Yields approach new cycle highs, boosting US dollar

Gold and stock markets absorb collateral damage

Yen meltdown continues; how likely is intervention?

Bond rout spills over

The havoc in bond markets has started to spread into other asset classes. Yields on 10-year US Treasuries continue their relentless rally and are currently just a shade away from reaching new highs for this cycle. In turn, this has kneecapped riskier trades, which mechanically become less attractive as the risk-free interest rate rises.

Behind this seismic move in US yields lies a perfect storm of higher debt issuance by the Treasury to finance wider federal deficits, coupled with the Fed’s quantitative tightening program and speculation that US economic resilience might elicit another rate increase this year.

Market pricing currently implies a 40% probability for another Fed rate hike in November, amid widespread signs the US economy is running hot. The Atlanta Fed GDPNow model currently estimates annualized growth of 5.8% this quarter, making it difficult for Fed Chairman Powell to declare ‘mission accomplished’ at the Jackson Hole symposium next week.

Dollar and equities

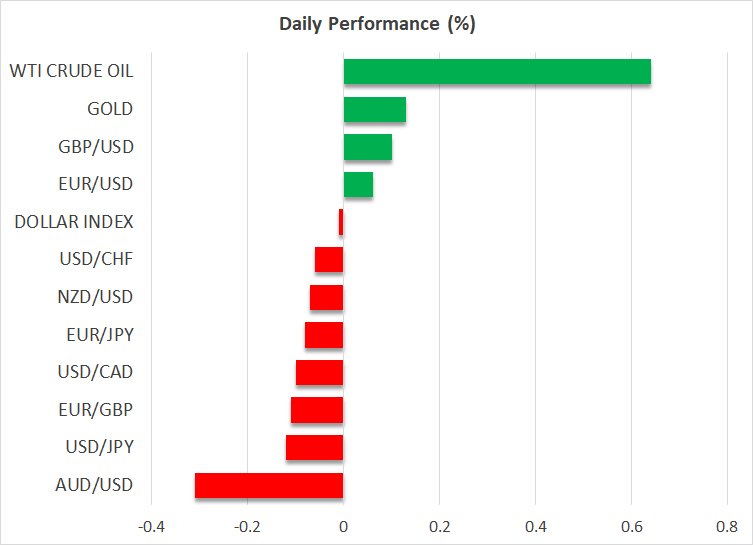

Riding the tide of rising yields is the US dollar, which has received a double boost from the interest rate differential channel and through safe-haven flows, as the spike in yields has translated into pain for riskier assets such as equities.

On a simpler level, the US economy is far superior to its competitors from a growth perspective, and that’s a force that could help the dollar extend its winning streak, especially when considering that the greenback is still down against the growth-starved euro this year. The minutes of the latest FOMC meeting overnight didn’t reveal anything new.

Wall Street fell victim to the rally in yields, with the S&P 500 falling 0.76% yesterday to close at its lowest level in five weeks. Since corporate earnings are down from last year, the entire S&P 500 rally this year has been one massive multiple expansion, and the best antidote to cure stretched valuations is a sharp spike in yields.

That said, the last time longer-dated US yields were trading at similar levels, the S&P 500 was trading 17% lower, so yields are not the only variable that matters. Fading recession concerns and liquidity injections have certainly played a role. Still, the longer yields remain elevated, the more difficult it becomes for equities to resist that gravity.

Gold and yen suffer

Gold prices did not escape the wrath of rising yields unscathed either. The precious metal sliced below the $1,900 region to hit a fresh five-month low, succumbing to the pressure exerted by soaring real yields and a turbocharged dollar, despite the risk-averse tone in the markets. With bullion now below its 200-day moving average, the technical picture is quite alarming as there isn’t much support until the $1,860 zone.

Over in Japan, the yen has resumed its meltdown. Haunted by widening yield differentials and increasingly unfavorable terms of trade following the latest recovery in energy prices, the yen has fallen back into the ‘danger zone’ that Tokyo decided to defend last year through FX intervention.

But this time, Japanese authorities seem more relaxed, as they haven’t explicitly threatened another intervention. One reason is that the speed of the yen’s depreciation is not as severe as last year. The risk of intervention seems fairly low for now, something also reflected in the decline of USD/JPY implied volatility lately, although this calculation could change if the pair approaches the 150 region in a hurry.

Speaking of FX intervention, Chinese state-owned banks have apparently ramped up their market operations this week in order to smoothen the yuan's depreciation, by selling US dollars and buying the local currency, as the PBoC's latest rate cuts have exacerbated the downward pressure on the yuan. The fallout is also visible in the China-sensitive Australian dollar, which hit its lowest levels since late 2022 against the dollar today.