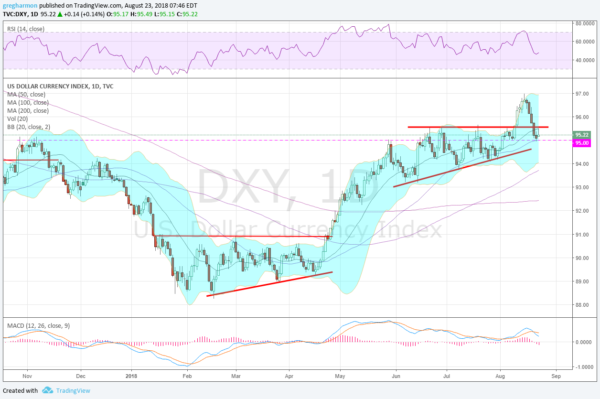

Last week in this space I noted the US Dollar Index could be topping in the short run and offer an opportunity to get involved at lower levels on a retest of a break out. It appears now that the retest is done and the US Dollar may be ready to reverse back to the upside. The chart below paints the picture.

After a breakout of an ascending triangle August 10th, the Index rose fast to a touch at 97 three days later. Then just as fast it confirmed a reversal to the downside and pulled back. The pullback was not to the prior triangle break out but to the longer term prior resistance, dating back to November. It was also a full retracement of the short term move higher and a retouch at the 50 day SMA.

The small body candle Wednesday, a possible Morning Star reversal pattern, is being confirmed in the early hours on Thursday. A positive close will confirm the reversal and a institute a higher low. Should this happen a move back over the triangle top, at 95.60, would constitute a buy signal.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.