- Dollar slides as traders seem reluctant to buy ahead of CPI figures

- Wall Street mixed ahead of today’s data, bank earnings on Friday

- Gold climbs back above $2,000 on the back of a weak dollar

- Bank of Canada decision also on tap

US CPI numbers and FOMC minutes enter the spotlight

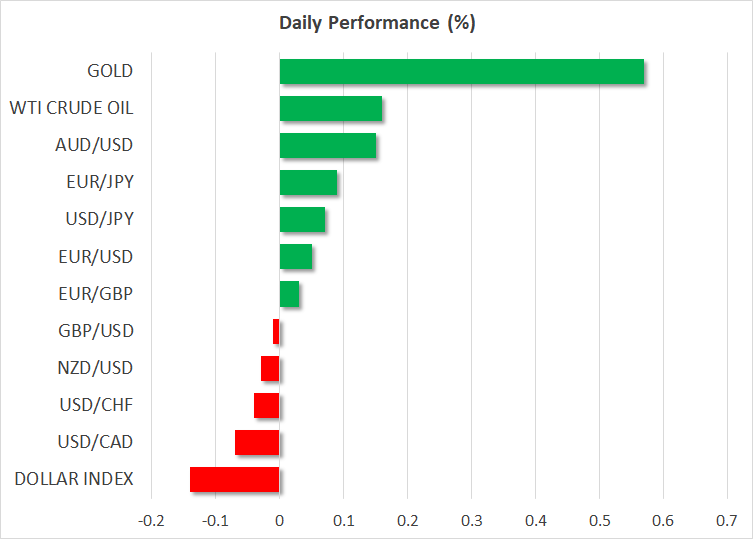

The US dollar traded lower against almost all the other major currencies on Tuesday and continued to underperform on Wednesday as well.

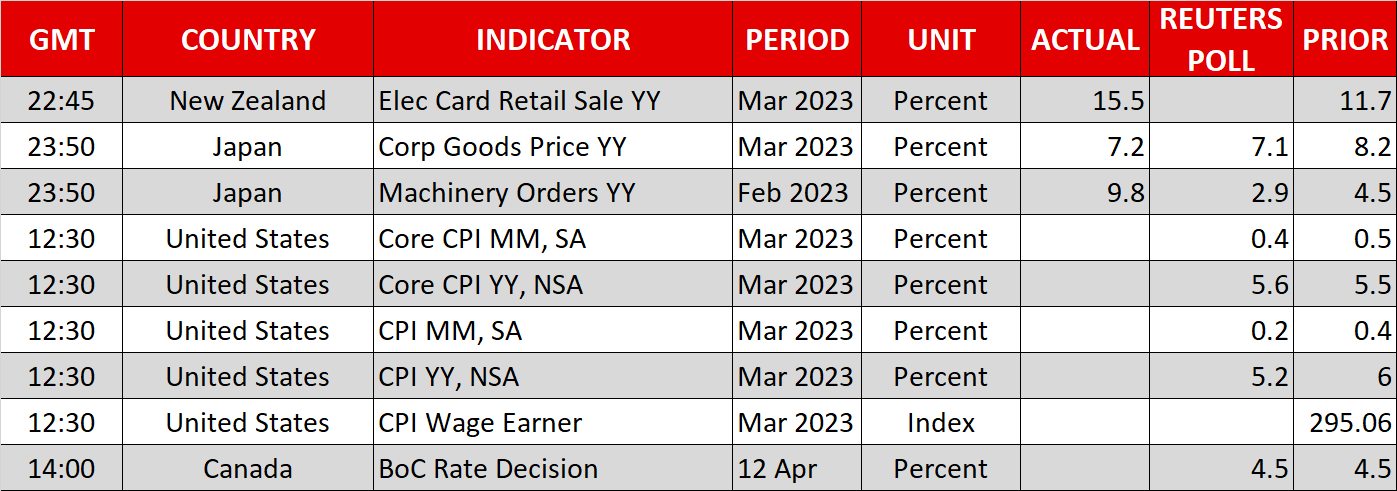

With no clear catalyst behind the weakness, dollar traders may have been reluctant to enter long positions ahead of the March US CPI numbers. The headline rate is forecast to have slipped to 5.2% y/y from 6.0%, but the core is anticipated to have ticked up to 5.6% y/y from 5.5%, suggesting that the slide in headline inflation may be due cooling prices in volatile items, like oil, whose year-over-year change is hovering in negative territory.

Coming on the heels of a solid employment report, a small acceleration in underlying price pressures could add more credence to the case of another 25bps hike by the Fed at its upcoming gathering, but it may not be enough to vanish speculation about rate reductions later this year. According to Fed funds futures, market participants are pricing in more than 50bps worth of rate reductions by December.

Investors may look for clues and hints regarding the Fed’s future course of action in the minutes of the latest meeting, which are released a few hours after the CPIs. However, recently, they seem to be ignoring anything that pushes against their pivot view and pay more attention to reaffirmations. Thus, even if the minutes suggest that no cuts are warranted for this year, traders may not listen. The dollar could gain somewhat, but that’s unlikely to be the beginning of a stellar comeback.

Now, if the core CPI comes in below its forecast, and the minutes reveal even the slightest discussion about the possibility of a rate reduction towards the end of the year, the greenback could extend its slide, especially against the euro. With the ECB expected to proceed with nearly three more quarter-point hikes, the divergence in policy expectations may push euro/dollar up to the high of February 2 at 1.1035.

Wall Street awaits US data, but earnings too

Wall Street indices traded mixed on Tuesday, with equity traders scratching their heads on how the data will impact the Fed’s future course of action, but also sitting on the edge of their seats in anticipation of the Q1 earnings season. The season starts on Friday with results from three major banks, Citigroup (NYSE:C), JPMorgan (NYSE:JPM), and Wells Fargo (NYSE:WFC), and investors will be eager to find how severely was the banking sector affected by the latest turmoil.

Overall, aggregate earnings for the S&P 500 are expected to have fallen 5.2% y/y, which is a massive downside revision from the 1.4% growth seen at the beginning of the quarter. This implies some upside risks if the results are still bad, but not as bad as anticipated. This may allow the S&P 500 to end the week above the key resistance zone of 4150, especially if today’s data reveal that US inflation continues to slow faster than expected.

Despite Treasury yields rising slightly yesterday, gold took advantage of the dollar’s weakness and climbed back above $2000. Combined with geopolitical concerns arising from China’s navy training around Taiwan, anything confirming the Fed pivot narrative may allow the precious metal to head towards the $2,070 zone, marked by the high of March 2022, or even the record peak of around $2,075, hit on August 7, 2020.

Can a sidelined BoC prove positive for the loonie?

Loonie traders will have another reason to keep their gaze locked on their screens today, as the Bank of Canada decides on monetary policy. The probability of a rate cut has now fallen to 5%, with the remaining 95% suggesting that officials will stay sidelined for the second meeting in a row.

So, if this is the case, traders will quickly turn their attention to the accompanying statement and the updated economic projection as they try to figure out how the Bank will proceed henceforth. Market participants are now pricing in a 25bps cut by the end of the year, but recent surveys and data do not justify that view. Thus, officials may push against market expectations, something that could prove positive for the loonie. Having said that though, whether it can hold onto its strength may depend on whether traders will put full trust in the Bank’s words or continue pricing in some basis points worth of cuts by December.