Risk markets attempted to rebound earlier today on China manufacturing data but failed to sustain gain so far. Nikkei closed nearly flat after initial rise to 8830 intraday high. Dollar index is trying to form a double bottom and could head back towards 80 psychological level should risk markets pull back further. Euro is generally soft, in particular in crosses against sterling and Aussie. Positive headlines about Greece provides little support to the common currency.

China's PMI manufacturing index unexpectedly stayed above 50 level in January and improved slightly to 50.5 versus expectation of a drop to 49.6. That's the second straight month of improve and suggest stabilization in the sector and affirmed the soft-landing scenario. Output rose to 53.7, best level since May. However, new export orders and imports contracted for the fourth straight month while employment component deteriorated to 47.1, worse number in almost three years. It's believed that more stimulus or accommodative measures would still be needed to safeguard the economy from downside risks.

Greek Finance Minister Venizelos said that they're "one step" away from finalizing the debt swap agreement with private bondholders. He said that the "next few days will determine what happens over the coming decade". And, it's a "greater PSI" than originally forseen in July. Venizelos further clarified saying that the haircut is about 50% on nominal value and 70% on net present value. Also, Venizelos said talks with EU and IMF on the new package must be completed by February 5 while the PSI debt swap off must be made by February 13.

Looking ahead, Portugal will sell 105-day and 168-day bills today just after two-year notes yield rose to record high of 21.82% yesterday. Swiss retail sales, SVME PMI, Eurozone PMI manufacturing final, CPI flash, UK PMI manufacturing, US ADP employment, ISM manufacturing will be released later today.

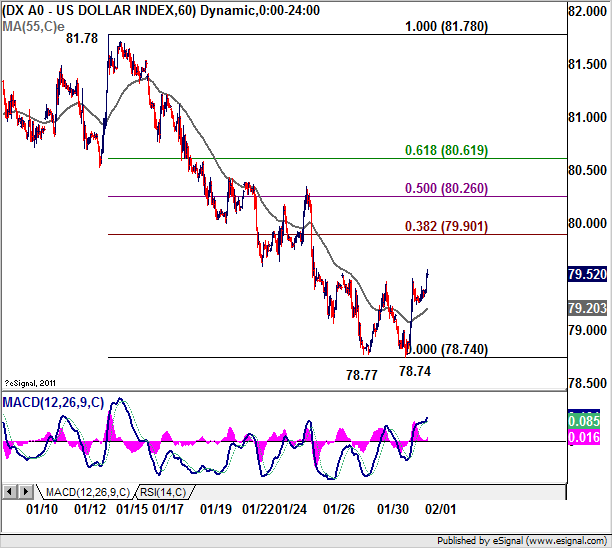

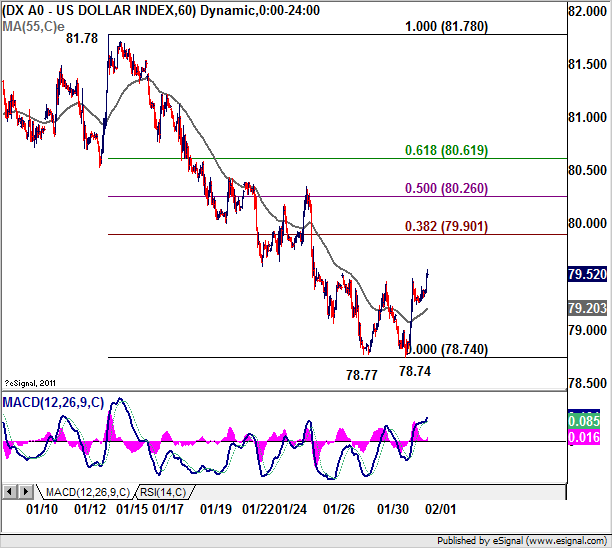

Dollar index's strong rebound suggests that a short term bottom is formed at 78.74, on a double bottom reversal pattern (78.77, 78.74). Stronger rally should be seen through 38.2% retracement of 81.78 to 78.74 at 79.90 for a test on 80 psychological level and above. However, at this point, we'd anticipating strong resistance from 61.8% retracement at 80.62 to limit upside. Meanwhile, below 4 hours 55 EMA (now at 79.20) will flip bias back to the downside for 78.74 support instead.

China's PMI manufacturing index unexpectedly stayed above 50 level in January and improved slightly to 50.5 versus expectation of a drop to 49.6. That's the second straight month of improve and suggest stabilization in the sector and affirmed the soft-landing scenario. Output rose to 53.7, best level since May. However, new export orders and imports contracted for the fourth straight month while employment component deteriorated to 47.1, worse number in almost three years. It's believed that more stimulus or accommodative measures would still be needed to safeguard the economy from downside risks.

Greek Finance Minister Venizelos said that they're "one step" away from finalizing the debt swap agreement with private bondholders. He said that the "next few days will determine what happens over the coming decade". And, it's a "greater PSI" than originally forseen in July. Venizelos further clarified saying that the haircut is about 50% on nominal value and 70% on net present value. Also, Venizelos said talks with EU and IMF on the new package must be completed by February 5 while the PSI debt swap off must be made by February 13.

Looking ahead, Portugal will sell 105-day and 168-day bills today just after two-year notes yield rose to record high of 21.82% yesterday. Swiss retail sales, SVME PMI, Eurozone PMI manufacturing final, CPI flash, UK PMI manufacturing, US ADP employment, ISM manufacturing will be released later today.

Dollar index's strong rebound suggests that a short term bottom is formed at 78.74, on a double bottom reversal pattern (78.77, 78.74). Stronger rally should be seen through 38.2% retracement of 81.78 to 78.74 at 79.90 for a test on 80 psychological level and above. However, at this point, we'd anticipating strong resistance from 61.8% retracement at 80.62 to limit upside. Meanwhile, below 4 hours 55 EMA (now at 79.20) will flip bias back to the downside for 78.74 support instead.