The dollar rally is finally gaining momentum after Federal Reserve officials supported the case for a March rate hike. Therefore, the market started to price in a potential rate rise in two weeks with the odds for such a move increasing to 65 percent.

On Wednesday we saw broad-based dollar strength with the British pound and euro trading sharply lower against the greenback. Traders are now wondering how low the pound and euro may go in short-term time frames. Let us take a brief look at the technical picture.

GBP/USD

The pound was the worst performer on Wednesday and fell to a low of 1.2270. We now expect the 1.22-level to lend a short-term support to the pound. If the cable drops however below 1.2190, it may head for a test of the lower barrier at 1.2120. In case of any pullbacks, we anticipate the 1.24-level to act as a resistance.

EUR/USD

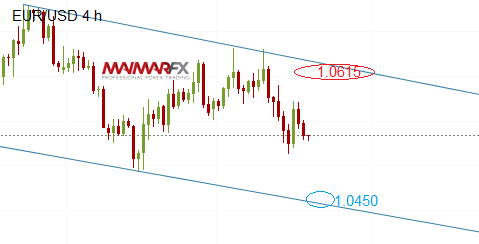

The euro is comfortably trading within its downtrend channel. The current downtrend is mainly due to renewed dollar strength and US-rate hike expectations. Today, the Eurozone Consumer Price Index is scheduled for release at 10:00 UTC and a higher reading could remind investors that inflation is on the rise. Higher inflation increases the pressure on the ECB to exit its loose monetary policy. This would be euro-positive but for now, the euro is taking its cue from a strengthening dollar.

In short-term time frames we expect the pair to trade between 1.0615 and 1.0450. The 1.0460/50 area could attract the attention of buyers, positioning for some pullback.

Here are our daily signal alerts:

EUR/USD

Long at 1.0590 SL 25 TP 20, 40

Short at 1.0514 SL 25 TP 20, 50

GBP/USD

Long at 1.2330 SL 25 TP 20, 45

Short at 1.2260 SL 25 TP 40-50

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.