Main Market Movers

USD

The direction of the dollar will be dictated by the outcome of today’s non-farm payrolls. The change in the number of people employed is expected to be 180,000, which is in line with the Federal Reserve’s wider expectation of 4.4% unemployment.

However, if the actual figure undershoots forecasts or if wage growth dips lower we could see the dollar inching downwards.

For now, the dollar has been rattled by the grand jury probe ahead of the job’s report. Today’s plunging dollar is part of a wider bearish market for the currency. We saw the dollar reaching a 15-month low just two days ago.

A flurry of robust economic figures could put some bears into hibernation.

EUR

The euro is the main beneficiary of the weak dollar. Investors have jumped ship, betting that the European economy has a less muddled path to conquer over 2017.

The upcoming geopolitical hurdles in Europe pale in comparison to the continuous drama steaming from Washington thus, investors view the eurozone as a safer bet.

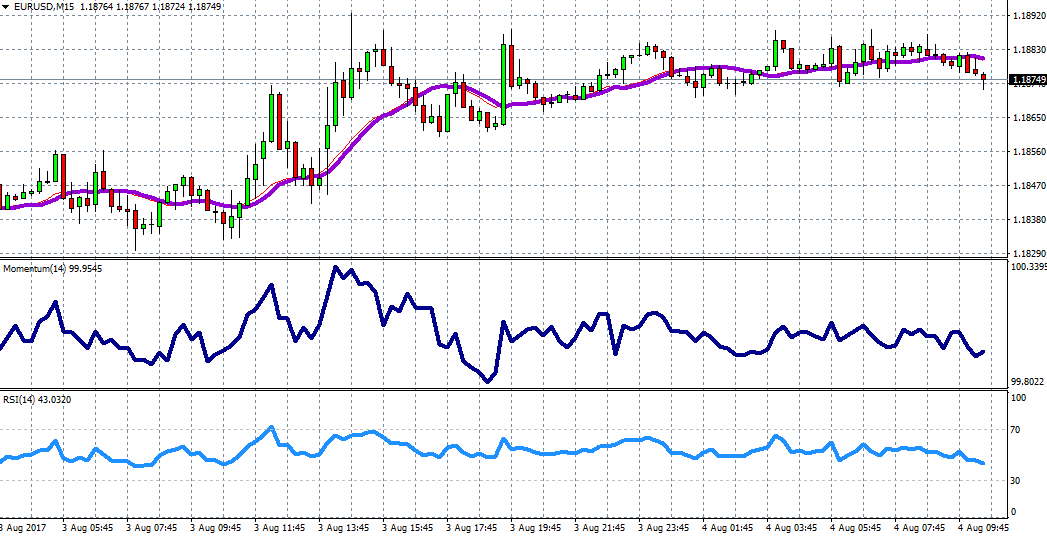

EURUSD

The EURUSD is flirting with highs with a target mark of 1.19. Momentum is tipping up as investors continue to take profits from the dollar side. We should continue to see bullish bets on the pair for the next few hours.

