Dollar Outlook

We haven't talked about the dollar strength lately, but over the past couple of days it has begun to work higher yet again and its strength is going to make it harder and harder for equity markets to rise.

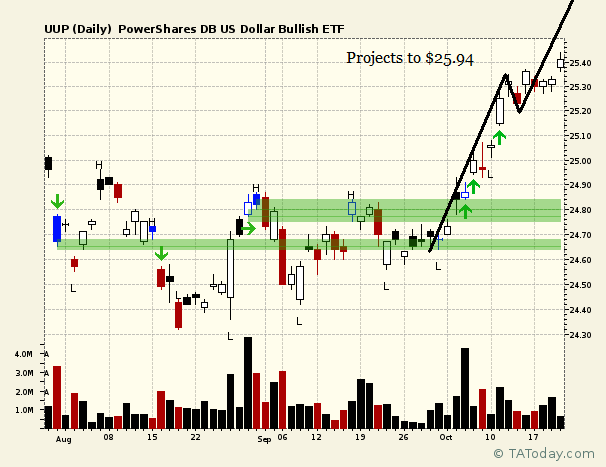

As readerss know, I have consistently called out the dollar as one of the better long term trades available to traders and investors and on a short term basis it is showing as heavily bullish (via PowerShares DB US Dollar Bullish (NYSE:UUP)).

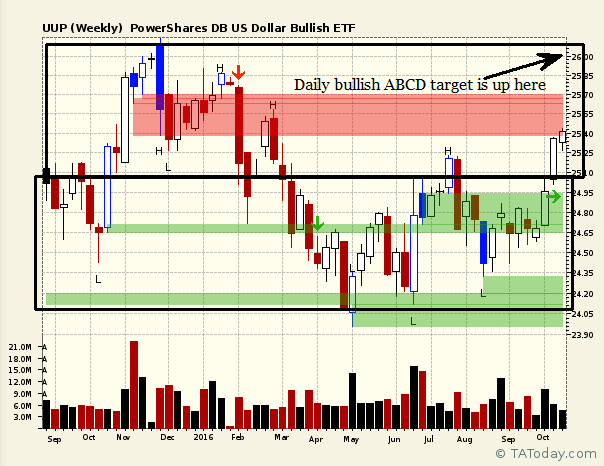

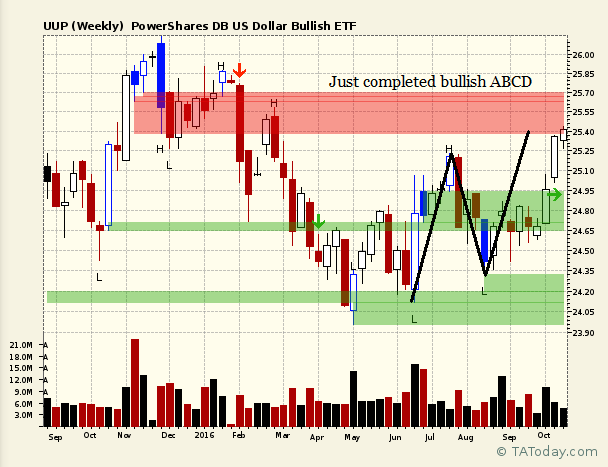

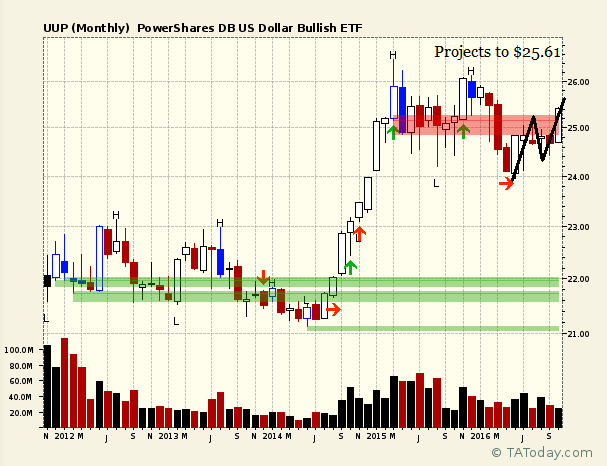

Right now it's not a market killer but the current bullish ABCD higher it has begun, if it hits the projections, would take it right up to the top of the higher range.

Bottom Line

The European Central Bank, though it did nothing but talk, is talking the euro lower again and that shows up in the dollar. There's conflicting signals on the dollar though. As shown above, it has room to run on the daily chart but the weekly and monthly show it's projections as about complete. Question is, will it extend anyway?

A strong dollar tends to hurt commodities and equity markets. Unless we start to see a fast move up and eventually a breakout topside on this chart, it's not a killer to these other markets but instead a thorn in their side. That now becomes the larger question for investors, what is it going to do?

If I had to wager a bet, it would be that the longer term projections prove more accurate, not the short term ones and therefore we should see this dollar pull back in some rather than running rampantly higher near term.