- Dollar trades mixed against the other majors

- PCE numbers and Fed speakers could reshape Fed bets

- Germany’s CPI data due out a day ahead of Eurozone’s inflation numbers

- Wall Street indices add more than 1% worth of gains each

Dollar awaits the PCE inflation numbers for direction

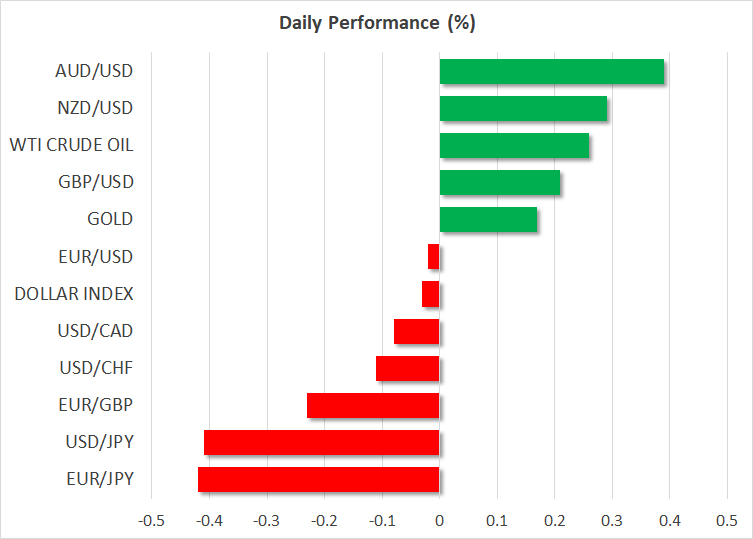

The dollar traded mixed against the other major currencies on Wednesday, finding it hard to assume a clear direction today as well.

The dollar recovered some of its recent losses on Wednesday, as concerns about the health of the US banking sector eased. However, investors are still wondering whether the crisis will prompt the Fed to press the pause button soon and cut rates later this year.

Although investors are expecting interest rates to end the year at a higher level than estimated at the height of the turmoil, they are still anticipating around 50bps worth of rate reductions by December, while they are evenly split on whether the Fed should deliver another quarter-point hike in May or take no action at all.