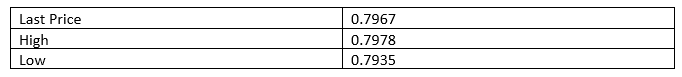

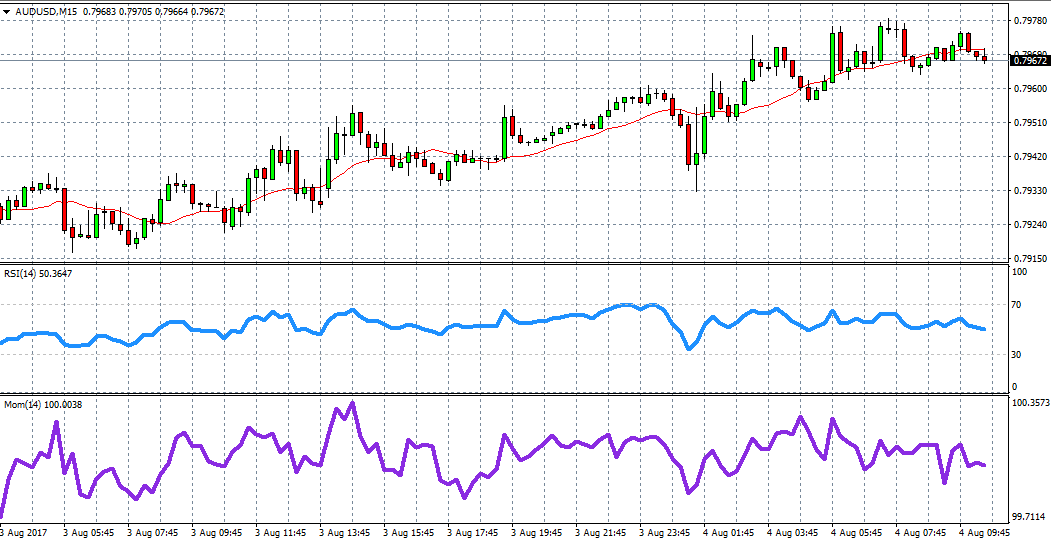

AUD

The Aussie dollar has rebounded after testing session lows earlier this morning. The Bank of Australia cut growth prospects by half a percentage for 2017, thanks to its currency’s strength. This dovish rhetoric pushed the Australian dollar lower.

AUDUSD

The Aussie dollar is approaching today’s high. We should see the currency hold it value as moving averages are tipping upwards.

Global Stocks

The Dow Jones is holding above 22012 as the weaker dollar and strong earnings help support higher US stock prices. Boeing (NYSE:BA), McDonald’s and Apple (NASDAQ:AAPL) gave the biggest hand to the DJ 30 reaching these historical levels.

The positivity not only spread across US equity markets, but to European and Asian stocks.

Leading the gains in Europe is the CAC 40, up 0.3%, reversing early losses. European Union’s proxy, the DAX 30, is not far behind, up 0.26%.

India’s Nifty 50 ended 0.72% higher. The MSCI Emerging Markets Index is 0.3% higher as investors continue to bet on the expansion of emerging markets.

MSCI

Oil

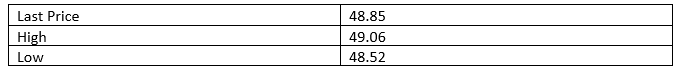

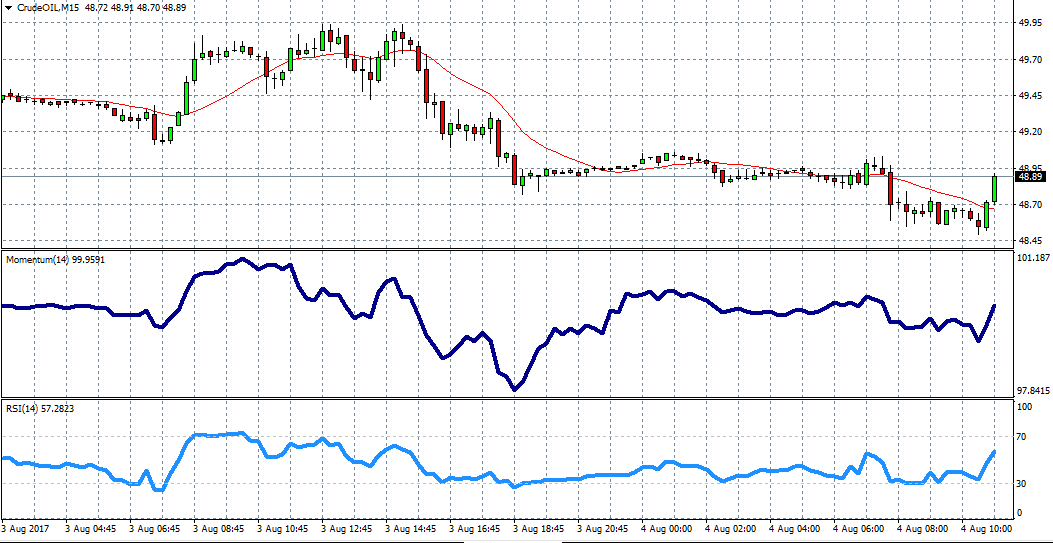

Oil found support in the Asian session, however as we veer further into the European session, bullish bets for oil are dwindling.

Crude Oil

Crude is finding momentum as it looks at 48.95 as its next target mark.