Dollar stays soft in Asian session today as markets focus turned to adjustment in expectation of Fed's tapering. There were talks that Fed policymakers would postpone its tapering so as to gauge the impacts of the government shutdown. Treasury yields dropped as default risk was removed and expectations for a QE tapering in the near-term diminished. 10-year yield closed at 2.587%, after hitting the lowest level since August. Some Fed members signaled that the central bank should consider carefully the impacts of the government shutdown on the country's recovery. Chicago Fed President Charles Evans suggested that policymakers should need "more information about how the economy is proceeding, how we are going to weather the most recent government shutdown". He added that, "the most likely outcome is one where we continue to go for a couple of meetings to assess this". Hawkish Dallas Fed president Fisher also indicated that no adjustment would be announced in October. He said that, "given all this uncertainty, it would be hard even to argue a change in course of monetary policy," and the Fed would likely "to stay the course at the next meeting". Indeed, there have been saying that the Fed would push backward the timing of tapering to early 2014.

A chunk of data release has been delayed due to the government shutdown since October 1. As the debt impasse ends, the BLS has announced that the September employment report will be released on October 22 (Tuesday) and the October employment report will be released on November 8 (a week later than the original schedule). The EIA's oil report for the week ended October 11 would be released on October 21 while that for the week ended October 18 on October 23.

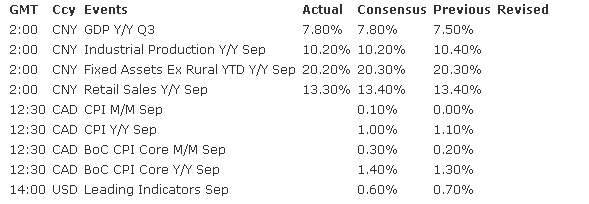

Released from China, the China GDP grew 7.8% y/y in 3Q13, up from 7.5% a quarter ago, as driven by the government's stimulus measures. On other economic indicators, FAI rose 20.2% y/y in September following a 20.3% gain in August. IP growth decelerated to 10.2% y/y in September, down from 10.4% in the prior month. Retail sales expanded 13.3% in September from the same period last year. Indeed, the growth rate has been steady over the past few months.

Looking ahead, Canada inflation data will be a main focus in US session. CPI is expected to moderate to 1.0% yoy in September. Core CPI is expected to accelerate to 1.4% yoy. A number of Fed officials will speak today including Tarullo, Evans, Dudley and Stein.

USD/JPY: Daily Outlook

Daily Pivots: (S1) 97.42; (P) 98.21; (R1) 98.69;

The USD/JPY's rebound from 96.56 might have completed at 99.00 already. Intraday bias is back on the downside and deeper fall could be seen back to 96.56 support first. Above 99.00 will bring another rally to 99.66 and then 100.61. Overall, the pair is still bounded in consolidation from 103.73 and more range trading could be seen.

In the bigger picture, the USD/JPY made a top at 103.73 and turned into consolidations. Some more sideway trading would be seen below 103.73. In case of another fall, downside will likely be contained by 92.56 support and bring rebound. Rise from 103.73 is expected to resume after the consolidation.USD/JPY Hourly Chart" title="USD/JPY Hourly Chart" width="600" height="600" src="https://d1-invdn-com.akamaized.net/content/picc7258b04edaa5e4bd68bc71048ee19dd.png" />

USD/JPY Daily Chart" title="USD/JPY Daily Chart" width="600" height="600" src="https://d1-invdn-com.akamaized.net/content/pic09b7afa2f0b5c1989396811fc12106df.png" />

Economic Indicators Update: