- US labor market continues to improve modestly with jobless claims falling.

- Lowest claims figure since October 2007.

- However, drop attributed to two states not reporting figures.

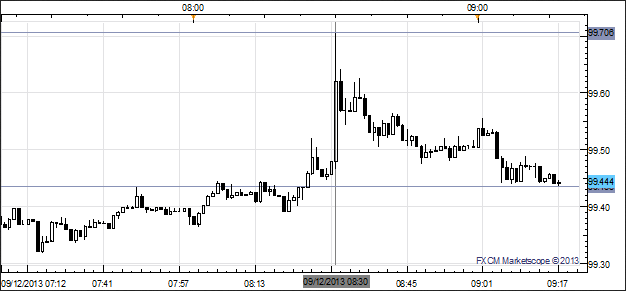

The first important data this week for the US economy has come across mixed and the US Dollar is gyrating violently as a result. The US Dollar remains a top performer through the first half of the day although the initial uptick seen following the data was quickly reversed, for a curious reason.

Although the Initial Jobless Claims figure dropped to 292K, the lowest level since the last week of October 2007, reports quickly emerged that the BLS’ tabulation was lighter than usual: two states did not report claims figures.

Here’s the data -- whose validity is in question given its incompleteness -- that is driving US Dollar price action.

- Initial Jobless Claims (SEP 7): 292K versus 330K expected, from 323K.

- Continuing Claims (AUG 31): 2871K versus 2960K expected, from 2944K (revised lower from 2951K)

Charts Created using Marketscope – prepared by Christopher Vecchio

Charts Created using Marketscope – prepared by Christopher Vecchio.

Following the releases, the USD/JPY rallied from ¥99.48 to as high as 98.71, but had fallen back to 99.44 at the time this report was written. US Dollar weakness was generally spurred on by a drop in US Treasury yields as market participants reconsidered the validity of the report: the 10Y yield slumped from 2.911% to as low as 2.877% in the minutes following the release.

by Christopher Vecchio, Currency Analyst