Nearer-Term Dollar Index Outlook

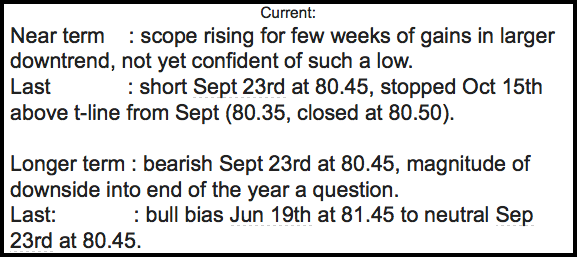

No change in the long discussed, big picture view of downside pressure into the end of the year (see longer term below). But nearer term, some positives continue to appear, and suggest that a few weeks of consolidating/correcting higher (within this larger period of downside pressure) may be nearing.

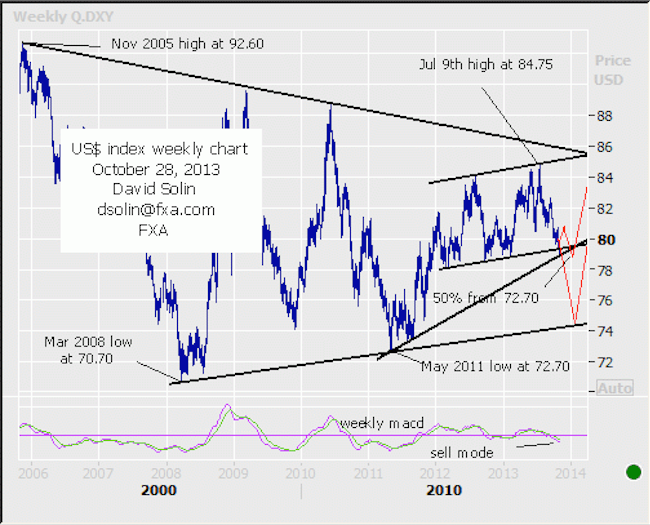

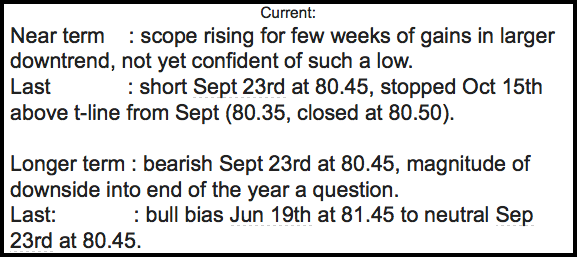

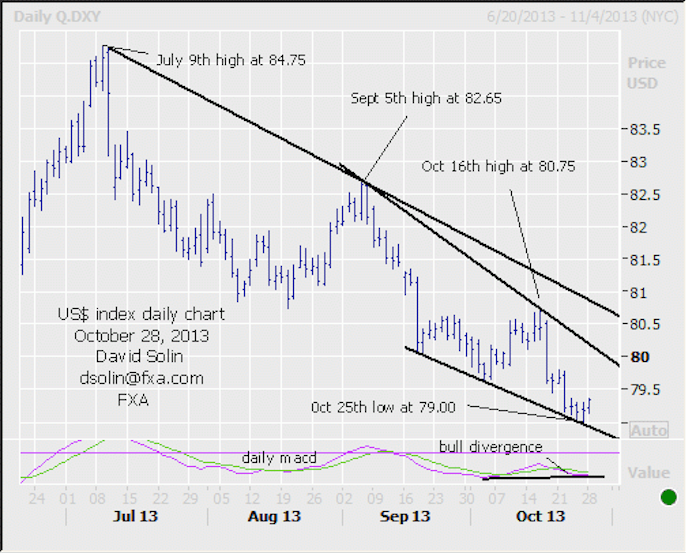

These positives include an oversold market after the last few months of declines, slowing downside momentum (early sign of a nearing reversal) and technicals not confirming the recent weakness (see bull divergence on the daily macd at bottom of chart below for example). Note, too, that the market has weakened in the long term 78.50/00 support area (bull trendline and a 50% retracement from the May-2011 low at 72.70, falling support line from mid Sept), while specific currency pairs have also weakened into longer term support (eur/$ resistance at 1.3830/65, cable into 1.6260/10, $/swiss at .8850/00. But at this point, there is still no confirmation of even a shorter term low (5 waves up on short term chart for example), so the confidence of such a bottom is not yet very high. Nearby resistance is seen at the earlier 79.35/45 high, 79.85/95 (50% retracement from the Oct 16th high at 80.75) and the bearish trendline from Sept (currently at 80.20/30).

