- US dollar eases from highs as bond yield rally pauses for breath

- Stocks headed for worst quarter in a year but techs lead rebound

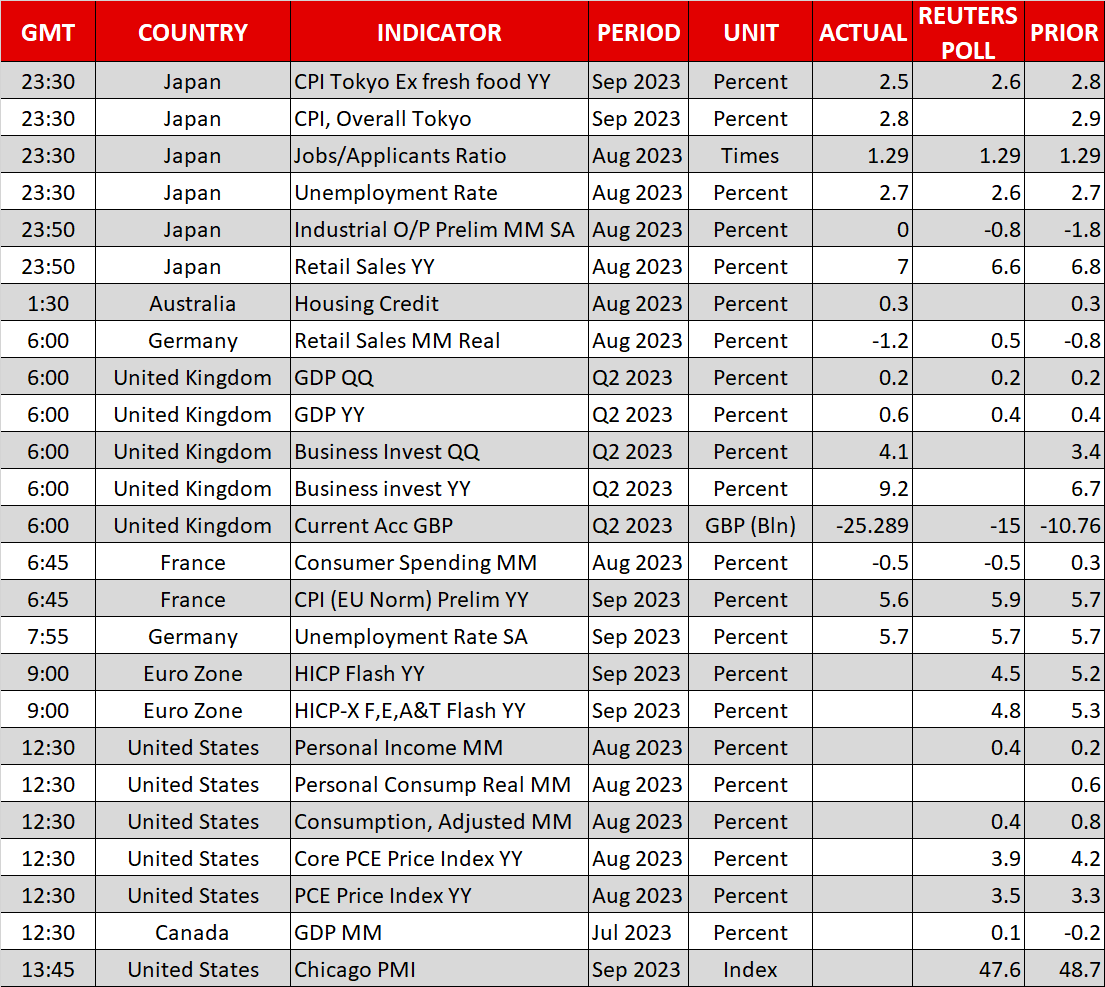

- Eurozone and US inflation data in focus

Fed speakers help take steam off yields rally

Bond yields slipped on Friday as ‘higher for longer’ bets took a step back on the last trading day of the quarter ahead of some key inflation and consumer spending data out of the United States. Hawkish Fed talk post the FOMC meeting backed up by solid US economic indicators has added fresh impetus to the rally in Treasury yields, with long-dated bonds being sold the most on the expectation that rates won’t be cut aggressively anytime soon.

The US 10-year yield brushed a 16-year high of just under 4.69% on Thursday before reversing lower to settle around 4.55%. Investors took some comfort from remarks overnight by Richmond Fed President Thomas Barkin who sounded less certain than some of his colleagues in recent days about the need for further tightening.

Meanwhile, Chicago Fed chief Austan Goolsbee added to hopes that the US economy can achieve a soft landing. His comments came not long after the latest weekly jobless claims figures that continued to point to a very tight labour market.

