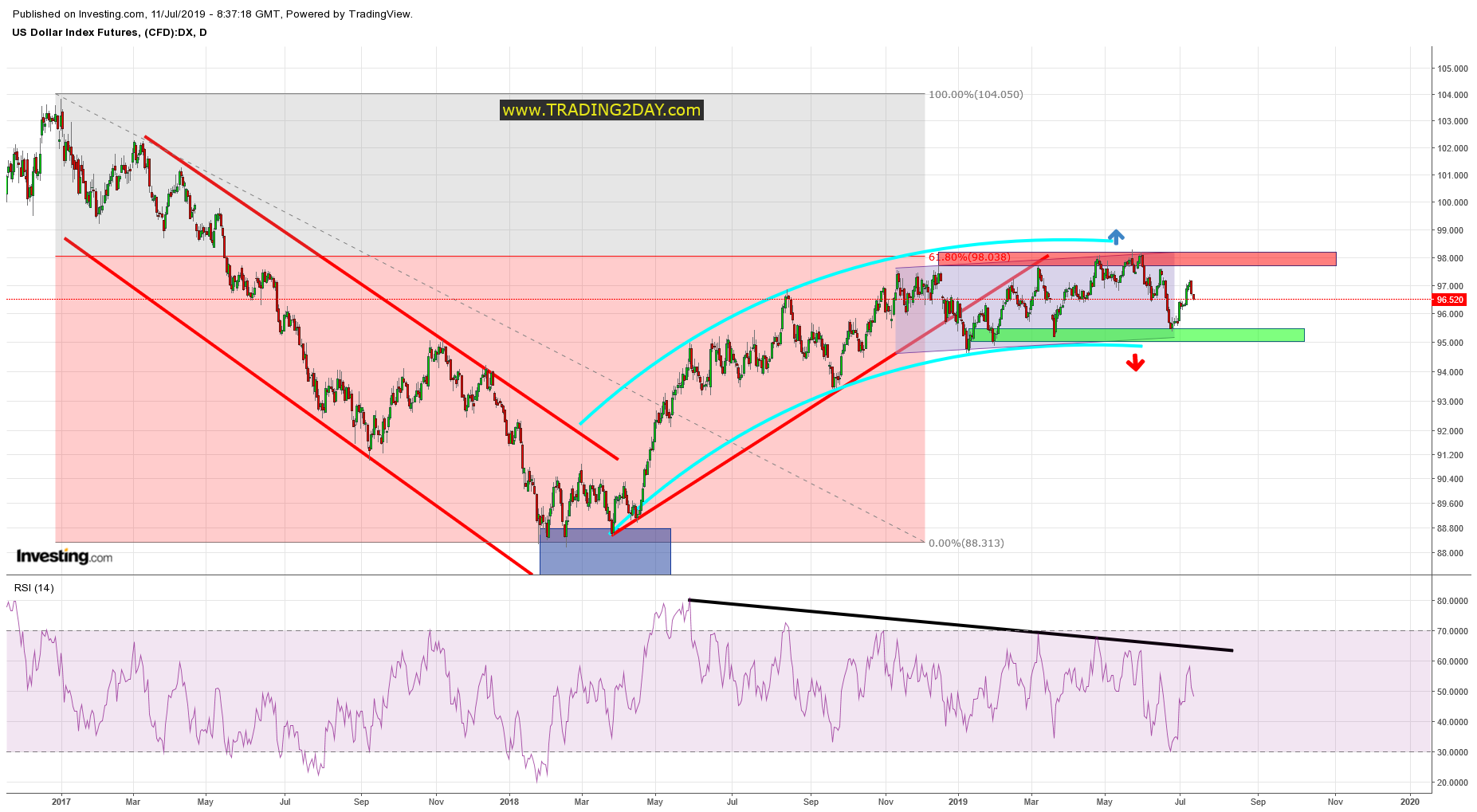

For more than a year, the Dollar Index is trading sideways between 95 and 98. Is this a distribution top? To be sure we need a weekly close below 95. Or is this a bullish consolidation? Recapturing 98 and staying above it could lead to new highs above 103. Thus far my expectation to reach the 61.8% Fibonacci retracement of the decline from 2016 highs to 2018 lows has been fulfilled. What now? We sell near resistance we buy near support until we see a breakout.

The RSI continues to diverge despite the new higher highs above 98. This is not a good sign. Verification of a major top will come with the break below the green area. As long as the green area is respected bulls still have hopes for a new upward move. Bears, on the other hand, want to see price remain below 98 and eventually break below 95. The longer it takes to break 95 the fewer chances bears have for a breakdown. I prefer to be bearish DXY as long as the price is below 98-98.20. Will add to my short on a break below the green area. A long-term target of this bearish scenario is below 88-87.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.