- Dollar shines, yen slides as US yields march higher

- Oil recovers on Saudi signals, stocks chop around

- RBNZ to roll out another rate increase, but how big?

Dollar kicks back

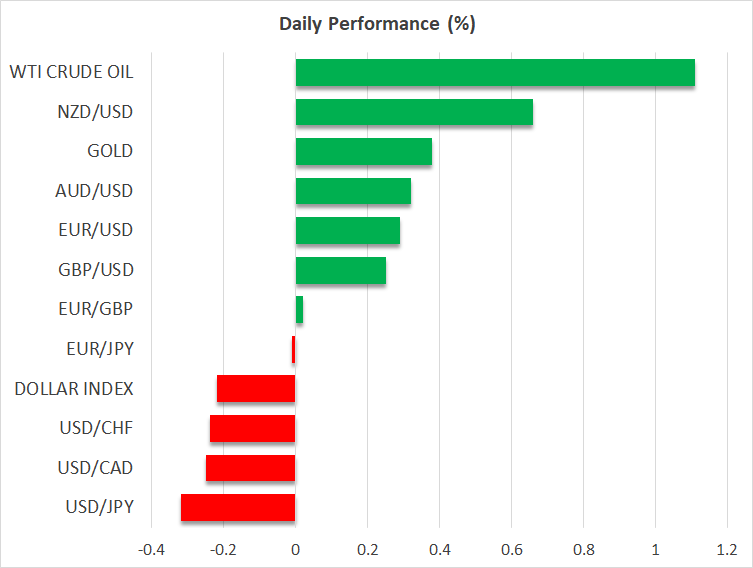

Another round of hawkish rhetoric from Fed officials and a flight to safety resulting from China’s virus outbreaks propelled the world’s reserve currency higher as the new week kicked off. The Fed’s Daly and Mester said that the pace of rate increases might be dialed down next month, yet stressed this won’t be the end of the tightening cycle, echoing the ‘higher for longer’ theme.

By every indication, the Fed intends to raise rates to around 5% and keep them there until inflation rolls over, a narrative that market pricing is exactly in line with. Policymakers are trying to walk a fine line between doing enough to slay inflation but not over-tightening and inflicting unnecessary damage on the economy.

With rate differentials widening back in the dollar’s favor, the main casualty was the Japanese yen, which continues to suffer from a severe case of central bank divergence. The Bank of Japan has not adjusted its yield ceiling strategy yet, so dollar/yen has turned into a pure play for Fed bets, having a 90% correlation with 10-year Treasury yields this month.

That said, there are some early signs this dynamic might change. Inflation in Japan has started to fire up and broaden out, the government has unveiled a $200bn stimulus package that includes incentives for companies to boost wages, and the BoJ chief has already opened the door for loosening yield curve control. The forward-looking Tokyo inflation data on Friday will be crucial in shaping market expectations ahead of next month’s BoJ decision.

Oil rebounds, stocks inch lower

Oil prices experienced heavy volatility, falling to their lowest levels of the year only to snap back, as traders sorted through some conflicting news reports. Concerns over fuel demand in China and Europe sent oil prices tumbling initially, and a media report suggesting OPEC was considering production increases added fuel to the selloff.

That report was later denied by the Saudi Arabian energy minister, which ignited a fierce comeback in oil prices. Overall, it’s tough to draw any concrete conclusions about oil prices at this stage, as the demand outlook is deteriorating rapidly but supply remains constrained, negating some of the selling pressure.

Meanwhile, US stock markets took a step back, pressured by rising yields and some caution around China. Trading was thin with volume running far below normal levels, which suggests investors are winding down and taking some chips off the table ahead of the Thanksgiving holiday on Thursday, worried that the absence of liquidity might amplify volatility.

Tesla (NASDAQ:TSLA) spearheaded the retreat, losing almost 7% to hit its lowest levels in two years after it recalled some 300k vehicles due to faulty tail lights, and amid anxiety that any tighter restrictions in China will disproportionately impact the carmaker.

RBNZ decision coming up

The economic calendar is low key today, with the only notable releases being retail sales from Canada and the latest Eurozone consumer confidence print. More importantly, the Reserve Bank of New Zealand will announce its rate decision at 01:00 GMT Wednesday.

Market pricing is leaning towards a 75bp rate hike, assigning a 66% probability to that outcome, with the remainder pointing to a smaller 50bp move. The domestic economy is running hot, with the labor market probably in the best shape it’s ever been and inflation far exceeding the RBNZ’s forecasts.

There are also signs inflationary pressures are becoming entrenched, which combined points to a 75bp move, despite signs of weakness in the housing market and China. That could boost the kiwi temporarily. If it is a 50bp move instead, it will likely be accompanied by hawkish commentary, which could help limit any losses in the currency.