- Dollar pulls back on cautious trading ahead of Jackson Hole

- 10-year Treasury yields extend rally to levels last seen in 2007

- China’s central bank sets yuan mid-point higher than expected

- Nvidia (NASDAQ:NVDA) lifts both Nasdaq and S&P 500 ahead of its earnings

Dollar slides but yields keep surging; Jackson Hole awaited

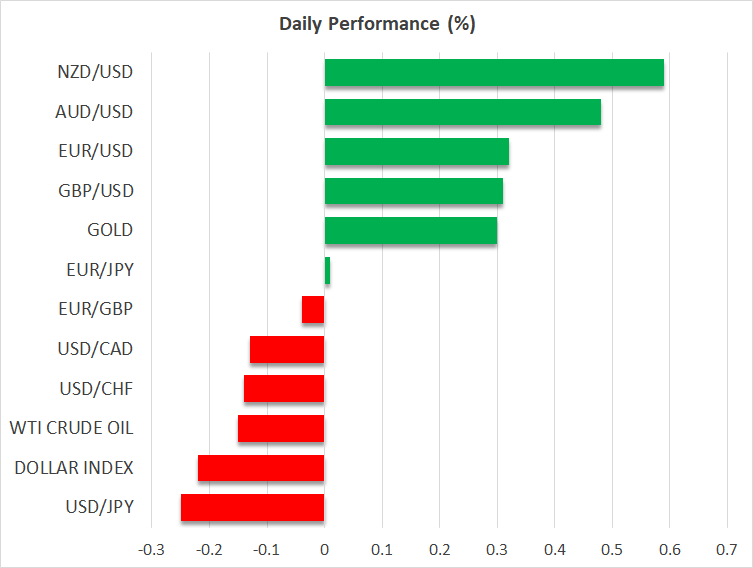

The US dollar traded lower against most of the other major currencies on Monday and remained on the back foot today. With no major catalyst behind the dollar’s setback, it seems that traders turned somewhat cautious ahead of the Jackson Hole economic symposium and a planned speech at the event by Fed Chair Powell on Friday.

Having said that, Treasury yields continued to drift north as apart from the better-than-expected economic data out of the US, they may be receiving supply-side support from the Treasury’s decision to issue more bonds following the Fitch downgrade. The 10-year yield rose more than 2% yesterday, entering territories last seen back in 2007.

At the last Fed meeting, Powell said that the central bank will make decisions meeting by meeting, closely watching economic data, adding that they could hike again in September if the data suggests so, but also that they could choose to hold steady.

With the data since then coming in more than encouraging, Powell may now tilt the scale towards another hike and/or highlight the need for interest rates to stay high for a longer period than the market currently anticipates. This could allow yields to continue rising and help the dollar resume its recent upside trajectory.

Dollar/yen resumes rally as intervention threshold seen higher

The yen was once again the bigger loser on Monday as despite the BoJ’s decision to loosen its yield target band, the surge in government bond yields elsewhere kept it a victim of widening rate differentials.

Dollar/yen rebounded from near the 145.10 zone, suggesting that traders are not afraid of intervention above the 145.00 barrier as they were back in June. That said, with Japan’s Finance Minister warning last week against excessive currency moves, should dollar/yen accelerate its rally, intervention at higher levels could become a more likely scenario. According to JPMorgan (NYSE:JPM) analysts, this could happen around the 150.00 area.

PBOC defends yuan

In China, the central bank set the yuan midpoint more than 1000 pips firmer than Reuter’s estimate, in an attempt to keep a floor under the currency which tumbled to a nine-and-a-half month low in offshore trading last week on mounting concerns about the health of the world’s second largest economy. Ahead of the decision, it was reported that state-owned banks were actively mopping up offshore liquidity to raise the cost of shorting the yuan.

Nonetheless, that’s far from good news for the aussie and kiwi as Beijing’s slow policy response to bolster a troubled economy leaves little room for optimism. Yes, both risk-linked currencies are in a recovery mode today, but should Chinese authorities continue to disappoint and Powell gives traders fresh reasons to buy US dollars, both the aussie/dollar and kiwi/dollar pairs are likely to resume their prevailing downtrends.

Nasdaq and S&P 500 rebound on Nvidia euphoria

Both the Nasdaq and the S&P 500 traded in the green yesterday, with the former gaining more than 1.5% as investors bought Nvidia stocks on optimism surrounding its earnings results, scheduled for tomorrow after the closing bell. The Dow Jones closed slightly in the red.

The technology sector offered the biggest boost to both the S&P 500 and the Nasdaq as Nvidia surged 8.5% after HSBC raised its price target on the stock to $780, with investors now expecting the semiconductor giant to forecast quarterly revenue above analysts' estimates.

Having said all that though, with Nvidia being one of the main drivers behind the latest rally on Wall Street, the risks surrounding its earnings results seem to be asymmetrical as a miss could lead to huge disappointment and thereby a sizable fall in the stock.