- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dollar Index Could Break Out On Yellen’s Comments

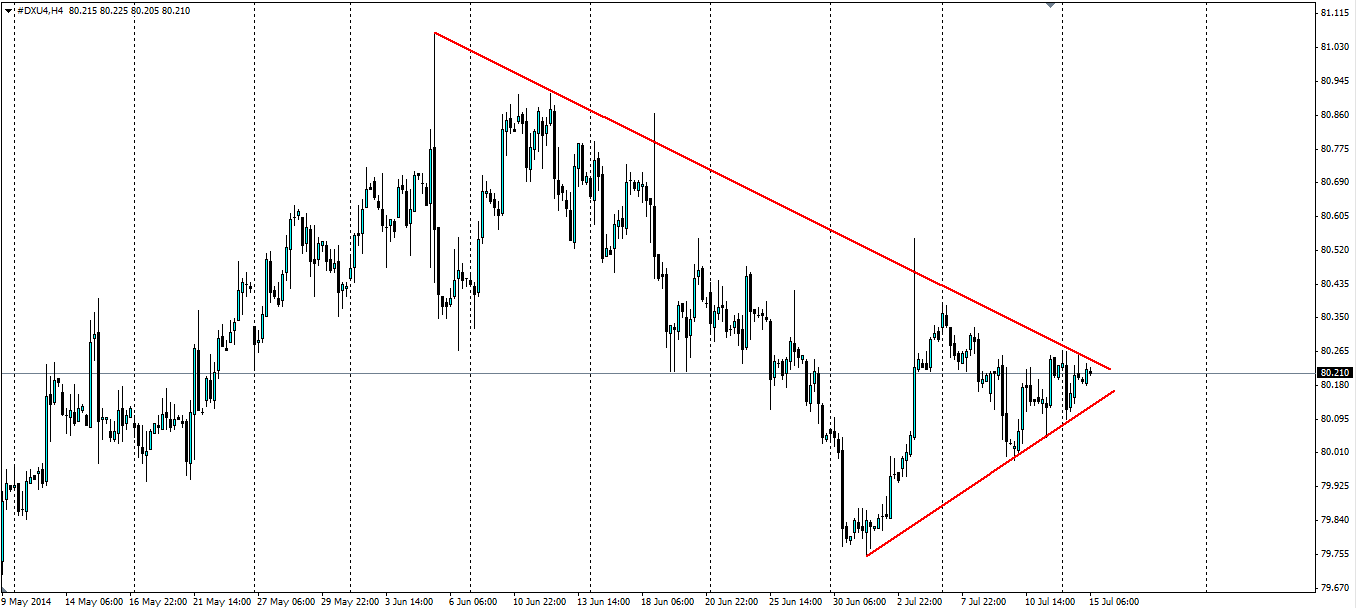

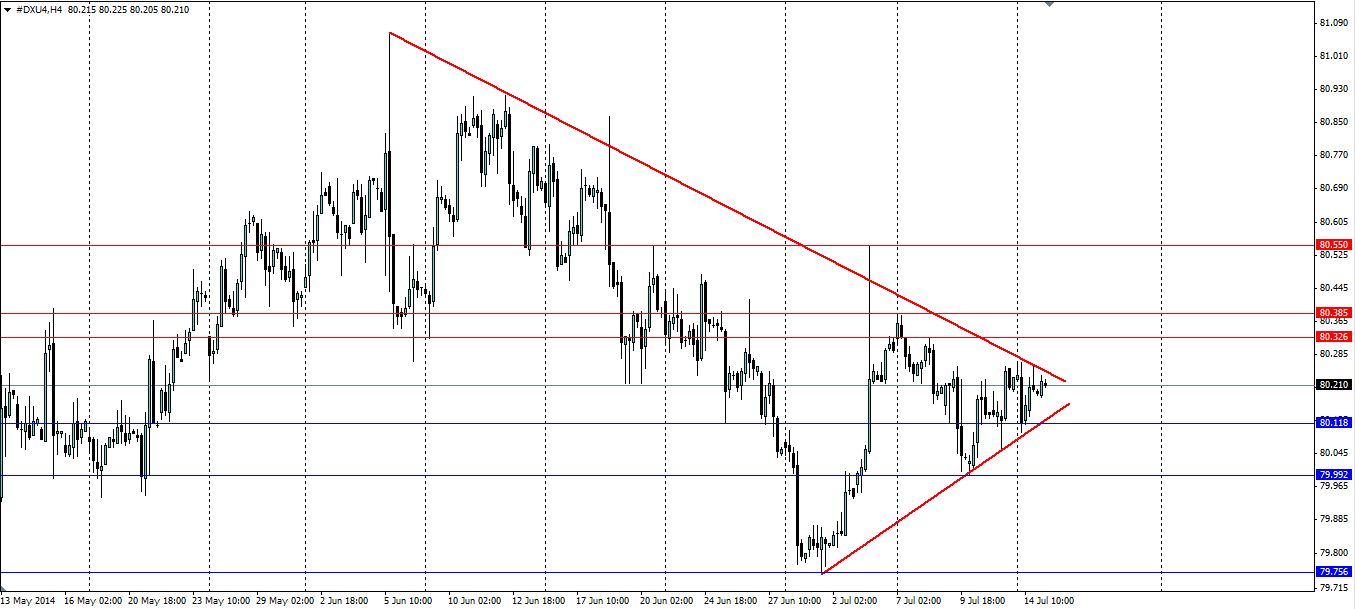

The US Dollar Index is forming itself into a triangle shape ahead of a speech by FED Chairwoman Janet Yellen. If her comments move the dollar enough in either direction, we will see a breakout of the shape.

Beginning on Tuesday, US Federal Reserve Chairwoman Janet Yellen will testify before congress for two days and the market will scrutinise every word she says. FED officials have previously indicated they will look to begin raising interest rates in the US summer next year. But they do not want to give any certainty around interest rates in order to give themselves room to move, should market conditions change between now and then.

Yellen will want to sound optimistic enough to justify tapering the Quantitative Easing(QE) programme that is scheduled to end in October. She has good reasons to optimistic; the unemployment rate is falling and the nonfarm payroll shows the employment situation improving. In the last month there have been many PMI reports out, all showing expansion, such as the Chicago PMI at 62.6 or the Services PMI at 61.0. Yellen will have one or two concerns, for example; GDP, which fell in Q1 this year by an annualised -2.9%, however on the balance of it she will be optimistic overall.

Any comments from Yellen that the FED is optimistic and might signal interest rate rises coming sooner than summer next year will send the dollar index smashing through the bearish resistance (upper) line of the triangle. Conversely, anything to signal that the fed is not as optimistic as the market and may hold off raising interest rates for longer will send the dollar the other way, plummeting through the bullish trend line.

Traders take advantage of a breakout either way. Setting stop entries outside the triangle with stop losses back inside should catch the momentum of a breakout. Look for previous levels of resistance/support to act as target levels for a breakout. Resistance can be found at 80.326, 80.385 and 80.550. Support can be found at 80.118, 79.992 and 79.756.

The upcoming two day testimony by US Federal Reserve Chairwoman Janet Yellen is likely to see the triangle on the US Dollar Index H4 chart tested. A breakout could occur on either side depending on her comments and previous levels of support/resistance will likely act as targets for a breakout movement.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.