There were no important data releases out of Europe today, giving a chance for both the euro and the pound to stabilize. Meanwhile the dollar extended higher against the yen to reach a fresh 6-year high, helped by higher US Treasury yields.

Market expectations on an early rate hike by the US Federal Reserve helped put more strength into the greenback, which hit as high as 106.78 yen in European trading hours today, the highest level since September 2008.

The dollar has been rallying strongly this week after a Federal Reserve research paper that showed investors expected a slower rate hike than Fed policymakers themselves expected. It is hoped that the research paper would convince many investors of the need to bring forward expectations for the timing of a first rate hike. Meanwhile, the continuation of overall positive economic data from the US has helped lend support to the dollar.

After moving off a 14-month low of 1.2858 on Tuesday, the euro rose against the dollar to trade as high as 1.2962 today in the absence of European data.

Sterling found strong support above 1.6050 and held steady versus the dollar since yesterday’s speech from Bank of England Governor Mark Carney. His hints on a possible rate hike in the spring of 2015 helped pause the recent decline the pound has experienced as a result of the Scottish independence campaign.

The increase in popularity of the pro-independence camp in recent polls has sparked some concern and spooked markets into selling off the pound, which hit a fresh 10-month low today. The Scottish independence vote will be held on September 18th.

While there were no data releases from the UK today, focus will be on BoE Governor Carney’s speech later today when he will appear before Parliament to talk about the Bank’s Inflation Report.

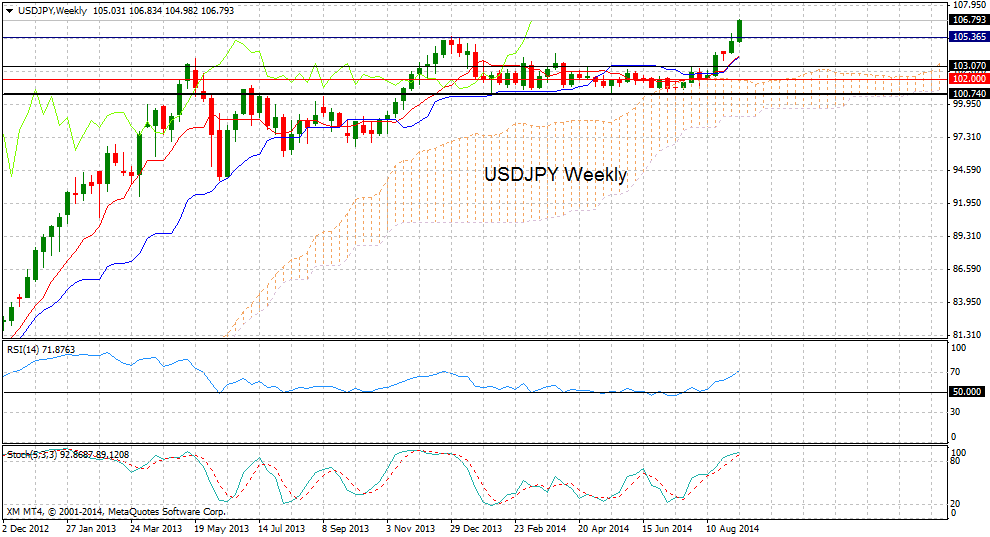

USD/JPY above 106.00

A long term-bullish bias is favoured for USD/JPY as long as key support at 100.74 holds. This is the low of February 2. The market has since approached this level several times without breaking below it.

As can be seen on the weekly chart, after a consolidation phase from February to August, prices have moved higher, recently breaking above key resistance of 105.43, which was the December 2013 high. Prices peaked at 106.78 today, which is the highest level since September 2008. There is scope to target the August 2008 high of 110.66.

For now, the RSI and stochastic are in overbought territory, suggesting a slowdown in the upward momentum before the uptrend resumes.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar Inches Higher Against Yen To 6 Year High

ByXM Group

AuthorTrading Point

Published 09/10/2014, 09:09 AM

Updated 05/01/2024, 03:15 AM

Dollar Inches Higher Against Yen To 6 Year High

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.