Strategy/Position: With potential rising for a few weeks of upside correcting, looking to trade from the long side. But just not enough evidence of such low (so far) to buy, and would be patient for a better risk/reward entry ahead.

Long-Term Outlook

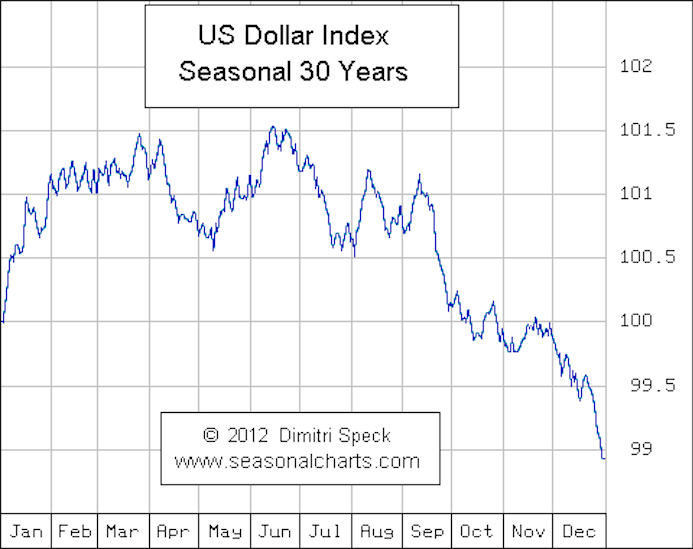

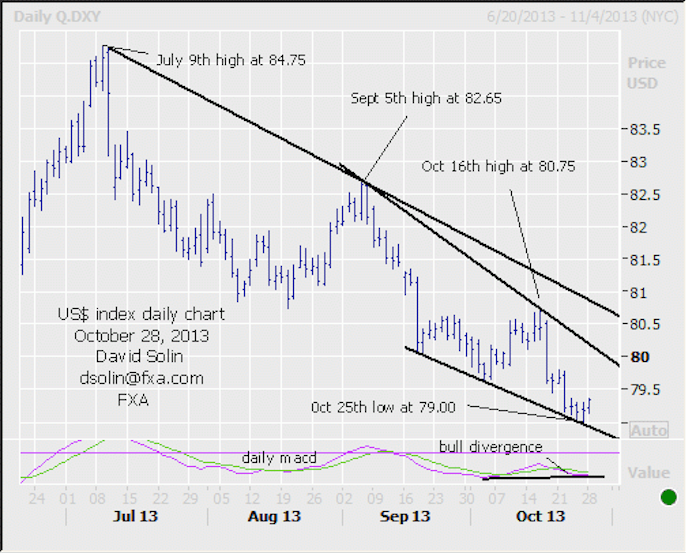

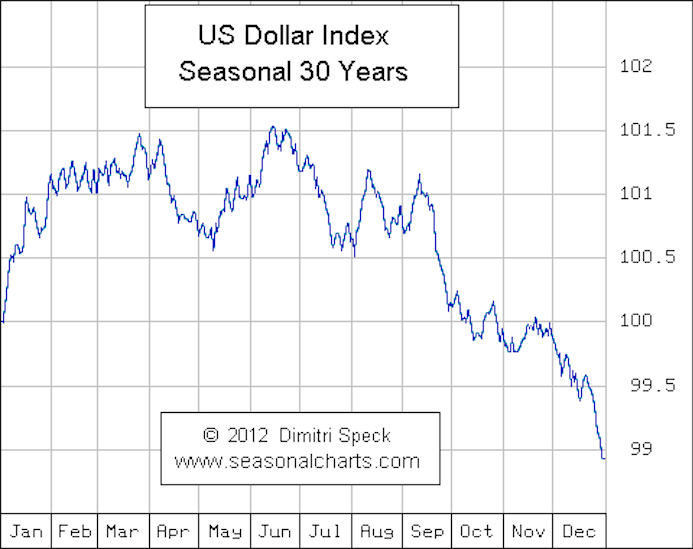

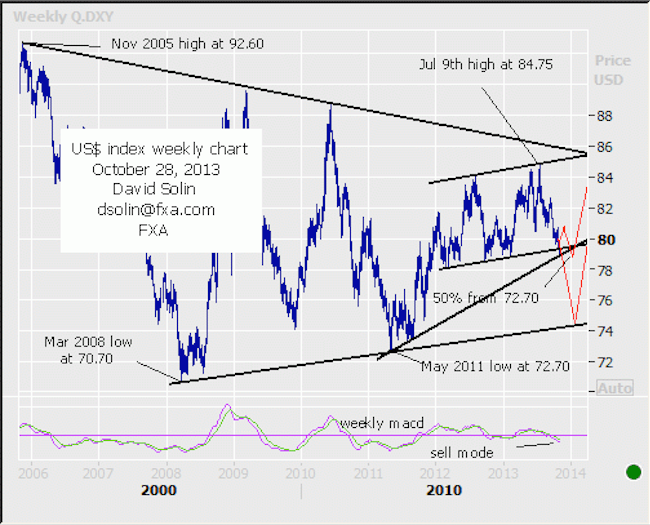

The long held view of downside "pressure" into the end of the year, remains in place. Note that weak long term technicals (see sell mode on the weekly macd at bottom of 2nd chart below) and the seasonal chart that points lower into the end of Dec (see 3rd chart below), add to this big picture view. But as been discussing, the shape/magnitude of this downside is a question. Still some chance for a further downside acceleration ahead, all the way back to the base of the large triangle since Nov 2005 (currently at 74.00/25). However, "prefer" a period of ranging/chopping lower (would also fit the nearer term view of a few weeks of consolidating approaching). But in both cases, this downside "pressure" into the end of the year is still favored (see in red on weekly chart/2nd chart below).

Strategy/Position: With downside pressure over the next few months still favored, would maintain the longer term bearish bias that was put in place on Sept. 23 at 80.45.

US Dollar Index

No change in the long discussed, big picture view of downside pressure into the end of the year (see longer term below). But nearer term, some positives continue to appear, and suggest that a few weeks of consolidating/correcting higher (within this larger period of downside pressure) may be nearing.

