The noise of Wednesday’s Fed minutes and Bernanke’s subsequent Q&A session continued to dominate investors’ thinking yesterday with the USD falling to its weakest level in trade-weighted terms in 2 weeks.

The assumption that tapering of Fed assets, which seemed a certainty to take place in September according to most commentators, has had doubt cast upon it in recent sessions with yesterday’s initial jobless claims numbers only adding to a pot devoid of clarity.

Claims missed estimates yesterday afternoon, rising to 360,000 vs 340,000 expected with the amount of continuing claims – those who have been claiming for more than 4 weeks – also increasing. Bernanke told you we needed an improvement in US labour functions before tapering would occur. What more do you want?

Until the number was published there had been a fair bit of USD buying taking place as traders obviously thought that the post-Bernanke move was overdone. Needless to say the USD has remained on its heels since.

There has been some respite for the Eurozone this morning with S&P upgrading its outlook on the Irish economy from ‘stable’ to ‘positive’. While this is not a rating upgrade it does mean that the next movement in the rating, barring any howlers, is likely to be positive.

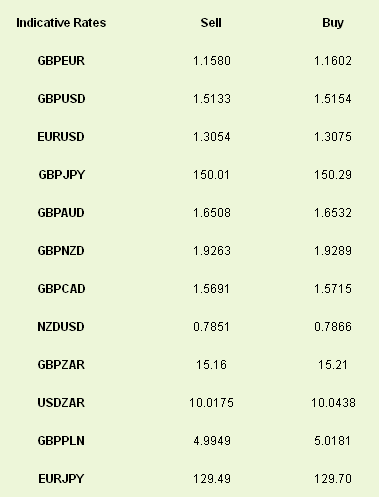

The upgrade is based on the country’s adherence to its deficit reduction program and the forecast reduction in its debt burden. EURUSD is relatively unchanged since yesterday but GBPEUR did pick its game up through yesterday’s session, ending above 1.16.

Eurozone industrial production, US producer prices and University of Michigan consumer confidence are the main data points on what is set to be a quiet day. Famous last words….

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar Remains Weaker After Jobless Claims Miss

Published 07/12/2013, 06:18 AM

Updated 07/09/2023, 06:31 AM

Dollar Remains Weaker After Jobless Claims Miss

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.