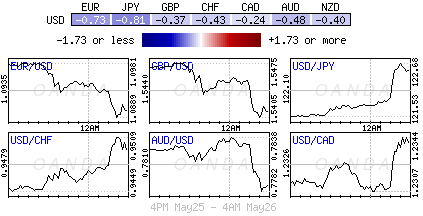

This morning after a long-three day weekend, market participants jump straight back into the fray to find the US dollar has built strongly on the gains seen after last Friday’s upside U.S CPI surprise, and comments from Fed Chair Yellen that a rate hike remains on the cards for this year.

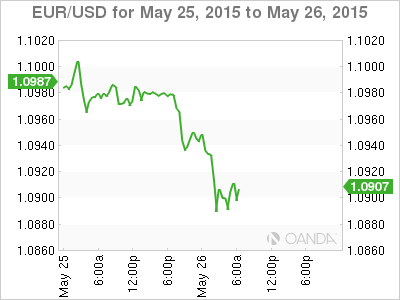

In Europe, dealers return to the grindstone where the Greek debt dance has Euro capital markets very much starting this shortened trading week on the back foot. The single unit trades at new one-month lows outright (€1.0890), while German and UK debt rallies on Greek risk aversion trading and on the surprise weekend Spanish vote results. Spanish yields have backed up after a negative reaction to the region polls in Spain where a strong showing for the opposition antiausterity parties (Podemos) is a clear threat to the incumbent government and to the euro periphery stability.

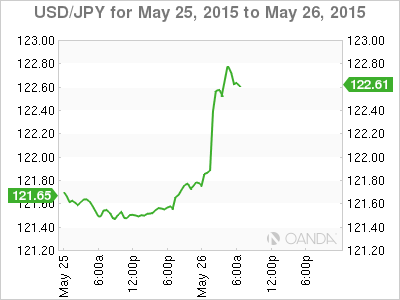

Market worries that Greece will be incapable of fulfilling its debt obligations to the IMF next week will only continue to weigh on the EUR in the short term, while U.S bond yields will favor the dollar against a host of G10 currencies. Yen trades at an eight-year low (¥122.79). It seems that the recent stability in the pair over the past few months had greatly reduce speculative yen shorts – the market wants to play catch up to the potential upside momentum due to U.S and Japanese interest rate differentials.

Investors are looking ahead to this morning’s U.S data menu (durable goods and new home sales) for key touch point guidance. Both reports are expected to show improvement over the previous months readings, which would only add value to the dominant current trading strategies. The market is most interested in the U.S housing data points – was last week’s surge in starts and permits a coincidence or not for the housing sector?

EUR’s Freefall Attempt to Parity

The two-prone attack on the EUR, Greek saber rattling and stronger U.S domestic data, has the unit -0.7% lower in overnight trading and threatening to build up further momentum to test its multi-year lows sub the €1.05 handle. The EUR is down close to -10% this year and -20% over the past 12-months.

Greek two-year yields have climbed a further +1.3bp to +23.9% amid growing fears over a default. Greek officials continue to take the hard stance by raising doubts over whether they will have enough money to fulfill its debt obligations to the IMF next month (€1.6b). What’s making the situation worse is the internal fighting within the Syriza party over creditors conditions – some officials it seems are willing to accept certain terms.

In Spain, bond prices reveal a similar scenario. Bonos have come under further pressure from the weekend’s election results, which showed the ruling Popular Party lose ‘big’ in municipal elections to the anti-austerity Podemos Party (Spanish 10-Year yield has climbed +8bp to +1.85%). It’s the reason why European officials and policy makers will only ever take a hardline stance approach to Greece – they do not want to legitimize Syriza’s claims, nor set a precedent that cannot be unwound that favor ant-austerity party claims.

Both U.K Gilts and German Bunds, which are considered somewhat safe haven, are benefitting from the periphery debt market underperformance. German bunds are down -6bp to +0.55% while UK 10-Year Gilts are trading at +1.86%. It’s no surprise to see that U.S treasuries are being dragged along for the safe haven ride. US 10's currently yield +2.18%, much tighter than this month’s low yield print of +2.32% amidst the global sovereign yield saga.

Commodities Fall on Dollar Direction

The USD remains the best of a ‘bad lot’ for most traders. Mixed domestic data, neutral comments from Fed Chair Yellen and risk aversions strategies certainly outweigh the current Euro/Greek saga, a weaker China and Japan requiring a lower currency value. Nevertheless, a dominant dollar strategy will weigh heavily on commodity prices and their affiliated currency pairs (CAD, AUD, NZD etc.), albeit crude, gold or dairy.

Again this morning, crude oil trades under pressure (Brent -0.8% to $65.02 and West Texas -0.7% to +$59.29), while the yellow metal seeks to discover what lies below the psychological $1,1200 handle (-1% to $1,194.5). The recent upward strength for oil was supported mostly by cuts in production (supply gluts remain an ongoing concern), and the mighty dollar shakeout over the past six-weeks, rather than on sustainable economic growth. With the USD finding favor, and a growing concern for both crude and gold fundamentals, being long this sector may require some nimble trading in the short term.