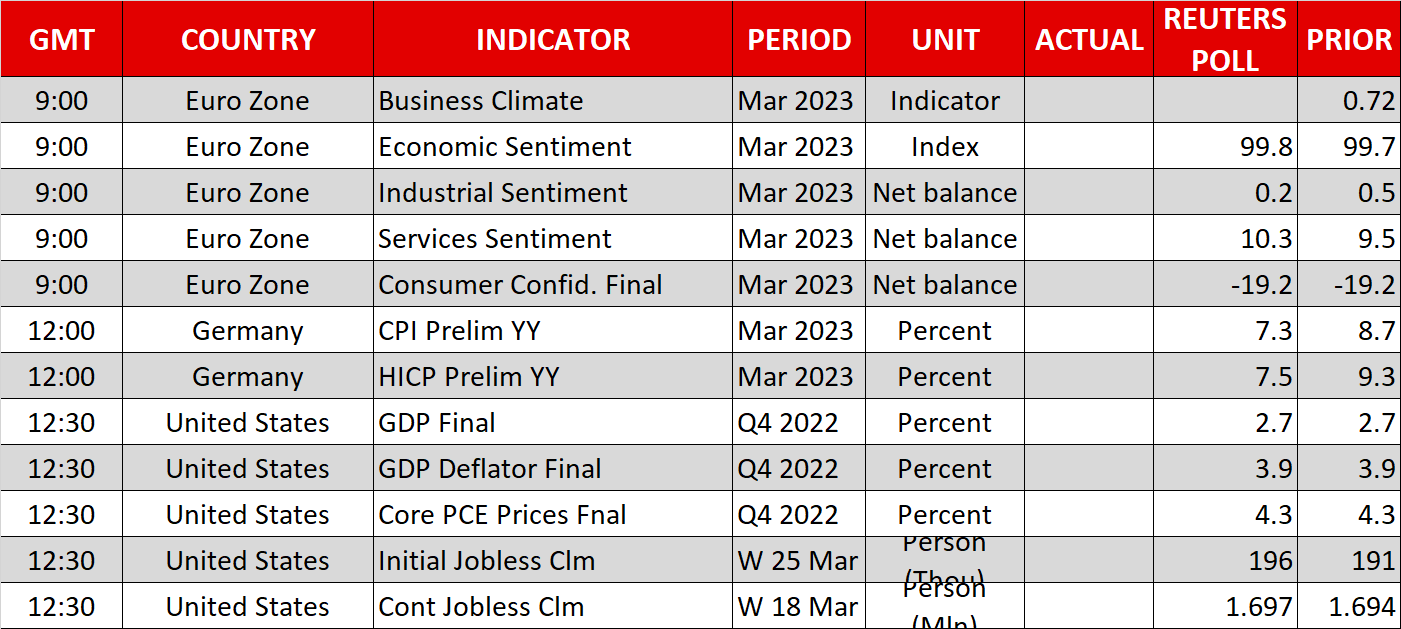

What could constitute an additional clue to the riddle of how the Fed will proceed henceforth may be the PCE inflation data for February, due out tomorrow. The highlight is likely to be the core PCE index, which is the Fed’s favorite inflation gauge, with its y/y rate expected to have held steady at 4.7%. However, with core CPI slowing further in February, the risks surrounding the PCE rate may be tilted to the downside.

Expectations about the Fed’s future course of action could also be affected by policymakers’ remarks. Following Bullard’s comments that monetary policy will continue aiming at bringing inflation to heel, Richmond Fed President Thomas Barkin and Minneapolis Fed President Neel Kashkari will step onto the rostrum today. It will be interesting to see whether they will sing from Powell’s hymn sheet and push back against rate cuts bets, but also whether the market will be convinced.

Eurozone inflation enters the spotlight too

Euro traders are likely to have a busy end of the week as well, as today, the preliminary German CPI data for March are coming out, a day ahead of the Eurozone’s numbers.

The forecasts point to a notable slowdown in German inflation, which could raise speculation that the Eurozone’s headline rate will move in a similar fashion. However, with the bloc’s underlying metrics expected to have continued accelerating, euro traders may become more convinced about the need for more rate hikes by the ECB, and thereby add to their long positions.

With the yen coming under selling interest due to the easing concerns surrounding the banking industry, euro/yen may climb a bit higher, especially if the Tokyo CPIs for March, due out early on Friday, slow further. Slowing inflation in Japan could allow the BoJ to wait for a while longer before removing further accommodation, but with companies and unions agreeing to the steepest wage increase in three decades, taking the case off the table seems unwise. Therefore, calling for a long-lasting bullish reversal in yen crosses may be premature. After all, renewed concerns about the banking sector cannot be ruled out just yet.

Wall Street jumps as outlook brightens

All three of Wall Street’s main indices added at least 1% worth of gains on Wednesday as upbeat outlooks from some firms eased further concerns about the health of the US economy.

Micron (NASDAQ:MU) shares rallied 7.2% after the chip maker projected a drop in Q3 revenue, but appeared optimistic with regards to its 2025 outlook, seeing artificial intelligence to be boosting sales, while Lululemon Athletica (NASDAQ:LULU) forecast annual sales and profit above Wall Street’s estimates, resulting in a 12.7% jump in its shares. It seems that with banking concerns taking the back seat and rate cuts still on their agenda, investors may feel more confident to add stocks back to their portfolios.

Gold traded somewhat lower yesterday, perhaps on safe-haven outflows. However, anything adding credence to the market’s view of a Fed pivot as soon as this year could weigh on Treasury yields and the US dollar, thereby keeping the metal supported, even during periods when stocks are also gaining.