- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dollar Mixed As Market Awaits Brexit Vote

The US dollar is mixed against major pairs on Monday. The greenback is down against the Japanese yen, the Swiss franc and the British pound, but is appreciating against the euro, Canadian, New Zealand and Australian dollars. Data released out China shows a slowdown in trade which has impacted global growth expectations to the downside. Despite the positive headlines out of Beijing and Washington about progress in their trade talks, there has been little to show. The tariff spat was fast and furious as both sides retaliated, but reaching an agreement has not been as speedy. Brexit will be the main focus on Tuesday as the UK parliament is set to vote, with success almost ruled out, but as an event that will be measured on how close Prime Minister May can get to a deal to see if there is hope for more attempts and something to use as leverage with the European Union to seek a time extension.

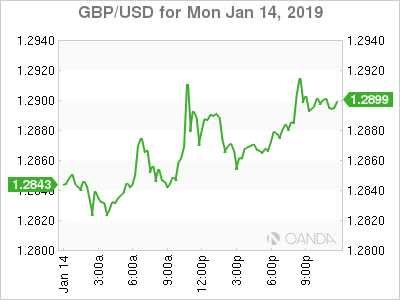

Pound Higher on Hope more than Reality

The GBP/USD dropped 0.25 percent on Monday. The currency pair is trading at 1.2867 awaiting the parliament vote on Brexit due on Tuesday. Prime Minister May has launched a strong campaign to pass the current deal on the table, but it is highly unlikely given how British politicians have already declared they will vote against it. May is now shifting gears and is trying to woo Leave supporters that a vote against her deal could embolden a no Brexit scenario if there is a referendum.

The divorce between the United Kingdom and the European Union has give the market plenty of uncertainty. The real impact of the Brexit vote has not been felt, but ever since article 50 was invoked it has put a timeline on big matters that need to get sorted before the March 29 final exit. A backstop has not been fully agreed to as both sides are far apart in their definition of a border. The EU is not conceding, but is said to be preparing a letter of support ahead of the vote in parliament on Tuesday.

Brexit could ironically end the actual Conservative government, even if that same government promised the original referendum. A no deal Brexit has steadily climbed in the probabilities as the UK government is deeply divided and whatever is agreed to internally would not be acceptable for the members of the EU.

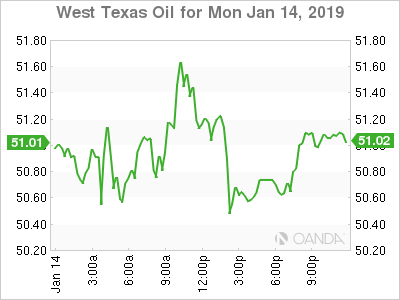

Energy prices fell more than 2 percent on Monday. Brent fell 2.35 percent and WTI 1.98 percent as disappointing data out of China hit energy demand forecasts. The Organization of the Petroleum Exporting Countries (OPEC) and other major producers have agreed to reduce production to stabilize prices, but the other side of the equation is driving prices lower. China-US uncertainty is lower after talks have been ongoing this year, but with little show after an acrimonious tariffs announcement in 2018, investors are not convinced.

March 2 is the deadline for the US and China to reach a trade deal, but given the damage of the trade restrictions had on global growth expectations it will take a significant deal to quickly undo all the pain. Chinese exports fell 4.4 percent in December and imports had their largest decline since 2016.

Saudi Arabia’s Energy Minister is not concerned about the Chinese data, but today’s price action might make him reconsider.

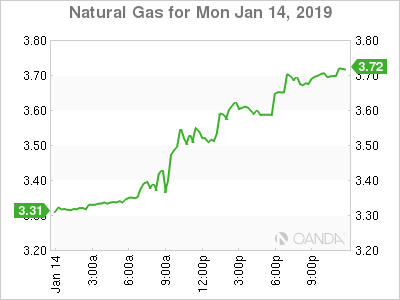

Natural Gas Rises 16 Percent on Colder Weather

Supply and demand showed their influence in the markets as natural gas surged 16.2 percent on Monday as colder weather is expected to remain for longer in the United States. The persistence of cold weather prompted traders to build on their long natural gas positions.

The summer was surprisingly long prompting lower prices as a shorter Winter term was expected. The new weather forecasts call for a longer and colder winter and prompting a rise in natural gas prices.

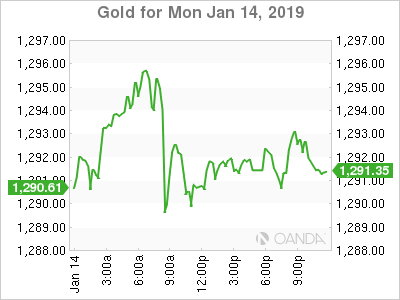

Gold Rises Slightly as China Data Prompts Safe Haven Buying

Gold rose 0.18 on Monday. The yellow metal was on its way to break the $1,300 price level after news out of China sent investors looking for cover. The softer than expected trade data out of China took gold to 1,295 only for the North American session to bring it back in line as Brexit headlines and a more stable stock market was negative for the metal.

Political uncertainty in the United States and the eventual fate of the Brexit vote will keep gold bid as investors look for a safe haven.

Related Articles

Recent headlines appear to have shaken investor sentiment. It’s premature to read too much into a few days of weaker-than-expected survey numbers. More importantly, the latest...

Trump threatens EU tariffs, creates confusion about Mexico and Canada duties Dollar rebounds but gold slides again Nvidia falls in after-hours trading as earnings fail to set...

Gold Consolidates Ahead of Key US Data Releases The gold (XAU/USD) price was relatively unchanged on Wednesday as markets remained cautious ahead of upcoming inflation data and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.