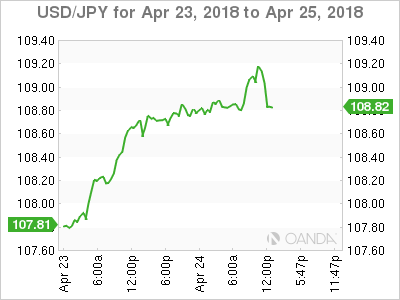

USD/JPY continues to move upwards this week. In Tuesday’s North American session, USD/JPY is trading at 109.14, up 0.40% on the day. On the release front, Japanese inflation data met expectations. The Services Producer Price Index dropped from 0.6% to 0.5%, matching the estimate. The Bank of Japan’s favored inflation indicator, BoJ Core CPI, came in at 0.7%, down from 0.8% a month earlier. This also matched the estimate. In the US, CB Consumer Confidence jumped to 128.7, beating the estimate of 126.0 points. US New Home Sales also looked sharp, jumping to 694 thousand and crushing the estimate of 625 thousand. This marked a 4-month high. However, manufacturing data was not as strong, as Richmond Manufacturing Index dropped 3 points, well off the estimate of a 16-point gain. This was the first contraction since October 2016.

The US dollar continues to flex its muscles and USD/JPY has climbed 1.1% this week. The yen is currently at its lowest level since February 5. The catalyst for the greenback rally was higher yields for 10-year US treasury bills, which rose to 2.996% on Monday. Higher yields for US-T bills have made them more attractive than European or Japanese counterparts and pushed the US currency higher. With oil pushing above $70 a barrel, there are concerns that inflation will rise, which has pushed bond prices lower and yields upwards. The dollar has also benefitted from a reduction in geopolitical risk, with an easing of tensions between North and South Korea, and a lull in the conflict in Syria.

Japan’s economy continues to grow and key indicators are generally performing well. At the same time, inflation has lagged behind growth and remains well below the Bank of Japan’s target of around 2 percent. The markets have been speculating that stronger economic conditions might cause the BoJ to re-examine its ultra-accommodative monetary policy. However, on Monday, BoJ Governor Haruhiko Kuroda poured cold water over such sentiment, stating that in order to reach its inflation target, “the Bank of Japan must continue very strong accommodative monetary policy for some time”. The BoJ will issue an inflation forecast on Friday, with the bank expected to reiterate that the inflation target will be reached in fiscal year 2019. Kuroda’s dovish statement can be seen as an attempt to curb volatility in the yen following the release of the inflation forecast.

USD/JPY Fundamentals

Monday (April 23)

- 19:50 Japanese CSPI. Estimate 0.5%. Actual 0.5%

Tuesday (April 24)

- 1:00 BoJ Core CPI. Estimate 0.7%. Actual 0.7%

- 9:00 US HPI. Estimate 0.5%. Actual 0.6%

- 9:00 US S&P/CS Composite-20 HPI. Estimate 6.3%. Actual 6.8%

- 10:00 US CB Consumer Confidence. Estimate 126.0. Actual 128.7

- 10:00 US New Home Sales. Estimate 625K. Actual 694K

- 10:00 US Richmond Manufacturing Index. Estimate 16. Actual -3

*All release times are DST

*Key events are in bold

USD/JPY for Tuesday, April 24, 2018

USD/JPY April 24 at 10:50 DST

Open: 109.09 High: 109.17 Low: 109.03 Close: 109.14

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 107.29 | 108.00 | 108.89 | 110.11 | 111.22 | 112.06 |

USD/JPY inched higher in the Asian session. The pair edged higher in the European session and continues to move higher in North American trade

- 108.89 has switched to a support role after gains by USD/JPY on Tuesday

- 110.11 is the next resistance line

Further levels in both directions:

- Below: 108.89, 108.00, 107.29 and 106.64

- Above: 110.11, 111.22 and 112.06

- Current range: 108.89 to 110.11

OANDA’s Open Positions Ratios

USD/JPY ratio is showing slight movement towards short positions. Currently, long positions have a majority (62%), indicative of trader bias towards USD/JPY continuing to move to higher ground.