Will the Dollar soar or will the Dollar be sacrificed to save the market from a crash? Can both scenarios come true? As always I take a look at charts from a technical and wave perspective as I try to find which scenario has the most chances of success.

No need to repeat that our bounce target from 2018 lows has been achieved.

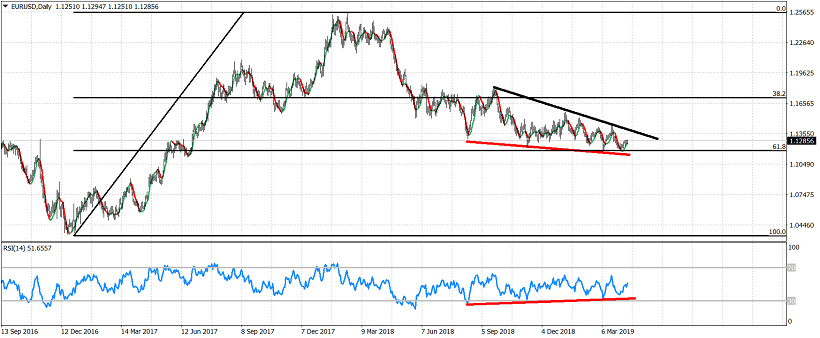

What now? Price has been stuck around the 61.8% Fibonacci retracement of the entire decline.

Its major component EUR/USD has also been forming a bullish wedge pattern above the 61.8% Fibonacci retracement.

Will we see a major up trend reversal soon? 1.14 is key. I favor the bearish Dollar/bullish EUR scenario as the form (wave wise) of both the rise (EUR) the decline (USD) and the following bounce (USD) decline (EUR) tell me that the Dollar should start falling again. The decline in EUR and rise in USD are corrective while the rise in EUR and decline in DXY are both impulsive. I may be wrong—it wouldn’t be the first time—but last time I nailed the bigger picture of the movement in the Dollar index. Let’s see now.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.