These positives include an oversold market after the last few months of declines, slowing downside momentum (early sign of a nearing reversal) and technicals not confirming the recent weakness (see bull divergence on the daily macd at bottom of chart below for example). Note, too, that the market has weakened in the long term 78.50/00 support area (bull trendline and a 50% retracement from the May-2011 low at 72.70, falling support line from mid Sept), while specific currency pairs have also weakened into longer term support (eur/$ resistance at 1.3830/65, cable into 1.6260/10, $/swiss at .8850/00. But at this point, there is still no confirmation of even a shorter term low (5 waves up on short term chart for example), so the confidence of such a bottom is not yet very high. Nearby resistance is seen at the earlier 79.35/45 high, 79.85/95 (50% retracement from the Oct 16th high at 80.75) and the bearish trendline from Sept (currently at 80.20/30).

Strategy/Position: With potential rising for a few weeks of upside correcting, looking to trade from the long side. But just not enough evidence of such low (so far) to buy, and would be patient for a better risk/reward entry ahead.

Long-Term Outlook

The long held view of downside "pressure" into the end of the year, remains in place. Note that weak long term technicals (see sell mode on the weekly macd at bottom of 2nd chart below) and the seasonal chart that points lower into the end of Dec (see 3rd chart below), add to this big picture view. But as been discussing, the shape/magnitude of this downside is a question. Still some chance for a further downside acceleration ahead, all the way back to the base of the large triangle since Nov 2005 (currently at 74.00/25). However, "prefer" a period of ranging/chopping lower (would also fit the nearer term view of a few weeks of consolidating approaching). But in both cases, this downside "pressure" into the end of the year is still favored (see in red on weekly chart/2nd chart below).

Strategy/Position: With downside pressure over the next few months still favored, would maintain the longer term bearish bias that was put in place on Sept. 23 at 80.45.

US Dollar Index