The Dollar strengthened against most major currencies except the resilient Sterling overnight after Fed chair Yellen's speech. Yellen testified before Senate Banking Committee and noted that interest rate hike could come sooner if labor markets continue to surprise on the upside. She said that "if the labor market continues to improve more quickly than anticipated by the Federal Open Market Committee, resulting in faster convergence toward our dual objectives, then increases in the federal funds rate target likely would occur sooner and be more rapid than currently envisioned." Nonetheless, she still mentioned that "if economic performance is disappointing, then the future path of interest rates likely would be more accommodative than currently anticipated." Regarding the economy, she said that "recovery is not yet complete" and there was still "significant slack" in the labor markets.

Technically, the EUR/USD took out a near term support level of 1.3575 and would now be heading back to 1.3502 low. The USD/CHF also took out 0.8958 resistance and is heading back to 0.9036. The Dollar Index took out last week's high of 80.36 and the rebound from 79.74 resumed. Near term bias is now on the upside for the key resistance zone of 81.02/48. Nonetheless, it should be noted that the index is staying in sideway trading for a few months already and there is no sign of of strong momentum for breakout yet.

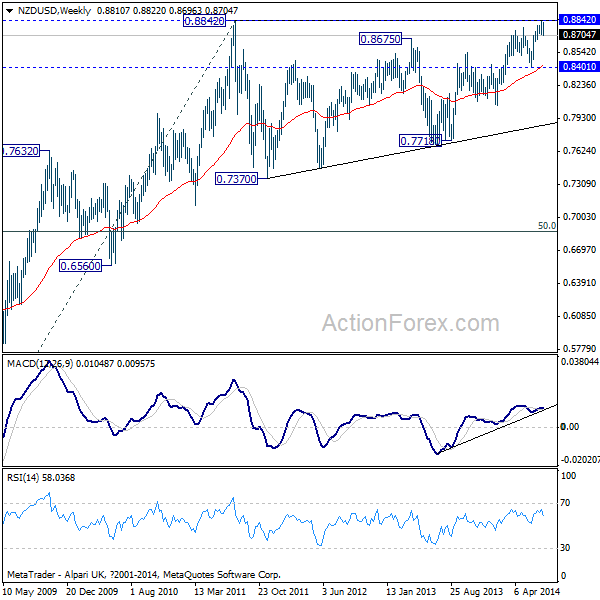

Meanwhile the NZD/USD dropped sharply in Asian session today after weaker than expected inflation data. CPI rose 0.3% qoq 1.6% yoy in Q2 comparing to expectation of 0.4% qoq, 1.8% yoy. We've mentioned before that the NZD/USD is still staying in the multi-year sideway pattern from 0.8842 (2011 high). Today's break of 0.8713 support confirmed near term topping at 0.9935, just ahead of 0.8842. It's also the first sign of trend reversal and focus will now turn back to 0.8401 support. Break there will confirm that the NZD/USD is in another falling leg of the multi-year consolidation pattern and would target lower trend line support (now at 0.7874).

Elsewhere, China GDP rose more than expected by 7.5% yoy in Q2 versus consensus of 7.4% yoy. Fixed asset investment rose 17.3% yoy in June, retail sales rose 12.4% yoy, industrial production rose 9.2% yoy. Australia Westpac leading index rose 0.1% mom in June. Looking ahead, UK employment data will be closely watched as the resilient Sterling would extend recent rally on strong data. Eurozone will release trade balance while Swiss will release ZEW. The US session will also be busy with BoC rate decision, US PPI, TIC capital flow, industrial production, NAHB housing market index and Fed's Beige Book featured.