.47, respectively in the last 30 days.

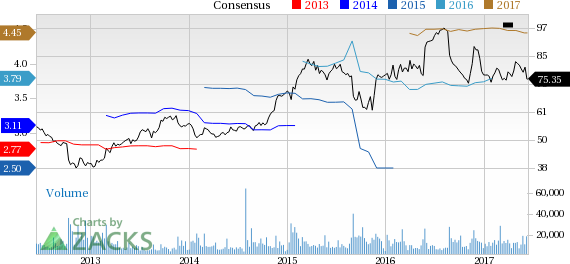

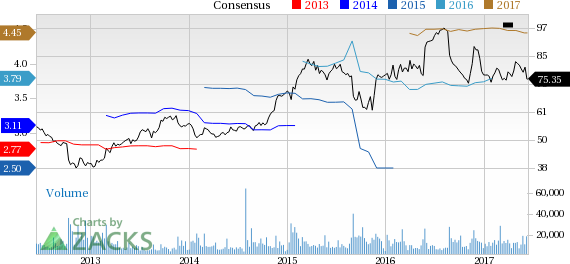

Dollar Tree, Inc. Price and Consensus

Dollar Tree, Inc. Price and Consensus | Dollar Tree, Inc. Quote

The Better Side of the Story

Nevertheless, both the top and bottom lines grew year over year in the quarter. Also, the company posted its 37th straight quarter of comps growth, driven by higher customer count and average ticket. Additionally, reduced merchandise and freight expenses helped gross margin expansion. These factors provided some respite to the otherwise dull scenario.

Other than this, we remain confident of Dollar Tree’s growth strategies, which include store expansion strategies, enhancement of store productivity, creating new store formats, tapping of new markets and incorporating innovative sales channels to serve its patrons better. Also, in order to improve the operating margin, Dollar Tree is focusing on imported goods, supply chain efficiency and aggressive cost cuts.

The company is also well on track with Family Dollar’s integration, which it had acquired last year. With the completion of the integration, the company is likely to become a mega U.S. discount retailer that can single handedly counter competition from retail bellwethers in the dollar-discount store segment.

Further, the company will be strongly positioned to reach out to more value-seeking consumers, offering multiple assortments at more compelling prices. Also, it will be in a better position to negotiate with suppliers, which is expected to enhance its purchasing power. While cannibalization is expected to hurt Dollar Tree’s performance throughout the re-banner process, synergies from Family Dollar’s acquisition should benefit the company in the long run.

Thus, it remains to be seen if the aforementioned efforts can bring a turnaround in Dollar Tree’s stock performance.

Where to Place Bets?

Until then, investors can safely place their bets on Dollar General Corp. (NYSE:) , Burlington Stores, Inc. (NYSE:) and Target Corp. (NYSE:) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dollar General has delivered back-to-back positive earnings surprise in the last two quarters. The stock also has a long-term growth rate of 10.6%.

Burlington, with long-term earnings per share growth rate of 15.9%, has delivered positive earnings surprise consistently in the last four quarters.

Target has a long-term growth rate of 8.2%. Also, the company has an average positive earnings surprise of 16.5% in the trailing four quarters.

Zacks' 2017 IPO Watch List

Before looking into the stocks mentioned above, you may want to get a head start on potential tech IPOs that are popping up on Zacks' radar. Imagine being in the first wave of investors to jump on a company with almost unlimited growth potential? This Special Report gives you the current scoop on 5 that may go public at any time.

One has driven from 0 to a $68 billion valuation in 8 years. Four others are a little less obvious but already show jaw-dropping growth. Download this IPO Watch List today for free >>