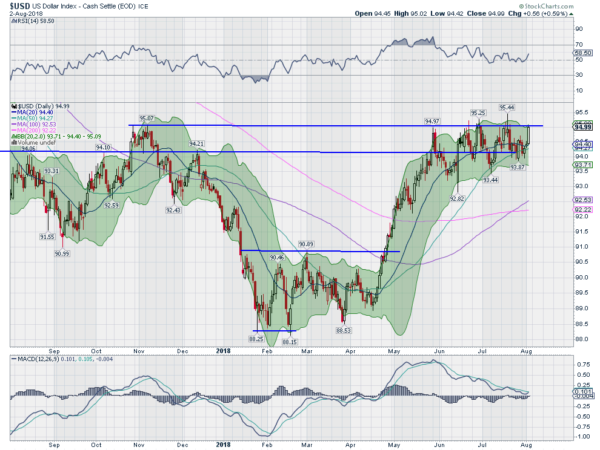

The US Dollar Index has been stuck in a rut. Since mid-May it has moved mainly sideways. Bouncing back and forth in consolidation, like it is bouncing off of the walls of a jail cell. The top of the consolidation is at the November high, a spot it just can’t seem to get over.

But the chart below suggests there may be a jailbreak soon. There are several thing to watch. First that consolidation has been tightening. Each low has been a little bit higher than the last one. This is a sign of buyers overwhelming sellers. It also creates an ascending triangle. A break to the upside carries a target to 97.

Momentum has held bullish, but reset off of the extreme levels of May. The RSI held at the mid line on the pullback and is now curling up. The MACD has also reset lower, nearly to zero, but remains positive. Finally the Bollinger Bands were pushed open Thursday as the price drove up to resistance. The strong day Thursday sets it up and the Non-Farm Payrolls report Friday just might be the catalyst for a jailbreak.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.