- Euro/dollar remains hostage to US yields and stock markets

- OPEC clips the wings of oil prices, gold loses some altitude too

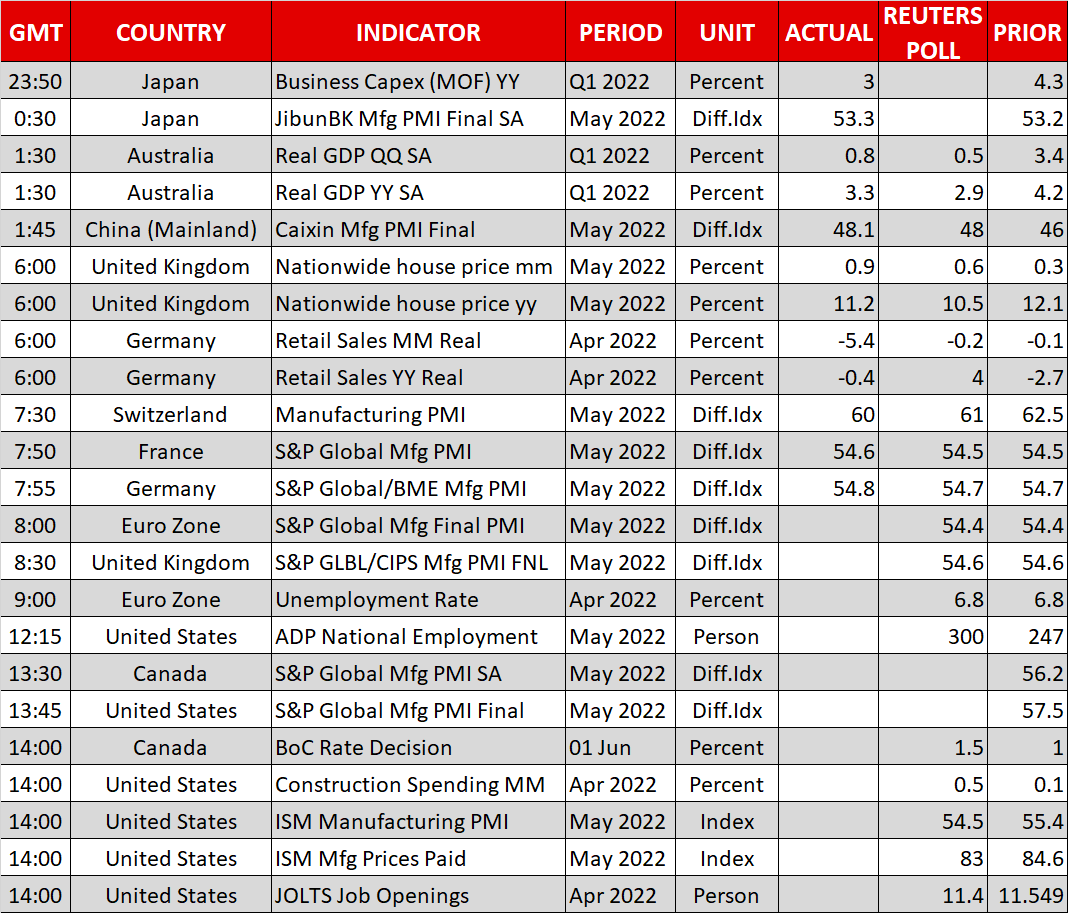

- Bank of Canada decision and US data in the spotlight today

One big trade

Global markets have turned into one giant trade in recent months. Almost every asset class is driven by the same two elements - the intensity of inflationary forces and the threat of recession. The bond market has been at the epicenter of this shift, with spikes in Treasury yields serving as the transmission mechanism that drives the price action in the forex and equity markets.

Euro/dollar encapsulates this pattern perfectly. The world’s most liquid currency pair has essentially been taken prisoner, having a strong positive correlation with US stock markets and a strong negative correlation with US yields. It’s a similar story for dollar/yen, sterling/dollar, and many of the commodity-linked currencies.

Of course currencies have always been very sensitive to interest rate changes and risk appetite, although this relationship has strengthened further recently. The takeaway is that FX moves cannot be viewed in isolation. Forecasting currency trends now requires a prediction of bond yields and equities.

Hence, it’s still difficult to call for a reversal in euro/dollar. The outlook for growth in Europe is worse than America and underlying inflationary pressures are softer, so expecting the ECB to keep pace with the Fed in raising rates as market pricing currently implies over the next year seems like a stretch. And with liquidity fading globally, equity markets are likely to remain volatile, which generally favors the dollar.

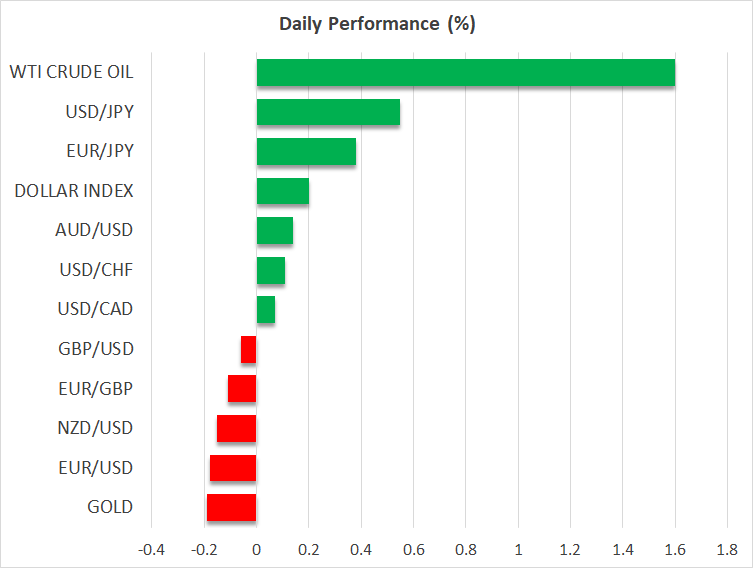

OPEC hits oil, gold stumbles

Oil prices got knocked down yesterday by reports that OPEC is considering suspending its alliance with Russia, allowing it to ramp up production. The fact that this story was released just a couple of days ahead of an official OPEC meeting is a signal in itself - the cartel finally seems willing to open the supply taps further.

It appears the ‘secret talks’ between Biden and Saudi Arabia to raise production were successful, begging the question of what the White House had to promise the Kingdom in return. Another question is whether Saudi Arabia can even raise production, with many arguing there’s almost no spare capacity left. Tomorrow’s OPEC meeting just became a lot more interesting.

Staying in the commodity sphere, gold prices suffered a sharp drop yesterday to cross back below their 200-day moving average, dragged down by the revival in the dollar and real US yields. It’s a gruesome environment for bullion and any rallies could remain shallow until there’s a catalyst that clips the wings of the dollar and yields, such as the Fed hitting the 'pause' button.

BoC decision, US releases coming up

Crossing into Canada, the central bank will meet today and markets have fully priced in a 50 basis points rate increase. As such, the reaction in the Canadian dollar will boil down to the tone of the statement and any signals about how hard the BoC will strike in the coming months.

The Canadian economy is booming with the unemployment rate at a five-decade low, solid consumption trends, and sizzling hot inflation, so the Bank is likely to strike an optimistic tone. The only area of concern is the nation's 'bubbly' housing market, which has started to show cracks now that mortgage rates have risen. That said, it might be a little too early for the BoC to highlight this risk.

Across the American border, the ADP jobs survey and the ISM manufacturing PMI will be in the spotlight as traders search for clues around Friday’s official employment report.