The Dollar Index is looking somewhat appealing from a technical standpoint.

Looking at the Dollar Index, it’s clear that there is a bullish trend line in play and certainly my long term view is bullish for the US dollar, and it’s easy to see why. With a strong economic recovery coming through and the advent of tapering, it’s certainly clear that we will see a boost to the USD overall. Though some might say otherwise, the data is certainly there to support it. GDP growth estimates have been lifted, and unemployment is expected to keep falling over the course of 2014.

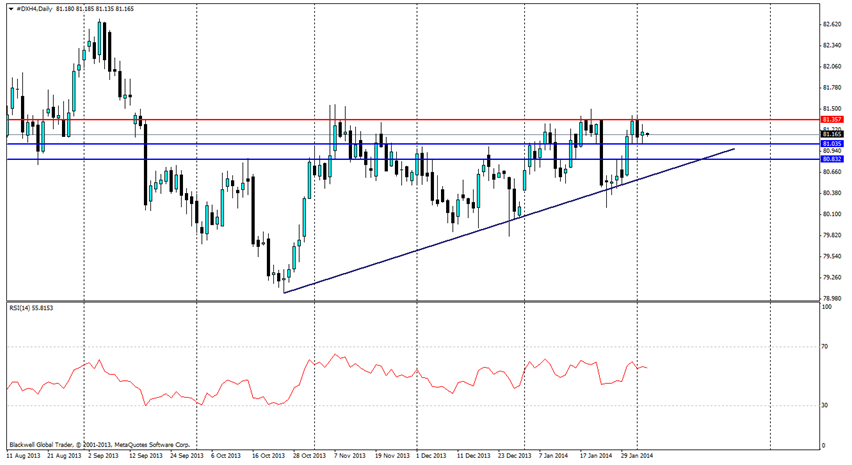

But the short term is a little more fickle, and the Dollar Index loves to play off technicals. Despite the good data, the pair has recently touched strong resistance at 81.357 – I would go so far to call it a ceiling, that will need something very strong to crack it.

Either way, past touches of the ceiling have led to sell offs for the Dollar Index, and in its current state, coupled with recent weak US data, I don’t see why we wouldn’t see a fall lower in the next few days.

Current support levels can be found at 81.035 and 80.832 respectively. Though when trading the pair, the main heavy support line should be the current bullish trend line, which will act as dynamic support. Traders can look for intraday triggers on the shorter time frames with these levels in mind.

Past movements for this pair of the ceiling have been lower, but it's also important to note I do not expect the bullish trend line to break unless there is a big change in the fundamental landscapeand at some point there is going to be a crunch and the ceiling will collapse and give way to the bullish trend.