With the Fed being more open to the idea that it may just be possible to cool the economy without pushing up unemployment, a soft set of PCE inflation numbers today could spark a further retreat in yields. The core PCE price index is forecast to have eased to 3.9% in August and personal consumption is also expected to have moderated.

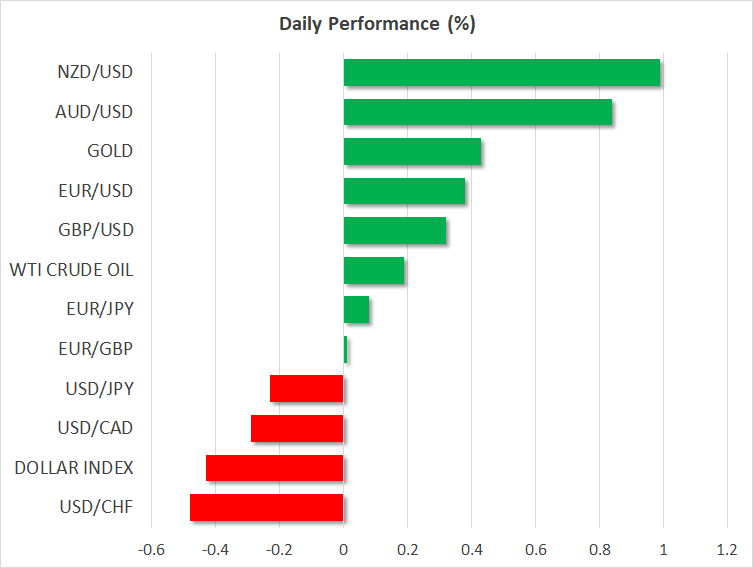

Euro and pound edge up as dollar off highs

The US dollar came under pressure yesterday as Treasury yields fell back and it’s widening its losses today, providing some much-needed relief to its rivals. The New Zealand dollar is the biggest gainer, followed by its Australian counterpart. The euro is up too, though it’s struggling to reclaim the $1.06 level, while the pound’s advance above $1.22 is looking more secure.

The euro may have received a boost from a surge in Eurozone government bond yields on Thursday after a spike in Italian yields, which came on news that Prime Minister Giorgia Meloni’s government is raising its deficit targets for this year and next, reviving fears about Italy’s high debt problem.

Moreover, inflation in the euro area fell more than expected in September according to the flash estimates out today. The two underlying measures of CPI also came in below forecasts, allaying stagflation risks for the Eurozone economy.

In the UK, a significant upward revision to GDP growth during the post-pandemic recovery period as well as confirmation that the economy expanded by 0.2% q/q in the second quarter aided the pound’s rebound against the weaker greenback.

Little relief for yen

The yen underperformed somewhat, however, on Friday, as earlier gains were trimmed after the Bank of Japan stepped in the bond market to limit the recent rapid rise in JGB yields. The BoJ purchased up to 300 billion yen of JGBs between 5- and 10-year maturities after the 10-year yield hit a decade high earlier in the session.

The dollar was last trading around 148.90 yen, remaining well within the intervention zone. Japan’s Finance Minister Shunichi Suzuki repeated on Friday that officials are watching FX volatility closely, but unless there’s a major pullback in the dollar, a retest of 150 yen seems inevitable at this stage. Adding to the yen’s woes was a softer-than-expected print in the Tokyo core CPI rate, which eased to 2.5% in September.

Stocks recover slightly but still headed for quarterly losses

Equities also perked up on Friday, with European indices and US futures heading higher. Asia had a mixed session as Japanese shares failed to join in the rebound, while Chinese markers were shut for the long Golden Week holiday. But Hong Kong’s Hang Seng index rallied 2.50% on hopes that the holiday week will encourage Chinese consumers to spend more and on reports that Beijing and Washington are setting the stage for a possible meeting between the two countries’ leaders.

Staying in politics, the US appears to be headed for a partial government shutdown as the Republican-led House and Democrat-controlled Senate are each working on different spending plans. But neither bill is likely to be passed by both chambers and a bipartisan deal seems some way off.

Nevertheless, lower yields were enough to buoy Wall Street and the S&P 500 and Nasdaq both closed with solid gains on Thursday. Shares were lifted by a strong performance in some Big Tech names such as Meta (NASDAQ:META) and Nvidia (NASDAQ:NVDA).

But despite dip buyers always being on standby when it comes to tech stocks, Wall Street is on track for its worst quarter in a year. Whether or not the stock market can bounce back in the fourth quarter will probably depend on what happens to yields from hereon.

Gold has also been devastated by the relentless rally in US and global yields, tumbling to a more than six-month low of $1,857.52/oz yesterday.