- Traders waiting for Powell’s speech - will he right the ship?

- Little action in FX complex, but stock markets edge higher

- Oil takes a hit on Iran news, UK raises energy price cap

All about Powell

The main event today will be the much-anticipated speech by Fed Chairman Powell at 14:00 GMT before the Jackson Hole symposium. This platform has been used in the past to signal strategy shifts, so market participants will be hanging on his lips for any guidance on the future of monetary policy.

In a nutshell, the US economy seems to be shifting into lower gear with business surveys warning of cooling demand, but inflationary pressures are still exceptionally high. The Fed’s problem is that markets aren’t doing its dirty work. Yields on longer-dated government bonds are simply not restrictive enough to tame inflation running at four times the Fed's target.

Bond traders are essentially saying the Fed can raise rates all it wants this year, but it will still be cutting them next year to deal with some crisis. This assumption has been embedded into asset prices, keeping longer-dated yields artificially low and the yield curve deeply inverted, which is counterproductive for the Fed in its inflation battle.

As such, Fed officials have been singing the same tune lately, stressing that interest rates will remain elevated for as long as it takes to slay the inflation dragon, even if the economy stalls. If Chairman Powell emphasizes the same point and quells speculation around rate cuts, that could ignite another selloff in risk assets but turbocharge the dollar.

Quiet on the FX front

Currency markets were caught in a stalemate ahead of Powell’s speech, with most major pairs sticking to familiar ranges as traders seemed hesitant to initiate new positions. Euro/dollar has been stuck below parity all week, meeting fierce resistance every time it attempts to cross above it thanks to the relentless rally in European natural gas prices, which hit another record high yesterday.

The energy shortage is going from bad to worse, stoking fears of stagflation in the Eurozone since this crisis will simultaneously hit consumption and pour gasoline on inflationary pressures. That means the ECB cannot ride to the rescue this time and European governments have been reluctant to shoulder the burden, so nobody wants to touch the euro.

Speaking of governments not doing enough, the British energy regulator announced it will increase the cap on electricity by 80% and warned that prices might need to rise much further next year, putting more pressure on struggling households. Even though the hike was widely expected, sterling still retreated in the aftermath as the regulator’s warning doesn’t exactly inspire confidence in the economy.

Oil pulls back, Wall Street climbs

Oil prices took some damage on Thursday after the White House said it would agree to a nuclear deal with Iran if it was in America’s best interests, feeding speculation of a breakthrough. Even so, crude prices were headed for solid weekly gains because OPEC members seem happy to counteract any new barrels from Iran by cutting their own supply, preventing the market from being flooded.

Stock markets came back to life yesterday. The S&P 500 gained 1.4% with a little help from retreating US yields and hopes that China would open the spending taps to stop the bleeding in its property sector. How resolute Chairman Powell is today will determine the next leg. In the big picture, it is difficult to get too optimistic in a regime where the Fed is still on a warpath, the economic data pulse is slowing, and earnings growth cannot keep pace with inflation.

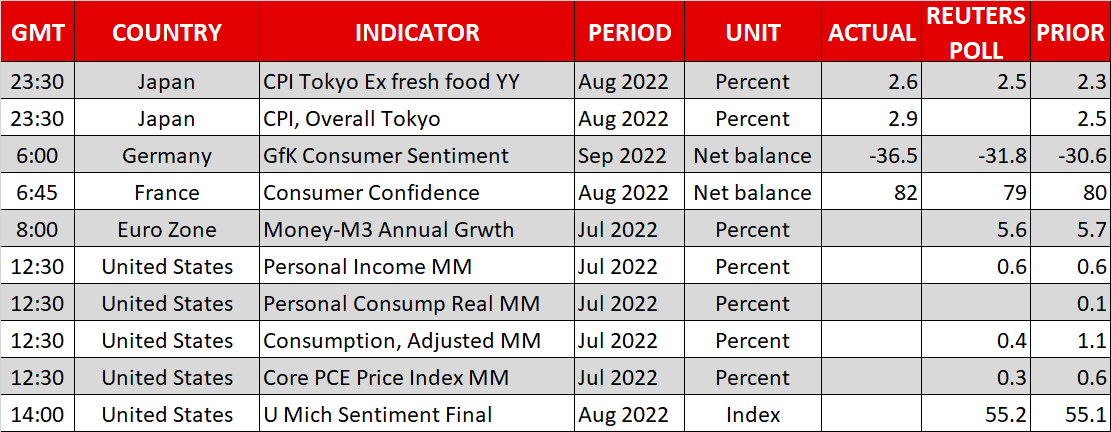

Aside from Powell’s speech, there’s also a slew of US data releases including the core PCE price index for July.