Investing.com’s stocks of the week

The dollar index continued to recover overnight and would probably maintain its gain before weekly close. Markets are getting more cautious ahead of the heavy weight events later in the month and traders are seen to be lighting up positions. Those events include FOMC meeting next week where new economic projections will be released. BOJ will announce policy decisions a day after Fed, with SNB and BoE rate decisions on the same day. Then EU referendum in UK will be held on June 23. Much volatility would likely be seen starting next week but the movements might not sustain until all the event risks are past. US equities, while firm, might struggle to find follow through buying with DJIA above 1800. But two developments are worth watching including oil's strength and falling treasury yields.

10 year yield drops sharply this week and hit as low as 1.659 before recovering to 1.68. The strong break of support level at around 1.7 should have completed a recent triangle pattern. Note also that TNX failed to sustain above 55 days EMA. Near term outlook is turned bearish and we could see an attempt to head lower to 1.6 handle, and possibly further to 1.567 low. And the development would limit dollar's strength for further rebound.

As for today, Japan domestic CGPI dropped -4.2% yoy in May. Tertiary industry index will be released from Japan. Eurozone will release German CPI final. Canada employment will be a main focus today and is expected to show 1.1k growth in May, with unemployment rate unchanged at 7.1%. US will release U of Michigan sentiment.

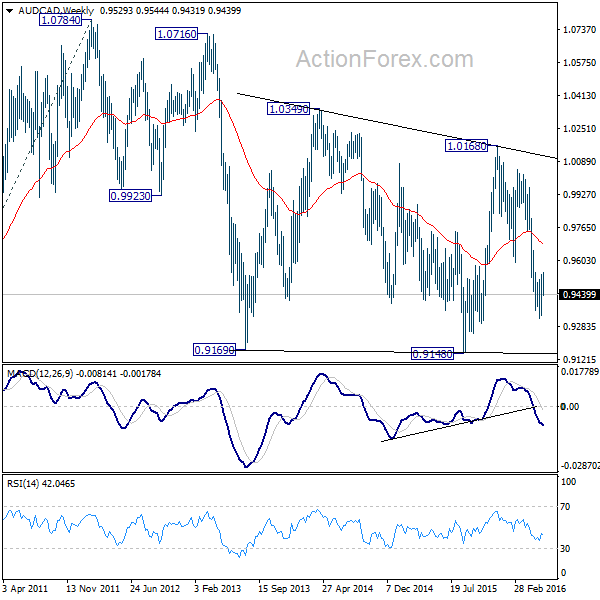

While the Aussie surges this week, it struggles to overpower Canadian, which was supported by surge in oil prices. The near term decline from 1.0168 is expected to extend lower to 0.9148 support at a later stage. This could be triggered by a good job report from Canada today, and further strength in oil. In that case, we'll look for bottoming at around 0.9148 to bring rebound to extend the medium term sideway pattern.