The dollar was mixed at midday against the G7 currencies. It was higher versus the NOK and CAD while lower against EUR, SEK, GBP and NZD.

The pound also gained against the euro after the UK construction PMI rose in January, contrary to market expectations for a decline. This went some way towards countering the bearishness after yesterday’s lower-than-expected manufacturing PMI for the same month.

However so far the GBP/USD hasn’t even managed to recover half of the loss that it suffered yesterday, which suggests that the market is looking more for excuses to sell GBP rather than reasons to buy.

The SEK gained even though the Riksbank’s business survey for February was rather gloomy, with companies saying there are “still no clear signs that a rapid recovery is underway.”

The EUR/USD was only slightly higher from this morning’s opening levels. The EU PPI for December and preliminary Italian CPI for January came out exactly in line with expectations and therefore didn’t have much impact on trading.

The CAD and NOK declined during the European morning, while the CHF, JPY and AUD were little changed.

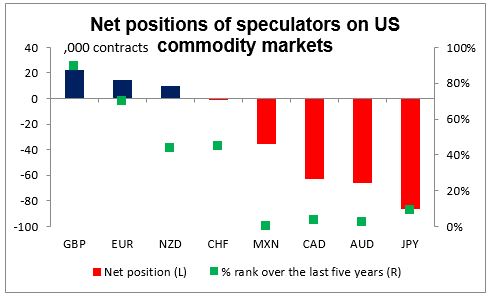

The concern I have about the FX market right now is that positioning is at extreme levels in several currencies. I track the net long or short positions among speculators on the US commodity futures exchanges and rank them over the last five years, with 100% being the largest long position over that time and 0% being the least long (or most short). Right now, MXN is at 0% or the most short it’s been in the last five years; AUD, 2%; CAD, 3%; and JPY, 9%. On the other hand, GBP is at 90%.

What this indicates is that many of my favourite trades (long GBP/CAD, for example) are crowded trades. In these conditions, a small change in market sentiment can have a large impact on rates, as people trying even just to trim positions have a hard time finding buyers. It looks like sentiment towards the GBP, CAD and AUD may be shifting. It’s too early to tell, but I would recommend traders with these positions on to exercise caution.

Disclaimer: This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients’ orders. This material is just the personal opinion of the author(s) and client’s investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained.

Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited. Risk Warning: Forex and CFDs are leveraged products and involves a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. IronFx Financial Services Limited is authorised and regulated by CySEC (Licence no. 125/10). IronFX UK Limited is authorised and regulated by FCA (Registration no. 585561). IronFX (Australia) Pty Ltd is authorized and regulated by ASIC (AFSL no. 417482)