Following a day of disappointing releases which confirmed a slowdown for the U.S. Manufacturing sector, the dollar rebounded against several of its trading counterparts. The greenback also benefitted from a decline in risk aversion brought on as emerging markets currencies climbed again on Tuesday. But the lackluster metrics out of the U.S. continued to worry investors as they could prompt the Federal Reserve to halt further cuts to stimulus. Gold prices dipped on Tuesday, after speculators closed their positions to capture gains made with Monday’s rally. Futures for April delivery traded at $1,253.90 on the New York Mercantile Exchange during the european market session. Contracts surged to $1,266.10 a troy ounce on Monday, which was the highest rate since the end of January. This occurred as the greenback declined subsequent to the announcement of disappointing Manufacturing numbers.

The euro traded steadily on Tuesday as traders awaited the release of the Services PMI. News out of Spain denoting another increase in the number of unemployed individuals prompted the shared currency’s decline. Investors are looking ahead to tomorrow’s european Central Bank policy meeting, during which time the main focus will be inflation. With Italy and the euro-zone posting weak inflation metrics, it’s likely that policy makers will implement measures to counteract the possibility of deflation. The British Pound erased losses and rallied after six days of declines on data denoting growth in Construction, and as Markit Economics revealed that the index sustained the biggest expansion in close to seven years.

The yen rebounded against the U.S. dollar after touching a two-month low. This took place as risk aversion ebbed in the markets following a rally for currencies from developing economies. The Japanese currency also benefitted from positive macroeconomics which revealed that New Vehicle Sales climbed dramatically in January, news which raised speculation that the economy may post an expansion for the fourth quarter.

Lastly, in the South Pacific, the Reserve Bank of Australia surprised investors by shifting policy from a bearish to a neutral stance, while leaving the benchmark interest rate at the current record lows. The New Zealand dollar rose in tandem with the Aussie against its U.S. peer, though its advance was capped by concerns over lackluster U.S. metrics issued on Monday.

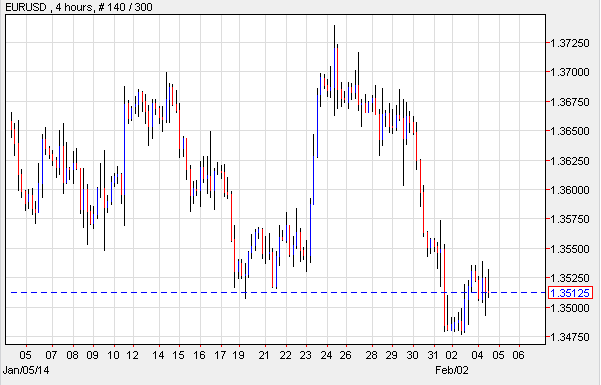

EUR/USD: Spain Reports Drop In Payrolls

The EUR/USD fell as Spain announced a greater number of unemployed individuals, which included a drop of 113,000 payrolls, suggesting that unemployment could continue to impact the nation’s economy. The EUR/USD failed to show much movement as investors awaited the Services PMI as well as the outcome of the ECB policy meeting. And it remained under pressure as last week’s metrics revealed a dip in inflation; the annual rate went from 0.8 to 0.7 percent. December was the fourth month during which inflation posted below 1 percent, a factor that worried policy makers. The EUR/USD remained to the downside as ECB President Mario Draghi intimated that the bank may conclude the “sterilization” of bond purchases, which are slated to add liquidity to the region’s financial institutions.

EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="474" height="242" />

EUR/USD Hourly Chart" title="EUR/USD Hourly Chart" width="474" height="242" />

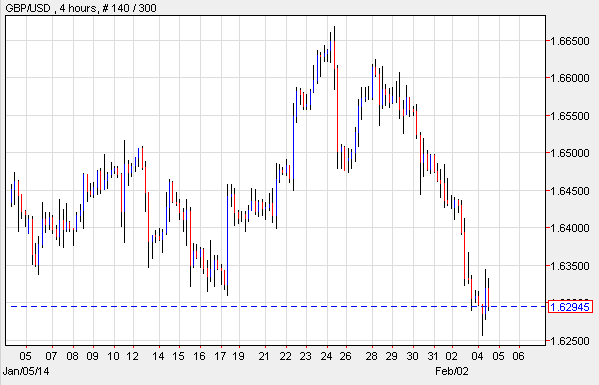

GBP/USD: Construction Surges

The GBP/USD jumped for the first time in over a week as reports revealed that the index which measures Construction activity surged to 64.6 in the first month of 2014. It had posted at 62.1 in December, denoting that the industry is still expanding. The pair also advanced on positive news issued by Markit Economics revealing that the index posted the largest expansion for the U.K. economy since 2007. The GBP/USD shrugged off prior lackluster Manufacturing PMIs out of the U.S. and the U.K. But since Construction only comprises 10 percent of the U.K.’s economy, analysts are hoping that Services PMI will come in high.

GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="474" height="242" />

GBP/USD Hourly Chart" title="GBP/USD Hourly Chart" width="474" height="242" />

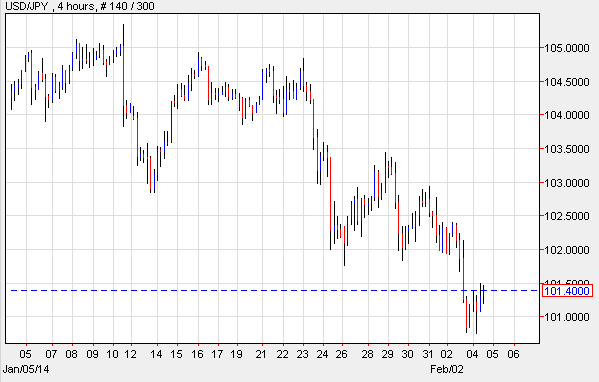

USD/JPY: Vehicle Sales Go Up

The USD/JPY dropped as demand for safety dipped in the market and as the greenback was impacted by disappointing economic fundamentals issued on Monday. The pair fell further on Tuesday as the yen was supported by domestic releases showing that New Vehicle Sales climbed 27.5 percent in the month of January, which was the most since 1997. Economists explained that the surge took place as consumers hoped to grab some last bargains before an increase in sales taxes kicks in. Given the strong figures, Japanese “think tanks” have predicted that the country could post an economic advance for the last quarter of 2013. The USD/JPY rebounded on Tuesday as investors look ahead to Friday’s Non-Farm Payroll releases.

USD/JPY Hourly Chart" title="USD/JPY Hourly Chart" width="474" height="242" />

USD/JPY Hourly Chart" title="USD/JPY Hourly Chart" width="474" height="242" />

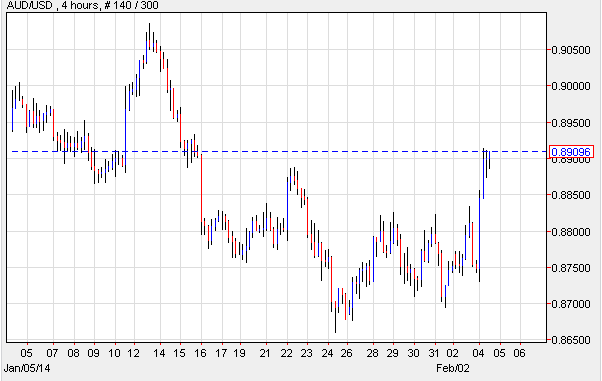

AUD/USD: RBA Announces No Change To Key Cash Rate

The AUD/USD rallied as the Reserve Bank of Australia opted for leaving the key cash rate at the current level. However, the bank announced a major shift in its policy stance, denoting that it will move away from a dovish to a more neutral position. For now, Governor Glenn Stevens said the benchmark interest rate will stay at 2.50 percent, and may remain at that level until the end of this year. The bank is hopeful that it will see progress in the economy and employment growth for the mining and construction sectors. However, policy makers intimated that should the economy spiral to the downside, the bank is prepared to cut the interest rate.

AUD/USD Hourly Chart" title="AUD/USD Hourly Chart" width="474" height="242" />

AUD/USD Hourly Chart" title="AUD/USD Hourly Chart" width="474" height="242" />

Daily Outlook: Today’s economic calendar shows that the euro region will report on Services PMI and Retail Sales. The U.S. will issue ADP Non-Farm Employment Change, ISM Non-Manufacturing Employment, ISM Non-Manufacturing New Orders, and ISM Non-Manufacturing PMI. Australia will announce the Trade Balance, Exports, Imports, and Retail Sales.