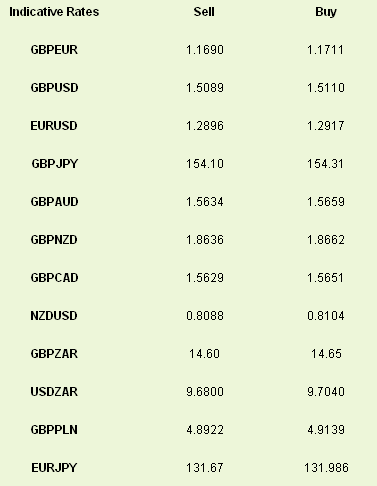

The combination of a quiet weekend and a bank holiday in the US and UK yesterday has led to little movement in prices since we downed tools on Friday afternoon.

The USD remains the main story as the battle between those who believe that the Fed will begin to ‘taper’ its purchases sooner rather than later, and those who don’t has seen the USD continually bought over the past few weeks. Each individual piece of US data is already closely scrutinised enough, but the binary nature of QE on or QE off is now the market in a nutshell; poor data equals more QE and USD falls, and vice versa.

Commodity currencies remained unloved following further pressures on the Chinese economy. Last week’s manufacturing data was poor and alongside the belief in China that the government will struggle to hit its 7% growth target through 2013, the market has become increasingly worried about Australian and New Zealand exports. We certainly expect the AUD to remain under pressure as the market continues to price in another rate cut by the RBA.

Japanese volatility has continued after the rally in the Nikkei came crashing down on Thursday with a 7% fall. Comments from policy makers have called into question the determination of Bank of Japan to carry on with the current expansionary policy too much further. The higher yields seen on Japanese debt of late has also hurt as the increase could stifle any nascent recovery.

Yesterday’s session in Europe was quiet but broadly positive with the lack of influence from elsewhere. This morning’s consumer confidence number from France has missed expectations massively however, and could easily see further declines in European assets. Consumer confidence was expected to rise to 85 from 84 but instead fell to 79; the lowest since July 2008 and the joint worst ever. GBPEUR has headed back towards 1.17 in the aftermath.

Today’s data is dominated by US consumer confidence at 15.00 BST. We should see a nice increase in confidence following the recent rise in equity markets and the broad increases made in the jobs market via better initial jobless claims. As we have said above, anything above 71.00 should see the USD continue its recent strong run.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar Remains Strong After Long, Quiet Weekend

Published 05/28/2013, 05:00 AM

Updated 07/09/2023, 06:31 AM

Dollar Remains Strong After Long, Quiet Weekend

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.