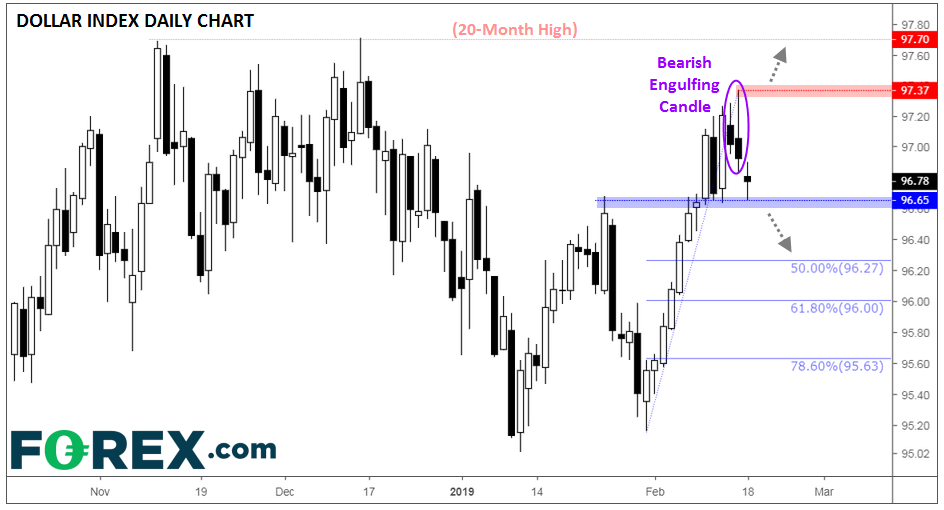

With both the U.S and Canada out on a bank holiday, we saw a relatively quiet session yesterday in the FX market. As the chart below shows, the dollar index is falling for its third consecutive day after rallying though the first seven days of the month.

Year to date, the dollar index has formed a minor higher high and higher low, suggesting that the long-term uptrend may be resuming after the December swoon. There are still potential longer-term concerns about the greenback’s rally, but the shorter-term momentum is pointing higher for now.

For this week, the key level to watch will be previous-resistance-turned-support around 96.65. If that near-term floor is broken, bears may look to push the pair down toward the Fibonacci retracements of this month’s rally at 96.27 (50%), 96.00 (61.8%), and 78.6% (95.63). Meanwhile, the key resistance level to watch will be the peak of Friday’s bearish engulfing candle at 97.37; if buyers are able to overcome last week’s peak, the dollar index could be testing its 20-month high at 97.70 this time next week.